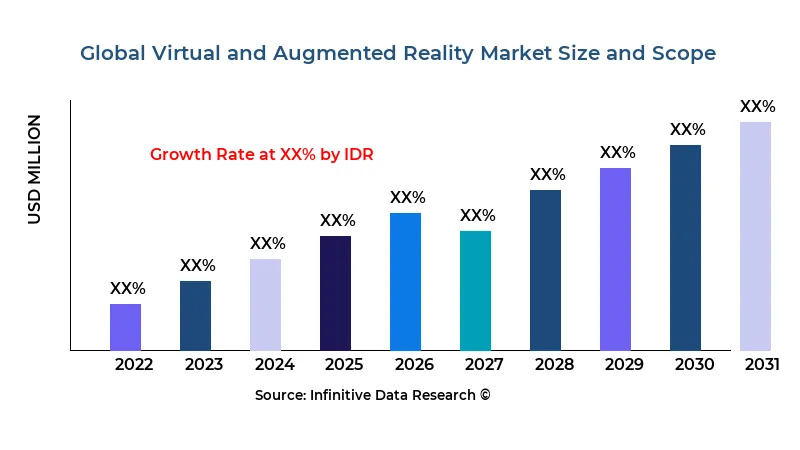

Virtual and Augmented Reality Market Growth CAGR Overview

According to research by Infinitive Data Research, the global Virtual and Augmented Reality Market size was valued at USD 34.1 Bln (billion) in 2024 and is Calculated to reach USD 80 Bln (billion) by the end of 2032, growing at an anticipated compound annual growth rate (CAGR) of 19.8% during the forecast period 2024 to 2032. This projected growth is driven by its increasing adoption across Software & Services industries such as Healthcare, Education, Retail, Gaming, Construction, Media and Entertainment, Automotive, Defense and Aerospace, ManufacturingThe virtual and augmented reality (VR/AR) market is undergoing rapid transformation, propelled by both hardware innovations and software ecosystem maturation. High‑resolution displays, inside‑out tracking, and advanced haptics are elevating user experiences, driving consumer adoption beyond gaming into domains like virtual collaboration, education, and healthcare. Meanwhile, enterprise deployment of mixed‑reality headsets for training, remote assistance, and design visualization is accelerating, as organizations seek to reduce travel costs and shorten product‑development cycles. This bifurcation between consumer and enterprise segments demands diverse go‑to‑market approaches from VR/AR vendors.

Content remains king in the VR/AR space, and platform holders are vying for developer mindshare through comprehensive SDKs, revenue‑share models, and funding programs. Meta’s Oculus, Microsoft’s HoloLens, and Sony’s PlayStation VR have cultivated sizable developer communities, but fragmentation across OS platforms and device capabilities poses challenges for cross‑platform content delivery. Emerging standards like WebXR aim to streamline experiences across standalone headsets and smartphone‑powered AR glasses, but adoption remains in early stages.

The convergence of 5G and edge computing is another critical dynamic. Ultra‑low‑latency network infrastructure enables real‑time streaming of high‑fidelity VR experiences to lightweight headsets, decoupling compute‑intensive rendering from device form factors. This shift paves the way for tether‑free devices that maintain graphical richness comparable to PC‑connected headsets. Telecom operators are launching “XR as a service” offerings for enterprise customers, bundling connectivity, cloud compute, and device management in subscription models.

Finally, privacy and safety considerations are reshaping product roadmaps. As headsets capture environmental and physiological data—such as room scans and eye‑tracking metrics—regulators are scrutinizing data‑handling practices. Companies integrating biometric analytics must navigate GDPR, CCPA, and emerging global privacy laws, balancing personalization with compliance. Vendors that embed robust security frameworks and transparent data policies stand to gain enterprise trust and consumer confidence.

>>> Understand The Key Trends Shaping This Market:- Download PDF Sample

Virtual And Augmented Reality Market Growth Factors

Declining hardware costs are a primary growth driver. Economies of scale in display manufacturing and advances in custom SoCs for VR/AR have reduced headset prices from over USD 1,000 five years ago to under USD 300 for many standalone models. This affordability threshold has unlocked mass‑market potential, particularly among tech‑savvy younger demographics interested in immersive social and entertainment experiences.

Enterprise demand for immersive training and remote assistance solutions is another catalyst. Industries such as aerospace, automotive, and healthcare are investing in VR/AR for simulated maintenance procedures, surgeon rehearsal, and remote expert guidance. The promise of reduced error rates, enhanced skill retention, and lower training costs justifies upfront investments in hardware and content development. Vendor roadmaps increasingly emphasize platform‑agnostic enterprise suites that integrate seamlessly with existing IT infrastructures.

Technological advancements in computer vision and machine learning are enriching AR experiences by enabling robust object recognition, occlusion handling, and gesture tracking. This progress expands AR’s applications in retail (virtual try‑on), logistics (warehouse picking guidance), and field service (on‑site diagnostics). The sophistication of markerless AR is narrowing the gap between pre‑defined and dynamic environments, allowing for contextual overlays in real‑world scenarios.

Lastly, the rise of social VR platforms is broadening the use cases beyond solitary gaming. Virtual events, concerts, and collaborative workspaces are proliferating, fostering network effects that drive platform stickiness. As user‑generated content becomes more prevalent, communities coalesce around shared virtual spaces, creating new monetization opportunities through avatar economies and virtual goods marketplaces.

Market Analysis By Competitors

- Samsung Electronics

- Microsoft Corporation

- Sony Interactive Entertainment

- Oculus VR LLC

- HTC Corporation

- ZeroLigh

- EON Reality

- Nokia Corporation

- Barco

- Blippar.com Ltd

- Aurasma Ltd. (Hewlett-Packard Development Company. L.P)

- MindMaze SA

- Virtalis

- Manus Machinae

- Independiente Communications

- VirZOOM

- NuFormer Projection

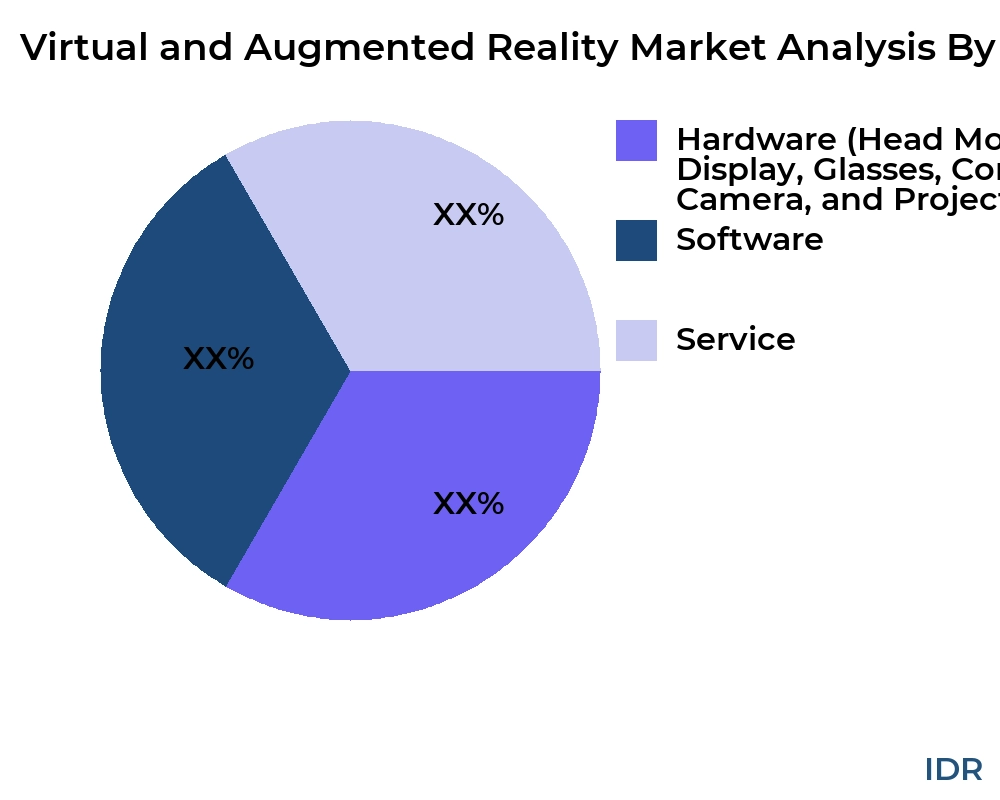

By Product Type

- Hardware (Head Mounted Display, Head Up Display, Glasses, Console, Sensor/Input, Camera, and Projector)

- Software

- Service

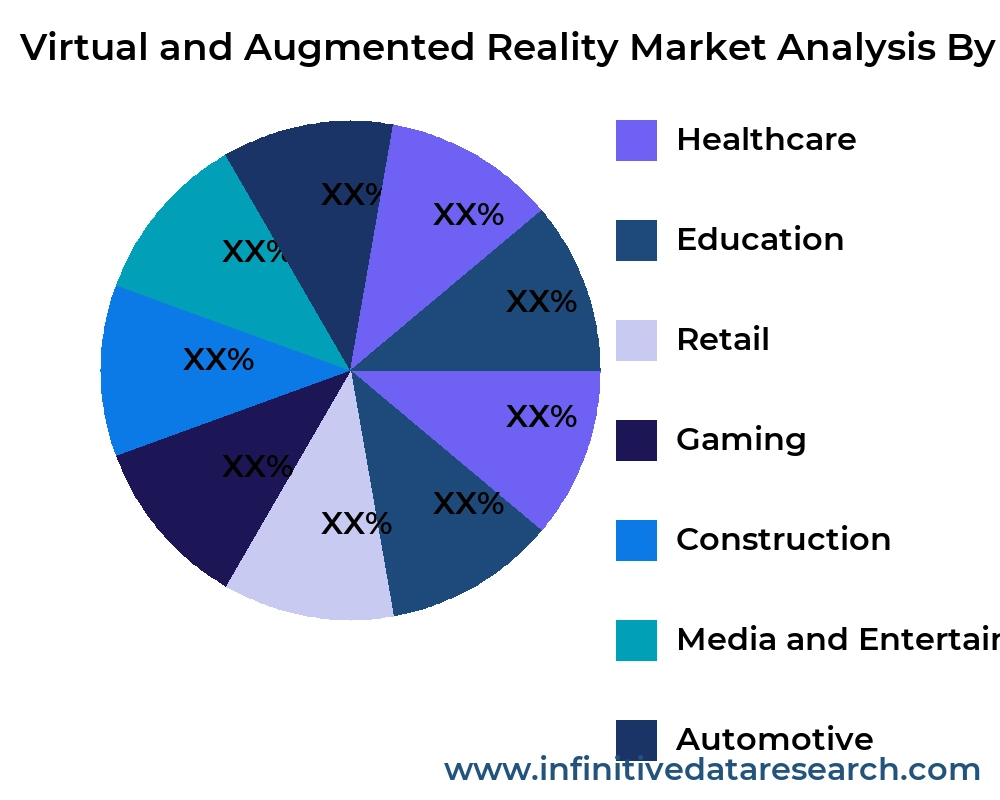

By Application

- Healthcare

- Education

- Retail

- Gaming

- Construction

- Media and Entertainment

- Automotive

- Defense and Aerospace

- Manufacturing

>>> Understand The Key Trends Shaping This Market:- Understand The Key Trends Shaping This Market:-

Virtual And Augmented Reality Market Segment Analysis

Distribution Channel: VR/AR headsets and peripherals are sold through both traditional retail channels—electronics superstores, specialty gaming outlets—and direct‑to‑consumer e‑commerce platforms. Enterprise sales are handled via dedicated account teams and channel partners specializing in corporate IT deployments. Subscription bundles, including device financing and managed services, are becoming common in enterprise procurement.

Compatibility: Compatibility in VR/AR refers to cross‑platform support for content and peripherals. Standalone headsets (Oculus Quest series, Pico Neo) versus tethered devices (Valve Index, HTC Vive) require different content pipelines. Middleware solutions and open standards like OpenXR are gaining traction, but full interoperability remains a work in progress. Peripheral ecosystems—controllers, trackers, haptic gloves—also vary by platform, affecting developer support and user choice.

Price: Price tiers range from entry‑level smartphone‑powered headsets (USD 50–150) to mid‑range standalone devices (USD 300–500) and high‑end PC‑tethered systems (USD 700–1,500). Enterprise configurations—bundling headsets with deployment software, training content, and managed support—can exceed USD 2,000 per seat. Volume licensing deals and education discounts further segment pricing.

Product Type: The VR segment includes gaming‑focused consoles, enterprise‑grade tethered systems, and standalone all‑in‑one headsets. AR covers smart glasses and mobile AR SDKs for smartphones/tablets. Mixed reality blends virtual elements into the physical world and is typified by devices like HoloLens 2. Sub‑segments include peripherals (haptic devices, eye‑trackers), software platforms (game engines, enterprise suites), and content marketplaces.

| REPORT ATTRIBUTES | DETAILS |

|---|---|

| Study Period |

2019-2032 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Historical Period |

2019-2022 |

| Unit |

Value (USD Billion) |

| Key Companies Profiled |

Google, Samsung Electronics, Microsoft Corporation, Sony Interactive Entertainment, Oculus VR LLC, HTC Corporation, ZeroLigh, EON Reality, Nokia Corporation, Barco, Blippar.com Ltd, Aurasma Ltd. (Hewlett-Packard Development Company. L.P), MindMaze SA, Virtalis, Manus Machinae, Independiente Communications, VirZOOM, NuFormer Projection |

| Segments Covered |

By Product |

| Customization Scope |

Free report customization (equivalent to up to 3 analyst working days) with purchase. Addition or alteration to country, regional and segment scope |

>>> Overview of Market Analysis:- Download PDF Sample

Virtual And Augmented Reality Market Regional Analysis

North America dominates the VR/AR market, driven by strong consumer appetite for gaming and early enterprise adoption in technology and healthcare sectors. The U.S. accounts for over half of global revenues, supported by leading platform providers headquartered in California and Washington. Canada’s AR software startups and academic VR labs further enrich the local ecosystem.

Europe is the second‑largest region, with the U.K., Germany, and France leading in both hardware sales and content creation. The EU’s Digital Europe program and Horizon 2020 funding have accelerated AR/VR innovation, particularly in cultural heritage and industrial applications. Regulatory harmonization across member states eases cross‑border deployments, benefiting enterprise customers.

Asia‑Pacific is the fastest‑growing market, anchored by China, South Korea, and Japan. Mobile AR experiences dominate in China, with super‑apps incorporating AR‑powered features like virtual try‑on. South Korea’s high‑speed 5G infrastructure fosters cloud‑streamed VR services, while Japan’s legacy in consumer electronics underpins strong hardware innovation. India’s nascent VR/AR industry is gaining momentum through startup hubs in Bengaluru and Hyderabad, focused on education and training solutions.

Latin America and Middle East & Africa remain emerging regions, with adoption led by educational institutions and oil & gas companies seeking remote training solutions. Infrastructure challenges—such as lower broadband speeds—limit consumer uptake, but project‑based enterprise deployments in urban centers are on the rise. Partnerships with global OEMs and local systems integrators are key to overcoming logistical and regulatory hurdles.

global Virtual and Augmented Reality market revenue (usd million) comparison by players 2024-2032

| Company/players | 2021 | 2022 | 2023 | 2024 | ... | (2032) |

|---|---|---|---|---|---|---|

| XX | XX | XX | XX | XX | XX | |

| Samsung Electronics | XX | XX | XX | XX | XX | XX |

| Microsoft Corporation | XX | XX | XX | XX | XX | XX |

| Sony Interactive Entertainment | XX | XX | XX | XX | XX | XX |

| Oculus VR LLC | XX | XX | XX | XX | XX | XX |

| HTC Corporation | XX | XX | XX | XX | XX | XX |

| ZeroLigh | XX | XX | XX | XX | XX | XX |

| EON Reality | XX | XX | XX | XX | XX | XX |

| Nokia Corporation | XX | XX | XX | XX | XX | XX |

| Barco | XX | XX | XX | XX | XX | XX |

| Blippar.com Ltd | XX | XX | XX | XX | XX | XX |

| Aurasma Ltd. (Hewlett-Packard Development Company. L.P) | XX | XX | XX | XX | XX | XX |

| MindMaze SA | XX | XX | XX | XX | XX | XX |

| Virtalis | XX | XX | XX | XX | XX | XX |

| Manus Machinae | XX | XX | XX | XX | XX | XX |

| Independiente Communications | XX | XX | XX | XX | XX | XX |

| VirZOOM | XX | XX | XX | XX | XX | XX |

| NuFormer Projection | XX | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX | XX |

global Virtual and Augmented Reality market revenue (usd million) comparison by product type 2024-2032

Product Type

2023

2024

...

2032

CAGR%(2024-32)

Hardware (Head Mounted Display, Head Up Display, Glasses, Console, Sensor/Input, Camera, and Projector)

XX

XX

XX

XX

XX

Software

XX

XX

XX

XX

XX

Service

XX

XX

XX

XX

XX

Total

XX

XX

XX

XX

XX

| Product Type | 2023 | 2024 | ... | 2032 | CAGR%(2024-32) |

|---|---|---|---|---|---|

| Hardware (Head Mounted Display, Head Up Display, Glasses, Console, Sensor/Input, Camera, and Projector) | XX | XX | XX | XX | XX |

| Software | XX | XX | XX | XX | XX |

| Service | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX |

global Virtual and Augmented Reality market revenue (usd million) comparison by application 2024-2032

Application

2023

2024

...

2032

CAGR%(2024-32)

Healthcare

XX

XX

XX

XX

XX

Education

XX

XX

XX

XX

XX

Retail

XX

XX

XX

XX

XX

Gaming

XX

XX

XX

XX

XX

Construction

XX

XX

XX

XX

XX

Media and Entertainment

XX

XX

XX

XX

XX

Automotive

XX

XX

XX

XX

XX

Defense and Aerospace

XX

XX

XX

XX

XX

Manufacturing

XX

XX

XX

XX

XX

Total

XX

XX

XX

XX

XX

| Application | 2023 | 2024 | ... | 2032 | CAGR%(2024-32) |

|---|---|---|---|---|---|

| Healthcare | XX | XX | XX | XX | XX |

| Education | XX | XX | XX | XX | XX |

| Retail | XX | XX | XX | XX | XX |

| Gaming | XX | XX | XX | XX | XX |

| Construction | XX | XX | XX | XX | XX |

| Media and Entertainment | XX | XX | XX | XX | XX |

| Automotive | XX | XX | XX | XX | XX |

| Defense and Aerospace | XX | XX | XX | XX | XX |

| Manufacturing | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX |

>>> Market Understand Through Graph And Chart:- Download PDF Sample

Virtual And Augmented Reality Market Competitive Insights

The VR/AR market is moderately concentrated, with a handful of platform‑holders (Meta, Sony, Microsoft) setting hardware standards and controlling key distribution channels. Platform lock‑in and network effects—driven by content libraries and social ecosystems—create high barriers for new entrants. However, specialized hardware vendors and software developers carve niches in enterprise verticals, offering tailored solutions and integration services.

M&A activity is heating up, as major tech firms acquire startups with innovative optics, gesture recognition, and haptics technologies. These acquisitions bolster intellectual property portfolios and accelerate roadmaps for next‑generation devices, particularly lightweight AR glasses that many consider the “holy grail” of mainstream adoption. Strategic investments by cloud providers in edge render farms further underscore the importance of networked 3D content delivery.

Content fragmentation remains a challenge, with developers weighing the trade‑off between platform exclusivity deals (which offer upfront funding) and broader market reach via cross‑platform engines. Unity Technologies and Epic Games (Unreal Engine) dominate as the primary engines for VR/AR development, offering robust toolsets but competing fiercely on licensing terms. The outcome of this competition will shape where developers invest their efforts.

Finally, standardization efforts—most notably OpenXR—are gradually reducing platform fragmentation, enabling hardware vendors and developers to align on common APIs. As these standards mature, interoperability will improve, benefiting end‑users and lowering development costs. Companies that actively support and contribute to these efforts are likely to emerge as de facto leaders in the open VR/AR ecosystem.

Virtual And Augmented Reality Market Competitors

United States:

-

Meta Platforms

-

Sony Interactive Entertainment

-

Microsoft Corporation

-

Google (Alphabet Inc.)

-

Apple Inc.

Germany:

-

ZEISS Group

-

Vuzix Corporation

-

Realfiction Holding AB

-

Varjo Technologies

-

Pimax Technology

China:

-

Pico Interactive

-

HiAR Technologies

-

DPVR (Deepoon)

-

Rokid Inc.

-

Nreal Limited

United Kingdom:

-

Ultraleap Ltd.

-

Improbable Worlds Ltd.

-

Blippar plc

-

Diota (Dassault Systèmes)

-

Zappar Ltd.

Japan:

-

Sony Corporation

-

Panasonic Corporation

-

Toshiba Corporation

-

Sharp Corporation

-

Epson Europe (MOVERIO)

India:

-

Tesseract Imaging

-

Scapic (MagicBox VR)

-

EON Reality India

-

Imaginate Software Labs

-

Gamooga Technologies

Virtual And Augmented Reality Market Top Competitors

Meta Platforms

Meta Platforms (formerly Facebook) has emerged as the VR industry leader with its Quest series of standalone headsets, combining affordability, ease of use, and a robust content ecosystem. Utilizing its massive social‑media user base, Meta has integrated VR social spaces like Horizon Worlds, driving network effects that bolster hardware sales. The company invests heavily in R&D for next‑generation optics, including pancake lenses that reduce headset bulk, and advanced hand‑tracking algorithms. Meta’s developer fund programs and revenue‑share incentives have attracted thousands of studios, resulting in a rapidly expanding app library. Despite regulatory scrutiny over data privacy and antitrust concerns, Meta’s willingness to subsidize hardware costs positions it to capture first‑mover advantage. With reported annual VR revenues exceeding USD 2 billion and growth rates north of 50%, Meta is setting the pace for mainstream VR adoption. Its investments in mixed‑reality research—under the Reality Labs division—signal ambitions to bridge VR and AR, making Meta a formidable all‑round XR contender.-

Sony Interactive Entertainment

Sony’s PlayStation VR (PS VR) ecosystem leverages the company’s dominant PlayStation console installed base of over 100 million units. While the original PS VR was tethered to PS4, the upcoming PS VR2 for PS5 promises improved resolution, adaptive triggers, and inside‑out tracking. Sony’s strength lies in exclusive game titles from renowned studios—such as “Astro’s Playroom” and “Horizon Call of the Mountain”—which drive hardware attach rates. The company’s deep integration of VR peripherals with its DualSense controllers enhances immersion. Although limited to the PlayStation ecosystem, Sony’s ability to cross‑promote VR titles alongside blockbuster console releases ensures strong holiday‑season sales. With publicly stated targets of 5 million PS VR2 units in the first year, Sony remains a key bellwether for console‑based VR engagement. -

Microsoft Corporation

Microsoft’s HoloLens line pioneered enterprise mixed reality, providing untethered, see‑through AR experiences for industrial, defense, and medical applications. With HoloLens 2, Microsoft improved ergonomics, field of view, and integration with Azure cloud services for real‑time collaboration and AI‑driven spatial mapping. Major customers include Boeing (for wiring harness inspections), Thyssenkrupp (for remote maintenance), and Case Construction (for equipment diagnostics). Microsoft’s volume‑licensing deals and Azure support contracts underpin a recurring revenue model, with device margins augmented by cloud‑service subscriptions. Though not focused on gaming, Microsoft’s acquisition of AltspaceVR and partnerships with telecom operators hint at broader immersive‑communication plays. As Azure infrastructure expands, Microsoft is well‑positioned to deliver low‑latency, enterprise‑grade XR applications at scale. -

Google (Alphabet Inc.)

Google’s foray into VR began with Cardboard and Daydream, but recent focus has shifted to AR via ARCore and the development of AR smart glasses prototypes like Project Iris. Google’s strength lies in its software ecosystem—leveraging Android, Android TV, and cloud AI—to deliver cross‑platform AR experiences on billions of devices. The company’s funding programs for AR/VR startups and investments in WebXR standards foster an open ecosystem, though hardware roadmaps remain fluid. Google Glass Enterprise Edition finds niche use in logistics and manufacturing, demonstrating the potential for lightweight AR wearables. As Google refines its wearable hardware and pushes ARCore enhancements, it aims to reclaim leadership in mobile AR applications. -

Apple Inc.

Apple’s rumored mixed‑reality headset (Vision Pro) is poised to disrupt the XR market with surgical‑grade displays, spatial audio, and a focus on privacy. Leveraging its ecosystem—iOS, Xcode, and Apple Silicon—Apple can ensure tight hardware–software integration and attract high‑quality developers. With expectations of premium pricing (north of USD 2,000), Apple’s entry targets the prosumer and professional markets initially. Pre‑launch developer kits and ARKit’s ubiquity on over a billion iPhones give Apple a head start in content creation. If Apple succeeds in delivering a seamless, intuitive user experience, it may redefine consumer expectations and catalyze broader XR adoption, much like it did with smartphones and tablets. -

Unity Technologies

Unity is the dominant game engine for VR/AR content creation, powering over 60% of all XR applications. Its cross‑platform runtime enables developers to build once and deploy across major headsets, simplifying the fragmentation challenge. Unity’s growth is fueled by subscription‑based licensing, cloud‑build services, and a marketplace for plugins and assets. The company’s investments in real‑time ray tracing and AI‑driven animation accelerate content quality, making VR/AR experiences more immersive. With strategic partnerships with platform holders—Meta, Microsoft, and Qualcomm—Unity ensures early access to SDKs and hardware roadmaps, cementing its status as the development standard. Recurring revenues now exceed USD 1 billion annually, and Unity’s pivot into enterprise‑focused solutions (digital twins, industrial training) broadens its addressable market beyond gaming. -

HTC Corporation

HTC Vive pioneered consumer and enterprise VR headsets with high‑fidelity tracking and extensive accessory ecosystems. The Vive Pro and Vive Focus lines cater to professional users, offering enterprise‑grade support, advanced ergonomics, and modular expansion options. HTC’s Viveport subscription service provides unlimited access to VR content libraries, creating a recurring revenue stream. While hardware sales have faced competition from lower‑cost standalone headsets, HTC’s focus on premium performance and tight partnerships with spatial‑computing software vendors sustain its niche. The company is exploring blockchain‑based content distribution and decentralized virtual environments, signaling an interest in Web3‑driven VR experiences. -

Pico Interactive

Pico has emerged as a strong contender in the standalone VR headset segment, particularly in Asia and select enterprise verticals. Its Neo series offers comparable performance to Quest at similar price points, often bundled with enterprise‑grade software packages and managed‑service options. Pico’s strategy involves OEM partnerships with regional telecom operators, enabling device financing and network‑optimized VR streaming. While lacking Meta’s brand recognition, Pico’s focus on open Android‑based platforms and local customer support gives it an edge in price‑sensitive markets. The company’s recent expansion into North American enterprise channels through partner networks suggests ambitions to challenge incumbent OEMs globally. -

Magic Leap

Magic Leap initially targeted consumers but pivoted exclusively to enterprise after limited commercial success with its first headset. The Magic Leap 2 focuses on field service, defense training, and healthcare, offering advanced optics and eye‑tracking capabilities. Strategic partnerships with Microsoft Azure and PTC Windchill enable seamless integration into industrial workflows. Magic Leap’s go‑to‑market strategy centers on white‑glove deployment services, content customization, and bundled software subscriptions. Though revenues remain modest compared to AR incumbents, the company’s deep IP portfolio and focus on high‑value use cases position it for sustainable growth in specialized niches. -

Varjo Technologies

Varjo, a Finnish startup, differentiates itself with ultra‑high‑resolution “human eye” display technology, aimed at simulation, training, and design visualization. Its headsets combine photorealistic rendering in foveated regions with wider‑angle peripheral views, drastically improving realism for aerospace and automotive simulations. Varjo’s solutions command premium pricing (USD 5,000+ per unit) and are sold with dedicated software suites and professional‑services agreements. Partnerships with Boeing, Airbus, and other aerospace leaders validate Varjo’s performance in mission‑critical applications. Despite serving a small addressable market relative to consumer VR, Varjo’s technological leadership and strong enterprise relationships ensure healthy margins and steady revenue growth.

The report provides a detailed analysis of the Virtual and Augmented Reality market across various regions, highlighting the unique market dynamics and growth opportunities in each region.

- US

- Canada

- Mexico

- UK

- Germany

- France

- Italy

- Russia

- Spain

- Switzerland

- Austria

- Belgium

- Rest of Europe

- China

- Japan

- South Korea

- Indonesia

- Vietnam

- Philippines

- Australia

- Thailand

- Singapore

- Rest of APAC

- UAE

- Saudi Arabia

- Egypt

- South Africa

- Israel

- Rest of MEA

- Brazil

- Argentina

- Rest of Latin America

>>> Need A Different Region Or Segment? Download PDF Sample

Key Takeaways

- The global Virtual and Augmented Reality market is expected to grow significantly from 2024 to 2032, driven by technological advancements, increasing demand, and government investments in urbanization.

- The market is characterized by a diverse range of manufacturers, product types, and applications, catering to different consumer needs and preferences.

- Regional insights highlight the unique market dynamics and growth opportunities in various regions, including North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

- The competitive landscape features key players who have created a dynamic and diverse market environment through collaborations, mergers and acquisitions, and innovative product developments.

- Market trends such as technological advancements, sustainability, customization, and digital transformation are shaping the growth and development of the Virtual and Augmented Reality market.

- Despite the positive outlook, the market faces challenges such as regulatory compliance, high initial investment costs, and economic uncertainties.

- The report provides comprehensive coverage of market size, market share, growth factors, and strategic insights to help businesses navigate the dynamic Virtual and Augmented Reality market and achieve long-term success.

By leveraging the information provided in this report, businesses can develop effective strategies, address market challenges, and capitalize on growth opportunities to ensure sustainable growth and long-term success in the global Virtual and Augmented Reality market.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Currency

- Key Target Audience

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Restraints

- Opportunities

- Challenges

- Global Virtual and Augmented Reality Market Analysis and Projection, By Companies

- Segment Overview

- Samsung Electronics

- Microsoft Corporation

- Sony Interactive Entertainment

- Oculus VR LLC

- HTC Corporation

- ZeroLigh

- EON Reality

- Nokia Corporation

- Barco

- Blippar.com Ltd

- Aurasma Ltd. (Hewlett-Packard Development Company. L.P)

- MindMaze SA

- Virtalis

- Manus Machinae

- Independiente Communications

- VirZOOM

- NuFormer Projection

- Global Virtual and Augmented Reality Market Analysis and Projection, By Type

- Segment Overview

- Hardware (Head Mounted Display, Head Up Display, Glasses, Console, Sensor/Input, Camera, and Projector)

- Software

- Service

- Global Virtual and Augmented Reality Market Analysis and Projection, By Application

- Segment Overview

- Healthcare

- Education

- Retail

- Gaming

- Construction

- Media and Entertainment

- Automotive

- Defense and Aerospace

- Manufacturing

- Global Virtual and Augmented Reality Market Analysis and Projection, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Russia

- Spain

- Switzerland

- Austria

- Belgium

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Vietnam

- Philippines

- Australia

- Thailand

- Singapore

- Rest of APAC

- Middle East

- UAE

- Saudi Arabia

- Egypt

- South Africa

- Israel

- Rest of MEA

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Global Virtual and Augmented Reality Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Virtual and Augmented Reality Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Coverage Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Samsung Electronics

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Microsoft Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Sony Interactive Entertainment

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Oculus VR LLC

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- HTC Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- ZeroLigh

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- EON Reality

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Nokia Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Barco

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Blippar.com Ltd

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Aurasma Ltd. (Hewlett-Packard Development Company. L.P)

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- MindMaze SA

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Virtalis

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Manus Machinae

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Independiente Communications

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- VirZOOM

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- NuFormer Projection

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

List of Table

- Drivers of Global Virtual and Augmented Reality Market: Impact Analysis

- Restraints of Global Virtual and Augmented Reality Market: Impact Analysis

- Global Virtual and Augmented Reality Market, By Technology, 2023-2032(USD Billion)

- global Hardware (Head Mounted Display, Head Up Display, Glasses, Console, Sensor/Input, Camera, and Projector), Virtual and Augmented Reality Market, By Region, 2023-2032(USD Billion)

- global Software, Virtual and Augmented Reality Market, By Region, 2023-2032(USD Billion)

- global Service, Virtual and Augmented Reality Market, By Region, 2023-2032(USD Billion)

- global Healthcare, Virtual and Augmented Reality Market, By Region, 2023-2032(USD Billion)

- global Education, Virtual and Augmented Reality Market, By Region, 2023-2032(USD Billion)

- global Retail, Virtual and Augmented Reality Market, By Region, 2023-2032(USD Billion)

- global Gaming, Virtual and Augmented Reality Market, By Region, 2023-2032(USD Billion)

- global Construction, Virtual and Augmented Reality Market, By Region, 2023-2032(USD Billion)

- global Media and Entertainment, Virtual and Augmented Reality Market, By Region, 2023-2032(USD Billion)

- global Automotive, Virtual and Augmented Reality Market, By Region, 2023-2032(USD Billion)

- global Defense and Aerospace, Virtual and Augmented Reality Market, By Region, 2023-2032(USD Billion)

- global Manufacturing, Virtual and Augmented Reality Market, By Region, 2023-2032(USD Billion)

List of Figures

- Global Virtual and Augmented Reality Market Segmentation

- Virtual and Augmented Reality Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top investment pocket in the Virtual and Augmented Reality Market

- Top Winning Strategies, 2023-2032

- Top Winning Strategies, By Development, 2023-2032(%)

- Top Winning Strategies, By Company, 2023-2032

- Moderate Bargaining power of Buyers

- Moderate Bargaining power of Suppliers

- Moderate Bargaining power of New Entrants

- Low threat of Substitution

- High Competitive Rivalry

- Restraint and Drivers: Virtual and Augmented Reality Market

- Virtual and Augmented Reality Market Segmentation, By Technology

- Virtual and Augmented Reality Market For Live Attenuated, By Region, 2023-2033 ($ Billion)

- Global Virtual and Augmented Reality Market, By Technology, 2023-2032(USD Billion)

- global Hardware (Head Mounted Display, Head Up Display, Glasses, Console, Sensor/Input, Camera, and Projector), Virtual and Augmented Reality Market, By Region, 2023-2032(USD Billion)

- global Software, Virtual and Augmented Reality Market, By Region, 2023-2032(USD Billion)

- global Service, Virtual and Augmented Reality Market, By Region, 2023-2032(USD Billion)

- global Healthcare, Virtual and Augmented Reality Market, By Region, 2023-2032(USD Billion)

- global Education, Virtual and Augmented Reality Market, By Region, 2023-2032(USD Billion)

- global Retail, Virtual and Augmented Reality Market, By Region, 2023-2032(USD Billion)

- global Gaming, Virtual and Augmented Reality Market, By Region, 2023-2032(USD Billion)

- global Construction, Virtual and Augmented Reality Market, By Region, 2023-2032(USD Billion)

- global Media and Entertainment, Virtual and Augmented Reality Market, By Region, 2023-2032(USD Billion)

- global Automotive, Virtual and Augmented Reality Market, By Region, 2023-2032(USD Billion)

- global Defense and Aerospace, Virtual and Augmented Reality Market, By Region, 2023-2032(USD Billion)

- global Manufacturing, Virtual and Augmented Reality Market, By Region, 2023-2032(USD Billion)

- Google: Net Sales, 2023-2033 ($ Billion)

- Google: Revenue Share, By Segment, 2023 (%)

- Google: Revenue Share, By Region, 2023 (%)

- Samsung Electronics: Net Sales, 2023-2033 ($ Billion)

- Samsung Electronics: Revenue Share, By Segment, 2023 (%)

- Samsung Electronics: Revenue Share, By Region, 2023 (%)

- Microsoft Corporation: Net Sales, 2023-2033 ($ Billion)

- Microsoft Corporation: Revenue Share, By Segment, 2023 (%)

- Microsoft Corporation: Revenue Share, By Region, 2023 (%)

- Sony Interactive Entertainment: Net Sales, 2023-2033 ($ Billion)

- Sony Interactive Entertainment: Revenue Share, By Segment, 2023 (%)

- Sony Interactive Entertainment: Revenue Share, By Region, 2023 (%)

- Oculus VR LLC: Net Sales, 2023-2033 ($ Billion)

- Oculus VR LLC: Revenue Share, By Segment, 2023 (%)

- Oculus VR LLC: Revenue Share, By Region, 2023 (%)

- HTC Corporation: Net Sales, 2023-2033 ($ Billion)

- HTC Corporation: Revenue Share, By Segment, 2023 (%)

- HTC Corporation: Revenue Share, By Region, 2023 (%)

- ZeroLigh: Net Sales, 2023-2033 ($ Billion)

- ZeroLigh: Revenue Share, By Segment, 2023 (%)

- ZeroLigh: Revenue Share, By Region, 2023 (%)

- EON Reality: Net Sales, 2023-2033 ($ Billion)

- EON Reality: Revenue Share, By Segment, 2023 (%)

- EON Reality: Revenue Share, By Region, 2023 (%)

- Nokia Corporation: Net Sales, 2023-2033 ($ Billion)

- Nokia Corporation: Revenue Share, By Segment, 2023 (%)

- Nokia Corporation: Revenue Share, By Region, 2023 (%)

- Barco: Net Sales, 2023-2033 ($ Billion)

- Barco: Revenue Share, By Segment, 2023 (%)

- Barco: Revenue Share, By Region, 2023 (%)

- Blippar.com Ltd: Net Sales, 2023-2033 ($ Billion)

- Blippar.com Ltd: Revenue Share, By Segment, 2023 (%)

- Blippar.com Ltd: Revenue Share, By Region, 2023 (%)

- Aurasma Ltd. (Hewlett-Packard Development Company. L.P): Net Sales, 2023-2033 ($ Billion)

- Aurasma Ltd. (Hewlett-Packard Development Company. L.P): Revenue Share, By Segment, 2023 (%)

- Aurasma Ltd. (Hewlett-Packard Development Company. L.P): Revenue Share, By Region, 2023 (%)

- MindMaze SA: Net Sales, 2023-2033 ($ Billion)

- MindMaze SA: Revenue Share, By Segment, 2023 (%)

- MindMaze SA: Revenue Share, By Region, 2023 (%)

- Virtalis: Net Sales, 2023-2033 ($ Billion)

- Virtalis: Revenue Share, By Segment, 2023 (%)

- Virtalis: Revenue Share, By Region, 2023 (%)

- Manus Machinae: Net Sales, 2023-2033 ($ Billion)

- Manus Machinae: Revenue Share, By Segment, 2023 (%)

- Manus Machinae: Revenue Share, By Region, 2023 (%)

- Independiente Communications: Net Sales, 2023-2033 ($ Billion)

- Independiente Communications: Revenue Share, By Segment, 2023 (%)

- Independiente Communications: Revenue Share, By Region, 2023 (%)

- VirZOOM: Net Sales, 2023-2033 ($ Billion)

- VirZOOM: Revenue Share, By Segment, 2023 (%)

- VirZOOM: Revenue Share, By Region, 2023 (%)

- NuFormer Projection: Net Sales, 2023-2033 ($ Billion)

- NuFormer Projection: Revenue Share, By Segment, 2023 (%)

- NuFormer Projection: Revenue Share, By Region, 2023 (%)

Infinitive Data Research provides comprehensive market research, offering in-depth market analysis to help companies understand their target market and industry competition. This research predicts the market acceptance of your brand and products, ensuring informed decision-making for business success.

Competitor Analysis in the Virtual and Augmented Reality Industry

Conducting a competitor analysis involves identifying competitors within the Virtual and Augmented Reality industry and studying their various marketing strategies. This comparative data allows you to assess your company's strengths and weaknesses relative to competitors, providing insights to enhance your market position.

Importance of Continuous Market Research

Consistently conducting market research is essential for minimizing risk at every stage of business operations. Virtual and Augmented Reality market research enables you to collect qualitative and quantitative data, which, when properly analyzed, leads to wise decisions that align with user and customer needs. Below are some crucial lessons learned through the Virtual and Augmented Reality market research process:

Key Dimensions of Virtual and Augmented Reality Market Analysis

- Trend and Pattern Identification: Analyzing data to spot market trends and patterns.

- Pricing Analysis: Assessing keyword pricing strategies.

- Actionable Insights: Implementing insights derived from data analysis.

- Market Potential: Evaluating the potential of the Virtual and Augmented Reality market.

- Competitor Analysis: Studying competitors' strategies and performance.

- Location Analysis: Assessing optimal locations for market penetration.

- Distribution Channels Analysis: Evaluating the effectiveness of distribution channels.

- Market Size and Growth Rate: Measuring market size and growth potential.

- Market Profitability: Assessing profitability prospects.

- Key Success Factors: Identifying critical factors for success.

- Cost Structure: Understanding the cost structure within the Virtual and Augmented Reality industry.

Target Audience for the Report

This report is valuable for a diverse audience, including:

- Virtual and Augmented Reality Market Manufacturers: To understand market dynamics and enhance production strategies.

- Investors and Financing Companies: To assess investment opportunities and risks.

- Virtual and Augmented Reality Market Suppliers: To identify market demands and supply chain efficiencies.

Necessity of the Report

Making Crucial Business Decisions

Understanding the Virtual and Augmented Reality market, competition, and industry landscape is vital for making informed business decisions. Without current and relevant market research, decisions may be based on outdated or irrelevant information, potentially harming the business.

Securing Investment Funds

Attracting investors requires demonstrating thorough market research. Investors need assurance that you understand the sector, current and potential competition, and whether your idea addresses a market need.

Identifying New Business Opportunities

Virtual and Augmented Reality market research goes beyond understanding trends and consumer behavior. It identifies new revenue streams and opportunities for business pivots. These insights can lead to strategic changes in the business model, promoting growth and adapting to market challenges.

Avoiding Business Failures

Market research also plays a crucial role in risk mitigation. It can reveal when not to pursue certain actions, saving the company from potential losses in revenue, brand image, and more. This proactive approach is often overlooked but is essential for long-term success.

Conclusion

Infinitive Data Research's comprehensive Virtual and Augmented Reality market research provides critical insights for making solid business decisions, securing investments, identifying new opportunities, and avoiding potential failures. Understanding market dynamics through continuous research ensures your company remains competitive and thrives in the Virtual and Augmented Reality industry.