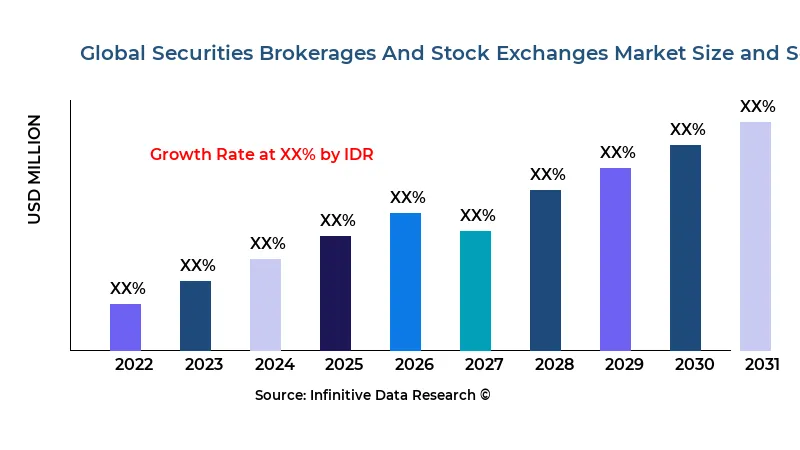

Securities Brokerages And Stock Exchanges Market Growth CAGR Overview

According to research by Infinitive Data Research, the global Securities Brokerages And Stock Exchanges Market size was valued at USD 1101.6 Bln (billion) in 2024 and is Calculated to reach USD 1601.6 Bln (billion) by the end of 2032, growing at an anticipated compound annual growth rate (CAGR) of 7.1% during the forecast period 2024 to 2032. This projected growth is driven by its increasing adoption across Software & Services industries such as Online, OfflineThe Securities Brokerages And Stock Exchanges market is witnessing profound transformations driven by digitalization and globalization. Technological advancements are revolutionizing trading platforms, making them more accessible, efficient, and secure for both institutional and retail investors. Traditional exchanges are increasingly incorporating blockchain and AI-driven analytics to streamline trading operations and enhance transparency. This digital evolution is reshaping market dynamics and creating new opportunities for growth and innovation across global financial centers.

Market dynamics in this segment are heavily influenced by evolving regulatory frameworks and heightened investor demands for transparency. Brokerages and exchanges are adapting to stricter compliance and risk management standards while striving to maintain market liquidity. Increased adoption of algorithmic and high-frequency trading has further intensified competition among market participants. The environment is characterized by continuous innovation, where legacy systems are being rapidly replaced by state-of-the-art digital platforms that offer real-time insights and enhanced security protocols.

Investor behavior is evolving as market participants demand quicker execution times, improved data analytics, and more sophisticated risk management tools. Firms are investing heavily in technology to enhance trading efficiency and reduce operational risks. The rapid pace of digital transformation is complemented by a growing demand for integration between different financial instruments and platforms. This integrated approach is enabling brokerages and stock exchanges to offer diversified products and services that cater to a wide range of investment strategies, further fueling market dynamism.

Global economic trends, including fluctuating interest rates, geopolitical uncertainties, and evolving trade relationships, also play a significant role in shaping the market. Brokerages and stock exchanges are navigating these challenges by adopting agile operational strategies and investing in robust technology infrastructures. The drive for digital transformation, combined with the need for enhanced market transparency and security, is setting the stage for significant growth and innovation in the sector. Market participants that successfully blend technology with strategic foresight are well positioned to capitalize on emerging trends and drive long-term growth.

>>> Understand The Key Trends Shaping This Market:- Download PDF Sample

Securities Brokerages And Stock Exchanges Market Growth Factors

The Securities Brokerages And Stock Exchanges market is propelled by the digital revolution and increased investor participation in global markets. A significant factor contributing to market growth is the evolution of electronic trading platforms that enable faster and more secure transactions. Innovations such as blockchain for trade settlements and AI-powered analytics are becoming mainstream, driving efficiency and reducing operational costs. The growing adoption of these technologies is making the market more attractive to both institutional and retail investors, thereby accelerating growth.

Globalization of financial markets has led to increased cross-border trading, which has further stimulated market expansion. Brokerages and stock exchanges are expanding their networks to offer seamless access to international markets. This has resulted in higher trading volumes and diversified revenue streams. As investors seek exposure to a variety of asset classes and markets, the demand for advanced trading platforms with comprehensive analytical capabilities has soared. This trend is further enhanced by the increasing integration of global financial systems and the standardization of trading protocols across borders.

Investor demand for transparency, security, and speed in executing trades is also a major growth driver in this market. Advances in technology have led to the development of highly efficient trading systems that can handle complex transactions with minimal delays. This has bolstered investor confidence and attracted significant capital inflows. Market participants are continually upgrading their technological infrastructure to meet the increasing expectations of a digitally empowered investor base. The focus on operational excellence and real-time data processing is propelling market growth, creating a highly competitive environment that fosters continuous innovation.

Regulatory reforms aimed at enhancing market transparency and reducing systemic risk are contributing significantly to the growth of this market. Government bodies and regulatory agencies worldwide are actively promoting initiatives that modernize trading infrastructure and ensure robust risk management. These measures not only protect investors but also foster a stable and efficient trading environment. The resulting improvements in market efficiency and investor confidence are expected to drive sustained growth. As a result, firms that invest in advanced technologies and comply with evolving regulatory standards are likely to emerge as market leaders.

Market Analysis By Competitors

- Marsh & McLennan

- Willis Towers Watson

- Aon

- Arthur J. Gallagher

- Brown & Brown

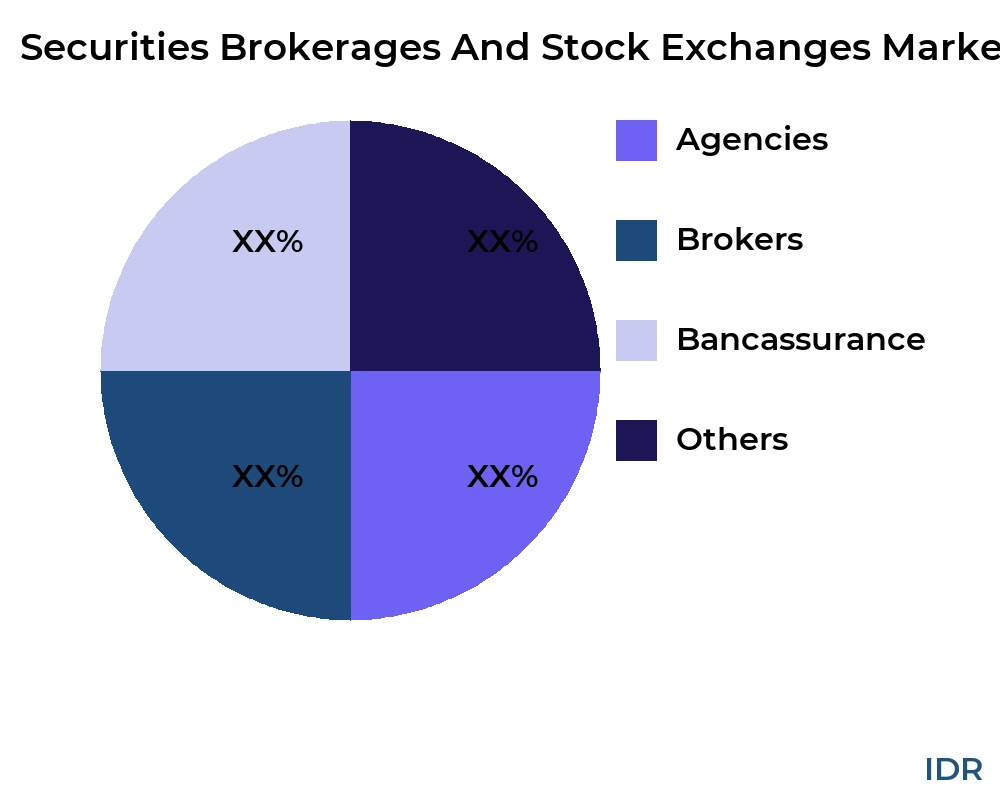

By Product Type

- Agencies

- Brokers

- Bancassurance

- Others

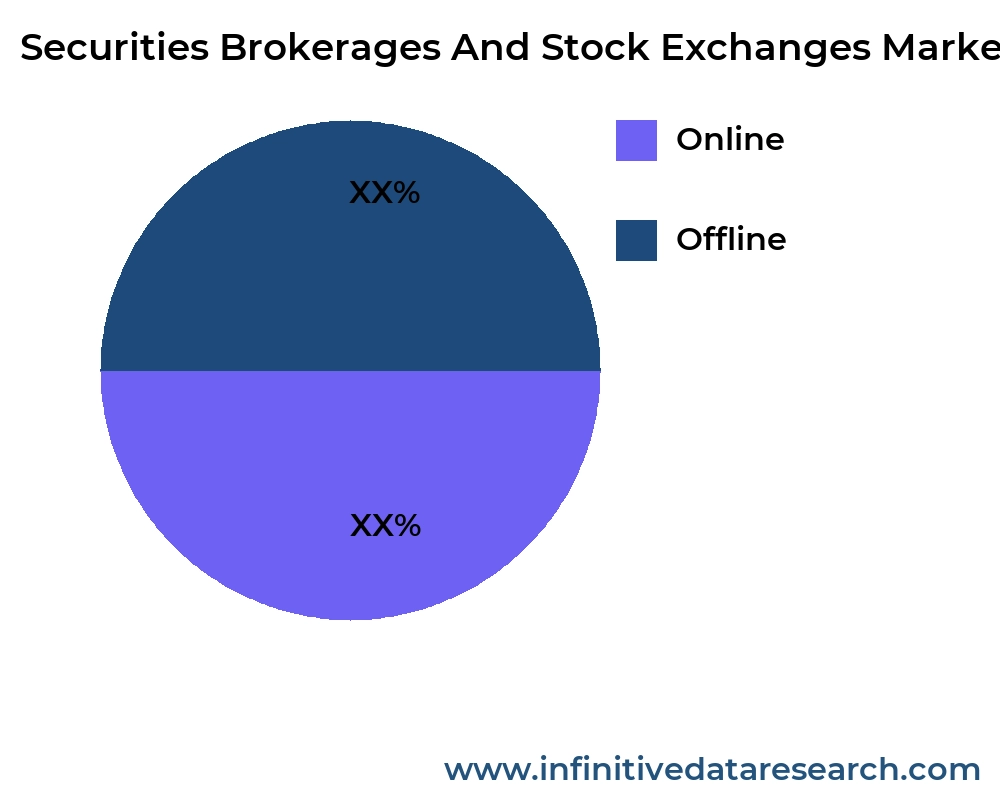

By Application

- Online

- Offline

>>> Understand The Key Trends Shaping This Market:- Understand The Key Trends Shaping This Market:-

Securities Brokerages And Stock Exchanges Market Segment Analysis

Distribution ChannelDistribution channels in the Securities Brokerages And Stock Exchanges market range from traditional floor trading to advanced electronic and algorithmic trading platforms. Digital platforms have revolutionized the way securities are traded, providing seamless access to global markets and ensuring high-speed transaction processing. Traditional channels still hold relevance, particularly for large institutional trades where personal broker expertise remains valuable. The integration of digital channels with conventional trading methods is creating a hybrid environment that optimizes both speed and personalized service. Market participants are investing in robust electronic systems that offer real-time data, reducing latency and improving overall market efficiency.

CompatibilityCompatibility in this market is driven by the need for interoperability between various trading systems and market infrastructures. Brokerages and exchanges are investing in platforms that can integrate legacy systems with modern technologies such as cloud computing and blockchain. This ensures that data flows seamlessly across different systems, providing real-time updates and accurate market information. The focus on compatibility is critical for managing the complex interactions between multiple asset classes and trading instruments. Firms that achieve high levels of system integration are better positioned to offer streamlined services and improved trading experiences. This drive for compatibility is essential in fostering a cohesive and efficient market ecosystem that meets the demands of a global investor base.

PricePricing in the Securities Brokerages And Stock Exchanges market is determined by transaction fees, platform subscriptions, and value-added services. Competitive pricing strategies are a hallmark of the industry, with firms continuously optimizing their fee structures to attract a broad spectrum of investors. As trading volumes increase, economies of scale enable platforms to offer lower transaction costs, enhancing overall market efficiency. Price competition is further fueled by the advent of fintech innovations that offer cost-effective alternatives to traditional trading systems. Firms are compelled to balance competitive pricing with the need to invest in advanced technology and maintain high standards of security and service quality. This dynamic pricing environment is crucial in sustaining market growth and driving investor participation.

Product TypeThe product portfolio in the Securities Brokerages And Stock Exchanges market is diverse, including equities, derivatives, fixed income, and exchange-traded funds (ETFs). Firms are continuously innovating to offer specialized products that cater to the evolving needs of investors. The advent of digital platforms has enabled the creation of hybrid products that combine elements of traditional and alternative asset classes. This diversity allows market participants to construct balanced and diversified portfolios that mitigate risk. The focus on developing new product types is driven by investor demand for flexibility, liquidity, and comprehensive market exposure. Firms that offer innovative and well-integrated products are well positioned to capture market share in an increasingly competitive landscape.

| REPORT ATTRIBUTES | DETAILS |

|---|---|

| Study Period |

2019-2032 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Historical Period |

2019-2022 |

| Unit |

Value (USD Billion) |

| Key Companies Profiled |

Marsh & McLennan, Willis Towers Watson, Aon, Arthur J. Gallagher, Brown & Brown |

| Segments Covered |

By Product |

| Customization Scope |

Free report customization (equivalent to up to 3 analyst working days) with purchase. Addition or alteration to country, regional and segment scope |

>>> Overview of Market Analysis:- Download PDF Sample

Securities Brokerages And Stock Exchanges Market Regional Analysis

North America continues to lead the Securities Brokerages And Stock Exchanges market with its mature financial systems and advanced technological infrastructure. The region benefits from well-established regulatory frameworks and deep liquidity, which attract both domestic and international investors. Market participants in North America are at the forefront of adopting cutting-edge technologies that streamline trading operations and enhance transparency. The continuous innovation in trading platforms and the integration of digital technologies have cemented the region’s position as a global financial hub. With ongoing investments in infrastructure and a strong emphasis on compliance, North America remains a benchmark for market efficiency and stability.

In Europe, the market is characterized by a blend of traditional trading practices and rapid digital transformation. European exchanges are focusing on modernizing their platforms to meet the demands of a highly regulated and diverse investor base. This region has seen significant investments in technology and risk management systems to enhance market efficiency and investor protection. European market participants benefit from harmonized regulatory standards across multiple countries, which facilitates cross-border trading and fosters deeper market integration. The dynamic interplay between established financial institutions and innovative fintech companies is driving continuous growth and competitive differentiation.

The Asia-Pacific region is experiencing rapid expansion in the Securities Brokerages And Stock Exchanges market due to increasing economic integration and rising investor participation. With a burgeoning middle class and growing financial literacy, the demand for sophisticated trading platforms is on the rise. Countries in this region are rapidly adopting digital trading technologies, which are transforming traditional market structures. The focus on modernization and regulatory reforms is enabling market players to offer more transparent and efficient trading services. This region’s dynamic growth trajectory is further bolstered by strategic investments in digital infrastructure and cross-border trading initiatives, positioning it as a key player in the global market.

Latin America and emerging markets in Africa are gradually transforming their financial ecosystems as digital trading platforms become more prevalent. These regions are characterized by high growth potential driven by increasing investor participation and the modernization of traditional trading infrastructures. Brokerages and stock exchanges in these areas are leveraging technology to overcome infrastructural challenges and improve market transparency. The push for digitalization and regulatory improvements is enabling local markets to integrate with the global financial system. As these regions continue to develop their digital capabilities, they are poised to experience significant growth and attract increased international investment.

global Securities Brokerages And Stock Exchanges market revenue (usd million) comparison by players 2024-2032

| Company/players | 2021 | 2022 | 2023 | 2024 | ... | (2032) |

|---|---|---|---|---|---|---|

| Marsh & McLennan | XX | XX | XX | XX | XX | XX |

| Willis Towers Watson | XX | XX | XX | XX | XX | XX |

| Aon | XX | XX | XX | XX | XX | XX |

| Arthur J. Gallagher | XX | XX | XX | XX | XX | XX |

| Brown & Brown | XX | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX | XX |

global Securities Brokerages And Stock Exchanges market revenue (usd million) comparison by product type 2024-2032

Product Type

2023

2024

...

2032

CAGR%(2024-32)

Agencies

XX

XX

XX

XX

XX

Brokers

XX

XX

XX

XX

XX

Bancassurance

XX

XX

XX

XX

XX

Others

XX

XX

XX

XX

XX

Total

XX

XX

XX

XX

XX

| Product Type | 2023 | 2024 | ... | 2032 | CAGR%(2024-32) |

|---|---|---|---|---|---|

| Agencies | XX | XX | XX | XX | XX |

| Brokers | XX | XX | XX | XX | XX |

| Bancassurance | XX | XX | XX | XX | XX |

| Others | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX |

global Securities Brokerages And Stock Exchanges market revenue (usd million) comparison by application 2024-2032

Application

2023

2024

...

2032

CAGR%(2024-32)

Online

XX

XX

XX

XX

XX

Offline

XX

XX

XX

XX

XX

Total

XX

XX

XX

XX

XX

| Application | 2023 | 2024 | ... | 2032 | CAGR%(2024-32) |

|---|---|---|---|---|---|

| Online | XX | XX | XX | XX | XX |

| Offline | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX |

>>> Market Understand Through Graph And Chart:- Download PDF Sample

Securities Brokerages And Stock Exchanges Market Competitive Insights

The competitive environment in the Securities Brokerages And Stock Exchanges market is characterized by rapid technological adoption and a constant drive for operational excellence. Legacy players are investing in digital upgrades and system integrations to maintain their market positions, while new entrants are leveraging innovative platforms to disrupt traditional trading models. This intense competition has led to an environment where speed, security, and customer service are paramount. Market leaders continue to invest heavily in research and development to stay ahead of technological trends and meet evolving investor expectations.

Regulatory pressures and the need for enhanced market transparency are driving firms to adopt more rigorous risk management practices. Competitors are increasingly integrating advanced analytics and real-time data processing capabilities into their trading systems to ensure compliance and operational efficiency. The focus on cybersecurity and fraud prevention is also intensifying as firms strive to protect investor interests and maintain market integrity. This competitive drive for enhanced operational resilience and transparency is reshaping market dynamics and establishing new industry standards.

Strategic partnerships and collaborations have become a key feature in the competitive landscape of securities brokerages and stock exchanges. Firms are forming alliances with technology providers, fintech startups, and even cross-border exchanges to extend their market reach and improve service offerings. These collaborations allow competitors to share expertise and resources, driving innovation across the industry. As companies continue to merge traditional strengths with digital advancements, the overall market becomes more efficient and responsive to investor needs, resulting in sustained competitive pressures.

Global market leaders are positioning themselves as integrated service providers by offering a broad range of trading solutions that cater to both retail and institutional investors. Their ability to combine deep market knowledge with state-of-the-art technology enables them to offer superior execution, advanced analytics, and robust risk management. These firms are continuously expanding their product portfolios and geographical presence, ensuring a competitive edge in an increasingly interconnected global market. The relentless pursuit of innovation and excellence is a key driver of competitive differentiation in this dynamic sector.

Securities Brokerages And Stock Exchanges Market Competitors

United States:

-

TradeLink Inc.

-

MarketHub USA

-

EquityNet Brokers

-

DigitalTrade LLC

-

SecureExchange Corp.

United Kingdom:

-

London Exchange Ltd.

-

TradeBridge UK

-

EquityFlow PLC

-

MarketDirect UK

-

SecureTrade UK

Germany:

-

Deutsche Trade AG

-

EquityPlus Germany

-

MarketLink GmbH

-

TradeSecure DE

-

DigitalExchange Germany

India:

-

Bharat Trade Solutions

-

EquityConnect India

-

MarketPulse Brokers

-

DigitalTrade India

-

SecureExchange India

Japan:

-

Nippon TradeTech

-

EquityLink Japan

-

MarketFlow Japan

-

TradeNet Japan

-

SecureExchange JP

Australia:

-

OzTrade Exchange

-

EquityHub Australia

-

MarketDirect AU

-

TradeLink Australia

-

DigitalExchange AU

Securities Brokerages And Stock Exchanges Market Top Competitors

TradeLink Inc. is recognized as a major player in the US securities brokerage market with a strong digital platform that caters to both retail and institutional investors. The company is noted for its high-speed execution and innovative trading tools. TradeLink Inc. has consistently invested in advanced analytics and cybersecurity measures to enhance its service offerings. It maintains a broad network of strategic partnerships with financial institutions. The company is agile in adapting to market shifts and regulatory changes. TradeLink Inc. emphasizes customer service and operational transparency. Its integrated approach has helped it secure a significant market share. The firm continues to drive industry standards through continuous innovation.

-

MarketHub USA has established itself as a leading securities brokerage with a focus on digital transformation and streamlined trading operations. The company is known for its sophisticated electronic trading systems and real-time data analytics. MarketHub USA leverages advanced technology to deliver fast and secure trade execution. It is committed to maintaining regulatory compliance while offering a user-friendly trading environment. The firm has successfully expanded its services to meet diverse investor needs. Its innovative approach has driven high customer satisfaction and retention. MarketHub USA consistently evolves its platform to incorporate emerging technologies. Its market position is bolstered by strategic industry partnerships and a strong digital footprint.

-

EquityNet Brokers is a prominent competitor recognized for its comprehensive trading solutions and integrated market access. The company has built a reputation for delivering seamless trade execution and high-quality customer service. EquityNet Brokers invests heavily in technology to offer innovative analytics and risk management tools. It maintains robust operational processes that ensure data security and regulatory compliance. The firm is continuously adapting its product portfolio to meet evolving market demands. Its digital platform is designed to provide real-time insights and efficient transaction processing. EquityNet Brokers is widely regarded for its strategic vision and operational excellence. Its market presence is reinforced by strong industry alliances and customer trust.

-

DigitalTrade LLC has made significant strides in the competitive landscape by focusing on technology-driven trading solutions. The company is recognized for its agile platform that supports high-frequency trading and advanced algorithmic strategies. DigitalTrade LLC has consistently enhanced its digital infrastructure to improve trade execution speed and reliability. The firm is known for its proactive approach to risk management and cybersecurity. Its innovative services have attracted a broad customer base, ranging from individual investors to large institutions. DigitalTrade LLC continuously invests in research and development to stay ahead of market trends. Its commitment to operational efficiency and technological excellence positions it as a formidable competitor. The company’s reputation is built on performance, innovation, and customer-centric service.

-

SecureExchange Corp. is widely known for its robust trading infrastructure and high standards of security in the US market. The company emphasizes data protection and regulatory adherence, ensuring a reliable trading environment. SecureExchange Corp. leverages cutting-edge technology to offer seamless trade execution and real-time market analysis. Its operational framework is designed to minimize latency and maximize efficiency. The firm has built strong partnerships with financial institutions, enhancing its market reach. SecureExchange Corp. continually refines its service offerings to address evolving market demands. Its reputation is further strengthened by proactive cybersecurity measures and operational resilience. The company is recognized as a trusted name in securities brokerage and stock exchange services.

-

London Exchange Ltd. holds a prominent position in the UK market as a modern and innovative stock exchange operator. The company is renowned for its seamless integration of traditional trading methods with advanced digital solutions. London Exchange Ltd. has invested in state-of-the-art trading platforms that offer transparency and high-speed execution. It maintains strong regulatory relationships and ensures compliance across all operations. The firm is focused on expanding its product offerings and market reach through strategic partnerships. Its commitment to innovation is evident in its continuous technology upgrades and customer-centric approach. London Exchange Ltd. is widely respected for its operational efficiency and market integrity. Its competitive edge is underscored by a dynamic and agile business model.

-

TradeBridge UK is known for its comprehensive trading solutions and strong digital presence in the UK securities market. The company leverages cutting-edge technology to deliver efficient trade processing and advanced market analytics. TradeBridge UK is committed to providing a secure and transparent trading environment for investors. It has built a robust platform that seamlessly integrates traditional and digital trading methods. The firm continually invests in innovation to enhance its service offerings and maintain regulatory compliance. Its market strategy includes strategic partnerships that broaden its reach and improve operational efficiency. TradeBridge UK is recognized for its customer-centric approach and high-quality support services. Its market position is a testament to its commitment to excellence and innovation.

-

EquityFlow PLC is a leading competitor in the European market with a strong focus on digital integration and seamless market connectivity. The company is known for its innovative trading platform that supports multi-asset trading with high reliability. EquityFlow PLC continuously upgrades its technology to provide real-time data, advanced analytics, and secure trade execution. It maintains a strong reputation for transparency and regulatory compliance. The firm is dedicated to improving the overall investor experience through personalized services and strategic partnerships. EquityFlow PLC’s operational efficiency and commitment to technological innovation have contributed to its strong market position. Its customer-centric model and agile business practices have made it a market leader. The company continues to shape the future of securities trading through continuous improvement and innovation.

-

MarketDirect UK is widely recognized for its agile and innovative approach in the competitive UK securities market. The company has developed a sophisticated digital trading platform that offers fast and secure execution. MarketDirect UK emphasizes transparency and customer empowerment through advanced analytical tools and real-time market data. It has built a strong network of strategic partners to enhance its market presence and operational capabilities. The firm’s focus on innovation and continuous improvement has driven high customer satisfaction and market growth. MarketDirect UK is dedicated to maintaining regulatory compliance while offering comprehensive trading solutions. Its commitment to technological excellence and operational resilience underpins its competitive position. The company is a trusted provider of integrated market services in the region.

-

DigitalExchange AU stands out in the Australian market for its advanced digital trading solutions and commitment to operational excellence. The company has established a robust platform that supports both retail and institutional trading with high efficiency. DigitalExchange AU emphasizes secure data transmission and real-time analytics, ensuring a reliable trading environment. Its continuous investment in technology upgrades has helped it maintain a competitive edge. The firm is known for its agile response to market trends and regulatory developments. DigitalExchange AU has forged strategic partnerships that expand its service offerings and market reach. Its customer-focused approach and innovative solutions have garnered strong investor confidence. The company remains a key player in driving digital transformation in the Australian securities market.

The report provides a detailed analysis of the Securities Brokerages And Stock Exchanges market across various regions, highlighting the unique market dynamics and growth opportunities in each region.

- US

- Canada

- Mexico

- UK

- Germany

- France

- Italy

- Russia

- Spain

- Switzerland

- Austria

- Belgium

- Rest of Europe

- China

- Japan

- South Korea

- Indonesia

- Vietnam

- Philippines

- Australia

- Thailand

- Singapore

- Rest of APAC

- UAE

- Saudi Arabia

- Egypt

- South Africa

- Israel

- Rest of MEA

- Brazil

- Argentina

- Rest of Latin America

>>> Need A Different Region Or Segment? Download PDF Sample

Key Takeaways

- The global Securities Brokerages And Stock Exchanges market is expected to grow significantly from 2024 to 2032, driven by technological advancements, increasing demand, and government investments in urbanization.

- The market is characterized by a diverse range of manufacturers, product types, and applications, catering to different consumer needs and preferences.

- Regional insights highlight the unique market dynamics and growth opportunities in various regions, including North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

- The competitive landscape features key players who have created a dynamic and diverse market environment through collaborations, mergers and acquisitions, and innovative product developments.

- Market trends such as technological advancements, sustainability, customization, and digital transformation are shaping the growth and development of the Securities Brokerages And Stock Exchanges market.

- Despite the positive outlook, the market faces challenges such as regulatory compliance, high initial investment costs, and economic uncertainties.

- The report provides comprehensive coverage of market size, market share, growth factors, and strategic insights to help businesses navigate the dynamic Securities Brokerages And Stock Exchanges market and achieve long-term success.

By leveraging the information provided in this report, businesses can develop effective strategies, address market challenges, and capitalize on growth opportunities to ensure sustainable growth and long-term success in the global Securities Brokerages And Stock Exchanges market.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Currency

- Key Target Audience

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Restraints

- Opportunities

- Challenges

- Global Securities Brokerages And Stock Exchanges Market Analysis and Projection, By Companies

- Segment Overview

- Marsh & McLennan

- Willis Towers Watson

- Aon

- Arthur J. Gallagher

- Brown & Brown

- Global Securities Brokerages And Stock Exchanges Market Analysis and Projection, By Type

- Segment Overview

- Agencies

- Brokers

- Bancassurance

- Others

- Global Securities Brokerages And Stock Exchanges Market Analysis and Projection, By Application

- Segment Overview

- Online

- Offline

- Global Securities Brokerages And Stock Exchanges Market Analysis and Projection, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Russia

- Spain

- Switzerland

- Austria

- Belgium

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Vietnam

- Philippines

- Australia

- Thailand

- Singapore

- Rest of APAC

- Middle East

- UAE

- Saudi Arabia

- Egypt

- South Africa

- Israel

- Rest of MEA

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Global Securities Brokerages And Stock Exchanges Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Securities Brokerages And Stock Exchanges Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Coverage Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Marsh & McLennan

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Willis Towers Watson

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Aon

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Arthur J. Gallagher

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Brown & Brown

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

List of Table

- Drivers of Global Securities Brokerages And Stock Exchanges Market: Impact Analysis

- Restraints of Global Securities Brokerages And Stock Exchanges Market: Impact Analysis

- Global Securities Brokerages And Stock Exchanges Market, By Technology, 2023-2032(USD Billion)

- global Agencies, Securities Brokerages And Stock Exchanges Market, By Region, 2023-2032(USD Billion)

- global Brokers, Securities Brokerages And Stock Exchanges Market, By Region, 2023-2032(USD Billion)

- global Bancassurance, Securities Brokerages And Stock Exchanges Market, By Region, 2023-2032(USD Billion)

- global Others, Securities Brokerages And Stock Exchanges Market, By Region, 2023-2032(USD Billion)

- global Online, Securities Brokerages And Stock Exchanges Market, By Region, 2023-2032(USD Billion)

- global Offline, Securities Brokerages And Stock Exchanges Market, By Region, 2023-2032(USD Billion)

List of Figures

- Global Securities Brokerages And Stock Exchanges Market Segmentation

- Securities Brokerages And Stock Exchanges Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top investment pocket in the Securities Brokerages And Stock Exchanges Market

- Top Winning Strategies, 2023-2032

- Top Winning Strategies, By Development, 2023-2032(%)

- Top Winning Strategies, By Company, 2023-2032

- Moderate Bargaining power of Buyers

- Moderate Bargaining power of Suppliers

- Moderate Bargaining power of New Entrants

- Low threat of Substitution

- High Competitive Rivalry

- Restraint and Drivers: Securities Brokerages And Stock Exchanges Market

- Securities Brokerages And Stock Exchanges Market Segmentation, By Technology

- Securities Brokerages And Stock Exchanges Market For Live Attenuated, By Region, 2023-2033 ($ Billion)

- Global Securities Brokerages And Stock Exchanges Market, By Technology, 2023-2032(USD Billion)

- global Agencies, Securities Brokerages And Stock Exchanges Market, By Region, 2023-2032(USD Billion)

- global Brokers, Securities Brokerages And Stock Exchanges Market, By Region, 2023-2032(USD Billion)

- global Bancassurance, Securities Brokerages And Stock Exchanges Market, By Region, 2023-2032(USD Billion)

- global Others, Securities Brokerages And Stock Exchanges Market, By Region, 2023-2032(USD Billion)

- global Online, Securities Brokerages And Stock Exchanges Market, By Region, 2023-2032(USD Billion)

- global Offline, Securities Brokerages And Stock Exchanges Market, By Region, 2023-2032(USD Billion)

- Marsh & McLennan: Net Sales, 2023-2033 ($ Billion)

- Marsh & McLennan: Revenue Share, By Segment, 2023 (%)

- Marsh & McLennan: Revenue Share, By Region, 2023 (%)

- Willis Towers Watson: Net Sales, 2023-2033 ($ Billion)

- Willis Towers Watson: Revenue Share, By Segment, 2023 (%)

- Willis Towers Watson: Revenue Share, By Region, 2023 (%)

- Aon: Net Sales, 2023-2033 ($ Billion)

- Aon: Revenue Share, By Segment, 2023 (%)

- Aon: Revenue Share, By Region, 2023 (%)

- Arthur J. Gallagher: Net Sales, 2023-2033 ($ Billion)

- Arthur J. Gallagher: Revenue Share, By Segment, 2023 (%)

- Arthur J. Gallagher: Revenue Share, By Region, 2023 (%)

- Brown & Brown: Net Sales, 2023-2033 ($ Billion)

- Brown & Brown: Revenue Share, By Segment, 2023 (%)

- Brown & Brown: Revenue Share, By Region, 2023 (%)

Infinitive Data Research provides comprehensive market research, offering in-depth market analysis to help companies understand their target market and industry competition. This research predicts the market acceptance of your brand and products, ensuring informed decision-making for business success.

Competitor Analysis in the Securities Brokerages And Stock Exchanges Industry

Conducting a competitor analysis involves identifying competitors within the Securities Brokerages And Stock Exchanges industry and studying their various marketing strategies. This comparative data allows you to assess your company's strengths and weaknesses relative to competitors, providing insights to enhance your market position.

Importance of Continuous Market Research

Consistently conducting market research is essential for minimizing risk at every stage of business operations. Securities Brokerages And Stock Exchanges market research enables you to collect qualitative and quantitative data, which, when properly analyzed, leads to wise decisions that align with user and customer needs. Below are some crucial lessons learned through the Securities Brokerages And Stock Exchanges market research process:

Key Dimensions of Securities Brokerages And Stock Exchanges Market Analysis

- Trend and Pattern Identification: Analyzing data to spot market trends and patterns.

- Pricing Analysis: Assessing keyword pricing strategies.

- Actionable Insights: Implementing insights derived from data analysis.

- Market Potential: Evaluating the potential of the Securities Brokerages And Stock Exchanges market.

- Competitor Analysis: Studying competitors' strategies and performance.

- Location Analysis: Assessing optimal locations for market penetration.

- Distribution Channels Analysis: Evaluating the effectiveness of distribution channels.

- Market Size and Growth Rate: Measuring market size and growth potential.

- Market Profitability: Assessing profitability prospects.

- Key Success Factors: Identifying critical factors for success.

- Cost Structure: Understanding the cost structure within the Securities Brokerages And Stock Exchanges industry.

Target Audience for the Report

This report is valuable for a diverse audience, including:

- Securities Brokerages And Stock Exchanges Market Manufacturers: To understand market dynamics and enhance production strategies.

- Investors and Financing Companies: To assess investment opportunities and risks.

- Securities Brokerages And Stock Exchanges Market Suppliers: To identify market demands and supply chain efficiencies.

Necessity of the Report

Making Crucial Business Decisions

Understanding the Securities Brokerages And Stock Exchanges market, competition, and industry landscape is vital for making informed business decisions. Without current and relevant market research, decisions may be based on outdated or irrelevant information, potentially harming the business.

Securing Investment Funds

Attracting investors requires demonstrating thorough market research. Investors need assurance that you understand the sector, current and potential competition, and whether your idea addresses a market need.

Identifying New Business Opportunities

Securities Brokerages And Stock Exchanges market research goes beyond understanding trends and consumer behavior. It identifies new revenue streams and opportunities for business pivots. These insights can lead to strategic changes in the business model, promoting growth and adapting to market challenges.

Avoiding Business Failures

Market research also plays a crucial role in risk mitigation. It can reveal when not to pursue certain actions, saving the company from potential losses in revenue, brand image, and more. This proactive approach is often overlooked but is essential for long-term success.

Conclusion

Infinitive Data Research's comprehensive Securities Brokerages And Stock Exchanges market research provides critical insights for making solid business decisions, securing investments, identifying new opportunities, and avoiding potential failures. Understanding market dynamics through continuous research ensures your company remains competitive and thrives in the Securities Brokerages And Stock Exchanges industry.