Reinforced Thermoplastic Pipes (RTP) Market Growth CAGR Overview

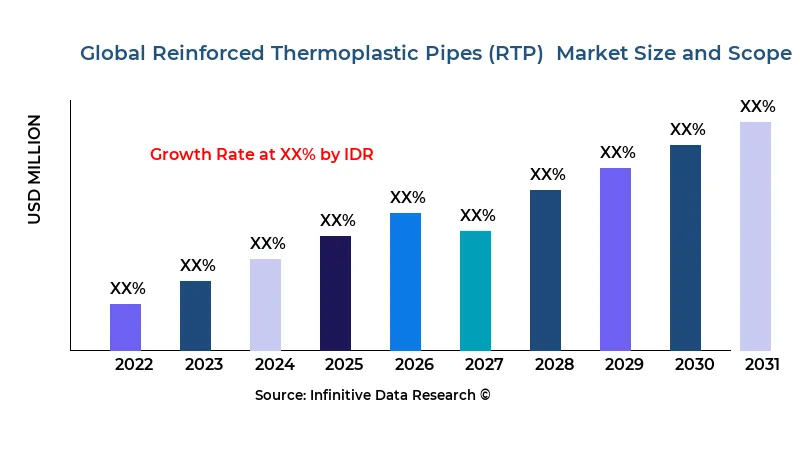

According to research by Infinitive Data Research, the global Reinforced Thermoplastic Pipes (RTP) Market size was valued at USD 5.3 Bln (billion) in 2024 and is Calculated to reach USD 7.47 Bln (billion) by the end of 2032, growing at an anticipated compound annual growth rate (CAGR) of 5.52% during the forecast period 2024 to 2032. This projected growth is driven by its increasing adoption across Chemical & Materials industries such as Oil Flow Lines, Gas Distribution Networks, Water Injection Lines, OthersThe Reinforced Thermoplastic Pipes (RTP) market is experiencing significant growth, driven by the increasing demand for durable, lightweight, and cost-effective piping solutions across various industries. RTPs are known for their superior strength-to-weight ratio, which makes them ideal for applications in sectors like oil and gas, water distribution, and chemical processing. The ability of RTPs to combine the flexibility of thermoplastics with the strength of reinforcement materials such as fiberglass or carbon fiber allows them to handle high pressures and temperatures. This unique feature makes them a preferred choice in industries that require resistance to corrosion, which is a common issue with traditional metal piping systems. As industries continue to emphasize sustainability and lower operational costs, RTPs are becoming more attractive due to their lower maintenance requirements and longer service life.

The increasing investment in infrastructure development, particularly in emerging economies, is also fueling the growth of the RTP market. As urbanization accelerates globally, there is a rising demand for modern water and wastewater management systems, along with reliable gas and oil transportation networks. RTPs offer a competitive edge in these areas because they are lighter and more flexible than conventional pipes, allowing for easier installation and transportation, especially in remote or hard-to-reach locations. Additionally, the need for more efficient and durable pipelines in the oil and gas sector has made RTPs highly sought after, especially for subsea and offshore installations, where corrosion-resistant, high-pressure solutions are critical.

However, despite the many advantages of RTPs, there are challenges that could impact market growth. One of the primary concerns is the high initial cost of production, particularly due to the specialized materials required for reinforcement and the advanced technology involved in manufacturing. This could limit their adoption, particularly in regions or industries that are sensitive to price fluctuations. Furthermore, while RTPs offer significant advantages over traditional pipes in terms of flexibility and durability, their long-term performance in highly aggressive environments, such as those involving extreme chemical exposure or high mechanical stresses, is still being evaluated. As the technology matures, innovations in materials and production processes are expected to address these concerns, opening new opportunities for market expansion in various industrial applications.

>>> Understand The Key Trends Shaping This Market:- Download PDF Sample

Reinforced Thermoplastic Pipes Rtp Market Growth Factors

The reinforced thermoplastic pipe (RTP) market has been experiencing significant growth due to the increasing demand for cost-effective, durable, and flexible piping solutions in various industries. RTPs are made by combining thermoplastic materials with reinforcement layers, such as fiberglass or carbon fibers, which enhance the pipes' strength and resistance to corrosion. This unique combination of flexibility, lightweight, and robustness makes RTPs ideal for applications in industries like oil and gas, water management, and construction. These pipes are particularly attractive in sectors where traditional metallic pipes are prone to corrosion, scaling, or require expensive maintenance. As industries seek to reduce their overall infrastructure costs while maintaining reliability and performance, the adoption of RTPs is rising rapidly.

Another key factor driving the growth of the RTP market is the increasing focus on environmental sustainability. RTPs are highly resistant to corrosion, which extends their service life and reduces the frequency of replacements, leading to less waste and lower environmental impact compared to traditional materials. Furthermore, RTPs are often made from recyclable thermoplastics, making them an environmentally friendly alternative to other types of piping materials. With stricter environmental regulations and a growing emphasis on sustainability, industries are leaning towards RTPs as a solution that supports green building practices and contributes to a reduction in the carbon footprint of infrastructure projects. This demand for more eco-conscious piping solutions is further fueling the market’s expansion.

Technological advancements in materials and manufacturing processes have also played a significant role in the accelerated growth of the RTP market. With improvements in resin technologies, reinforcement techniques, and the overall manufacturing process, RTPs have become more versatile, offering enhanced pressure resistance, higher temperature tolerance, and improved chemical resistance. This versatility allows for RTPs to be used in a broader range of industries, from offshore oil extraction to deepwater applications. The growing trend towards smart infrastructure and digital monitoring systems also enables better management of RTP installations, increasing their efficiency and reliability. As industries continue to innovate and push for higher-performance materials, the market for reinforced thermoplastic pipes is set to grow substantially in the coming years.

Market Analysis By Competitors

- Technip

- GE Oil & Gas(Wellstream)

- National Oilwell Varco(NKT Flexibles)

- Shawcor(Flexpipe Systems)

- FlexSteel

- SoluForce (Pipelife)

- H.A.T-FLEX

- Polyflow, LLC

- Prysmian

- Aerosun Corporation

- Changchun GaoXiang Special pipe

- PES.TEC

- Airborne Oil & Gas

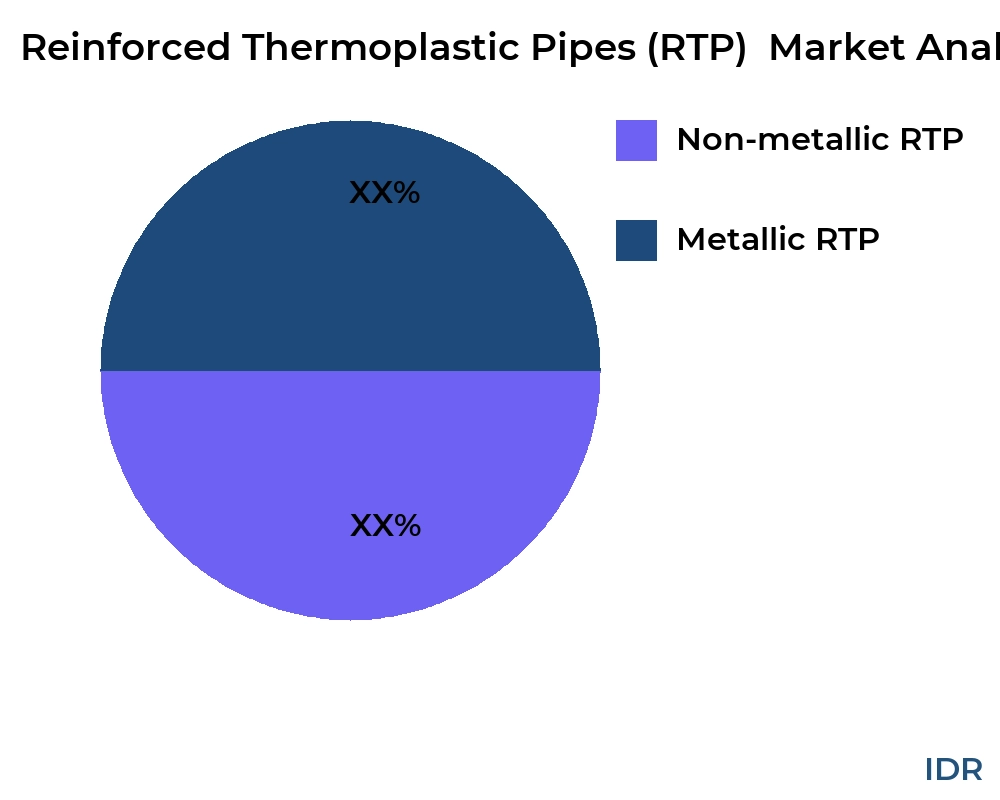

By Product Type

- Non-metallic RTP

- Metallic RTP

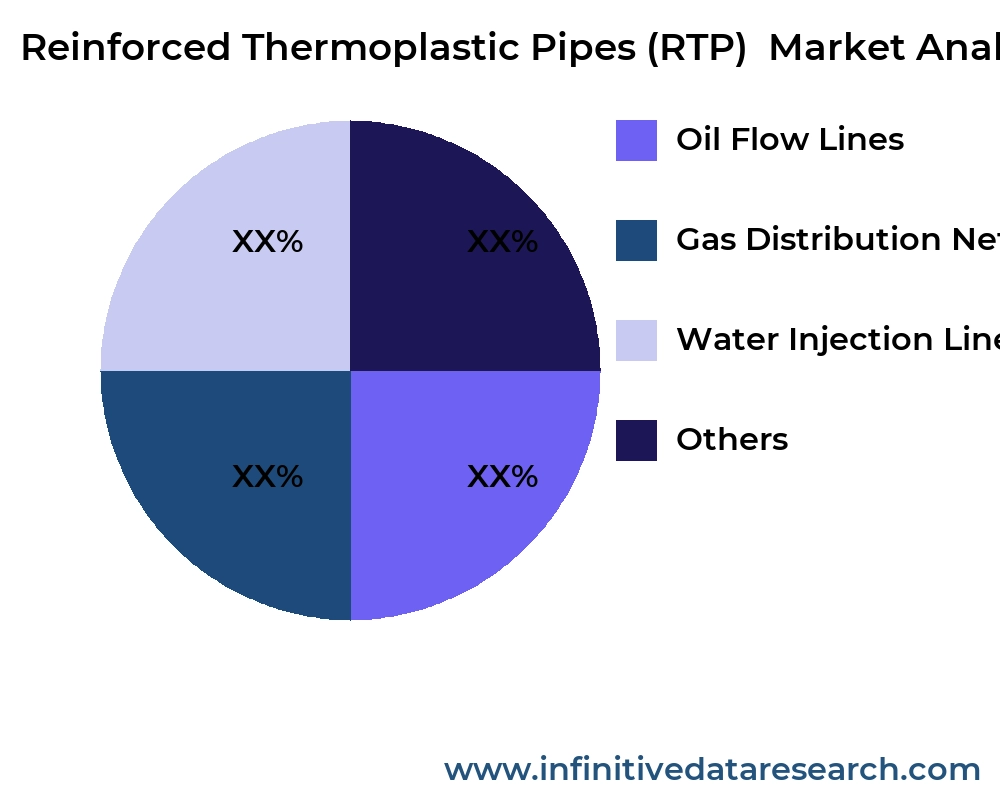

By Application

- Oil Flow Lines

- Gas Distribution Networks

- Water Injection Lines

- Others

>>> Understand The Key Trends Shaping This Market:- Understand The Key Trends Shaping This Market:-

Reinforced Thermoplastic Pipes Rtp Market Segment Analysis

1. Distribution Channel

The reinforced thermoplastic pipes (RTP) market is divided into multiple distribution channels, each with distinct attributes and contributions to the industry’s overall growth. Key distribution channels include direct sales, which involves manufacturers selling directly to end-users, as well as intermediaries such as distributors, wholesalers, and online platforms. Direct sales often provide manufacturers with better control over pricing and customer relationships, making it an ideal choice for large-scale projects where customized specifications and prompt technical support are crucial. On the other hand, distributors and wholesalers extend the market reach, enabling RTP manufacturers to cater to smaller companies and regional customers who rely on localized expertise. Meanwhile, the online channel, though relatively new in this industry, has been growing steadily due to the increasing preference for digital transactions, enhanced transparency, and easy access to a broader product portfolio. Each distribution channel serves a unique purpose, and manufacturers frequently adopt a multi-channel approach to maximize market penetration and maintain a competitive edge.

2. Compatibility

Compatibility is a critical factor when assessing RTP market segments. RTPs are designed to handle a variety of fluids, including hydrocarbons, water, and chemical solutions, and their material composition must be carefully selected to ensure resistance to corrosion, high pressures, and varying temperatures. The growing adoption of RTPs in oil and gas applications is largely due to their exceptional chemical compatibility with hydrocarbons and sour gases. This characteristic reduces maintenance costs and prolongs pipe lifespan, a key benefit in harsh upstream and midstream environments. Furthermore, compatibility extends beyond chemical resistance to include ease of integration with existing infrastructure. RTP systems often feature specialized connectors and fittings that ensure seamless installation and minimize the risk of leakage. In regions where pipelines run through ecologically sensitive areas or extreme weather conditions, compatibility with environmental and operational constraints is crucial. As end-users continue to prioritize safety and efficiency, RTP manufacturers are investing heavily in R&D to enhance the compatibility of their products with a wider range of applications and operating conditions.

3. Price Range

Price remains a significant determinant in the RTP market, influencing both purchasing decisions and overall industry trends. The cost of RTPs can vary greatly depending on factors such as pipe diameter, pressure rating, material composition, and brand reputation. For example, higher-end RTPs made from premium materials such as aramid or carbon fiber reinforcements command a higher price but offer superior performance, longevity, and resistance to extreme conditions. Conversely, more budget-friendly options often use standard thermoplastic layers and glass fiber reinforcements, which are sufficient for less demanding applications like municipal water systems or low-pressure oilfield operations. The price range also affects adoption rates among different customer segments. While large oil and gas companies are more willing to invest in premium RTPs for their offshore projects, smaller enterprises and emerging markets may gravitate toward mid-range or lower-cost alternatives. Manufacturers are therefore tasked with balancing innovation and cost-efficiency, ensuring that a diverse range of customers can access RTP solutions without compromising quality or safety.

4. Product Type

The RTP market is segmented by product type, which typically includes standard RTPs, high-pressure RTPs, and specialty RTPs tailored to specific applications. Standard RTPs are often used in water distribution, onshore oil and gas fields, and general industrial applications. These pipes offer a cost-effective solution for moderate pressure levels and relatively benign operating conditions. High-pressure RTPs, on the other hand, are designed for challenging environments such as deepwater offshore platforms and high-temperature gas wells. With their advanced reinforcement layers and proprietary coatings, high-pressure RTPs provide excellent reliability and long-term performance under extreme stress. Additionally, specialty RTPs are emerging to address niche applications—ranging from chemical processing plants to cryogenic pipelines—where unique material properties and design considerations are essential. As the market expands, the development of customized RTP products is becoming a major driver of innovation, enabling manufacturers to meet the evolving demands of diverse industries and maintain a competitive position in the global market.

| REPORT ATTRIBUTES | DETAILS |

|---|---|

| Study Period |

2019-2032 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Historical Period |

2019-2022 |

| Unit |

Value (USD Billion) |

| Key Companies Profiled |

Technip, GE Oil & Gas(Wellstream), National Oilwell Varco(NKT Flexibles), Shawcor(Flexpipe Systems), FlexSteel, SoluForce (Pipelife), H.A.T-FLEX, Polyflow, LLC, Prysmian, Aerosun Corporation, Changchun GaoXiang Special pipe, PES.TEC, Airborne Oil & Gas |

| Segments Covered |

By Product |

| Customization Scope |

Free report customization (equivalent to up to 3 analyst working days) with purchase. Addition or alteration to country, regional and segment scope |

>>> Overview of Market Analysis:- Download PDF Sample

Reinforced Thermoplastic Pipes Rtp Market Regional Analysis

The Reinforced Thermoplastic Pipes (RTP) market has seen a steady rise in adoption across key regions due to their versatility, cost-effectiveness, and enhanced performance in demanding environments. In North America, the market is driven by the robust oil and gas sector, which relies on RTP’s lightweight and corrosion-resistant properties to streamline transportation and reduce maintenance costs. With the ongoing push towards cost-efficient and environmentally sustainable solutions, the United States and Canada have emerged as prominent consumers of RTP. The region’s established pipeline infrastructure and significant investment in expanding shale gas production are further bolstering market growth.

Europe, another major region for the RTP market, has witnessed strong growth owing to its extensive network of gas pipelines and a rising emphasis on clean energy. Countries such as Germany, the Netherlands, and the United Kingdom are increasingly adopting RTP for natural gas distribution, as well as in offshore oil applications. The European market is also shaped by stringent regulations that encourage the use of materials with lower environmental impact. Furthermore, the region’s focus on reducing operational costs and improving pipeline safety is fueling the shift toward RTP solutions, making it a lucrative market for manufacturers and suppliers.

In the Asia-Pacific region, the demand for RTP is gaining momentum due to the rapid industrialization and urbanization taking place in countries such as China, India, and Australia. This region’s growing energy demand, coupled with the need to modernize aging pipeline infrastructure, has led to increased investments in RTP technology. Governments and private entities in the region are turning to reinforced thermoplastic pipes as a reliable, efficient, and cost-effective alternative to traditional steel pipelines. Additionally, the rise in offshore oil and gas exploration activities in Southeast Asia is providing significant opportunities for the RTP market to expand further in this dynamic and fast-growing region.

global Reinforced Thermoplastic Pipes (RTP) market revenue (usd million) comparison by players 2024-2032

| Company/players | 2021 | 2022 | 2023 | 2024 | ... | (2032) |

|---|---|---|---|---|---|---|

| Technip | XX | XX | XX | XX | XX | XX |

| GE Oil & Gas(Wellstream) | XX | XX | XX | XX | XX | XX |

| National Oilwell Varco(NKT Flexibles) | XX | XX | XX | XX | XX | XX |

| Shawcor(Flexpipe Systems) | XX | XX | XX | XX | XX | XX |

| FlexSteel | XX | XX | XX | XX | XX | XX |

| SoluForce (Pipelife) | XX | XX | XX | XX | XX | XX |

| H.A.T-FLEX | XX | XX | XX | XX | XX | XX |

| Polyflow, LLC | XX | XX | XX | XX | XX | XX |

| Prysmian | XX | XX | XX | XX | XX | XX |

| Aerosun Corporation | XX | XX | XX | XX | XX | XX |

| Changchun GaoXiang Special pipe | XX | XX | XX | XX | XX | XX |

| PES.TEC | XX | XX | XX | XX | XX | XX |

| Airborne Oil & Gas | XX | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX | XX |

global Reinforced Thermoplastic Pipes (RTP) market revenue (usd million) comparison by product type 2024-2032

Product Type

2023

2024

...

2032

CAGR%(2024-32)

Non-metallic RTP

XX

XX

XX

XX

XX

Metallic RTP

XX

XX

XX

XX

XX

Total

XX

XX

XX

XX

XX

| Product Type | 2023 | 2024 | ... | 2032 | CAGR%(2024-32) |

|---|---|---|---|---|---|

| Non-metallic RTP | XX | XX | XX | XX | XX |

| Metallic RTP | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX |

global Reinforced Thermoplastic Pipes (RTP) market revenue (usd million) comparison by application 2024-2032

Application

2023

2024

...

2032

CAGR%(2024-32)

Oil Flow Lines

XX

XX

XX

XX

XX

Gas Distribution Networks

XX

XX

XX

XX

XX

Water Injection Lines

XX

XX

XX

XX

XX

Others

XX

XX

XX

XX

XX

Total

XX

XX

XX

XX

XX

| Application | 2023 | 2024 | ... | 2032 | CAGR%(2024-32) |

|---|---|---|---|---|---|

| Oil Flow Lines | XX | XX | XX | XX | XX |

| Gas Distribution Networks | XX | XX | XX | XX | XX |

| Water Injection Lines | XX | XX | XX | XX | XX |

| Others | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX |

>>> Market Understand Through Graph And Chart:- Download PDF Sample

Reinforced Thermoplastic Pipes Rtp Market Competitive Insights

The reinforced thermoplastic pipes (RTP) market is experiencing notable growth due to increasing demand for lightweight, durable, and cost-effective pipeline solutions. Unlike traditional steel pipelines, RTPs consist of multiple layers, typically including a thermoplastic liner, a reinforced layer of high-strength fibers, and a protective outer sheath. This construction allows RTPs to offer exceptional corrosion resistance, flexibility, and ease of installation, making them a preferred choice in industries like oil and gas, water distribution, and chemical processing. In particular, the oil and gas sector has emerged as a significant driver, as these pipes are well-suited for challenging environments, such as offshore and high-pressure onshore applications, where their resistance to harsh chemicals and saltwater ensures long-term reliability and minimal maintenance.

Market competition is intensifying as a growing number of manufacturers invest in research and development to improve product performance and expand their portfolios. Key players are focusing on developing RTP solutions that can handle higher pressures and temperatures, which expands their use in more demanding applications. In addition, companies are working on advanced production techniques and materials to lower costs while maintaining the structural integrity and longevity of the pipes. This competitive environment encourages innovation, resulting in a broader range of products tailored to specific needs, such as flexible pipelines for quick installation or those designed for extreme environmental conditions. As a result, customers benefit from a wider array of options and improved pipeline efficiency, which further boosts the market’s appeal.

Regional dynamics also play a critical role in shaping the competitive landscape. In North America and Europe, stringent environmental regulations and the need to replace aging infrastructure drive RTP adoption. Meanwhile, emerging economies in Asia-Pacific and the Middle East present lucrative growth opportunities as industrial expansion and urbanization increase demand for modern, efficient pipeline systems. Companies aiming to strengthen their foothold in these regions are establishing partnerships, enhancing their local presence, and tailoring their offerings to meet regional standards and customer preferences. As these markets mature, the competition is expected to grow even fiercer, pushing companies to continuously innovate and improve their value propositions to gain a competitive edge.

Reinforced Thermoplastic Pipes Rtp Market Competitors

United States

- National Oilwell Varco

- Baker Hughes (a GE Company)

- FlexSteel Pipeline Technologies

- Magma Global Ltd.

Canada

- Shawcor Ltd.

- Fiberspar LinePipe LLC

Netherlands

- Strohm (formerly Airborne Oil & Gas)

- Wellstream International Ltd.

United Kingdom

- Pipelife Norge AS

- Subsea 7 S.A.

- MCS Advanced Subsea Engineering

China

- TechnipFMC (China operations)

- Hubei Yichang Plastic Factory

- CNPC Bohai Equipment Manufacturing Co., Ltd.

Brazil

- Braskem S.A.

- Karoon Gas Australia Ltd.

Norway

- Aker Solutions

- DNV GL Group

France

- Technip Energies

- Vallourec S.A.

Germany

- BASF SE

- Wavin GmbH

Japan

- Mitsubishi Chemical Corporation

- Sumitomo Chemical Company

India

- Reliance Industries Limited

- Welspun Corp Ltd.

Australia

- Oilfield Technologies Pty Ltd.

- Swagelining Limited

Reinforced Thermoplastic Pipes Rtp Market Top Competitors

1. National Oilwell Varco (NOV)

National Oilwell Varco, a global oilfield services company, holds a leading position in the RTP market through its NOV Fiber Glass Systems division. The company provides advanced RTP solutions for onshore and offshore applications, benefiting from its extensive experience in composite pipe technologies. NOV’s RTP offerings are known for their durability, corrosion resistance, and ease of installation, making them a preferred choice for the oil and gas industry. With a well-established global presence and a strong reputation for quality and innovation, NOV continues to expand its market share and set industry standards in the RTP sector.

2. Shawcor (Flexpipe Systems)

Shawcor, through its Flexpipe Systems division, is a key player in the reinforced thermoplastic pipe market. The company focuses on developing and manufacturing spoolable RTP products that deliver superior performance in oil and gas flowline and pipeline applications. Shawcor’s RTP solutions are designed to withstand high pressures, resist corrosion, and minimize installation time, making them highly sought after by operators. With a robust distribution network and continuous investment in research and development, Shawcor maintains a strong competitive edge and a growing customer base in the RTP market.

3. Pipelife International

A subsidiary of the Wienerberger Group, Pipelife International is a well-established manufacturer of thermoplastic pipe systems. Pipelife offers a wide range of RTP solutions for industrial and infrastructure applications, leveraging its expertise in polymer processing and composite technologies. The company’s RTP products are recognized for their reliability, lightweight design, and long service life, which help clients reduce operational costs and environmental impact. As a leading supplier in Europe and beyond, Pipelife continues to strengthen its market position by expanding its product portfolio and enhancing its production capabilities.

4. Future Pipe Industries (FPI)

Future Pipe Industries is a prominent provider of composite piping systems, including reinforced thermoplastic pipes. The company caters to a variety of industries, including oil and gas, chemical processing, and water utilities. FPI’s RTP solutions are known for their high mechanical strength, corrosion resistance, and ease of maintenance. With a strong presence in the Middle East, North Africa, and Asia, the company has established itself as a trusted partner for both onshore and offshore projects. FPI’s commitment to innovation and customer satisfaction helps it maintain a competitive position in the global RTP market.

5. Polyflow, LLC

Polyflow specializes in the development and production of spoolable RTP solutions for the oil and gas industry. The company’s flexible composite pipes are designed to handle challenging environments, offering excellent resistance to corrosion, pressure, and chemical exposure. Polyflow’s RTP products are often used for flowlines, gathering systems, and well intervention projects, providing a cost-effective and efficient alternative to traditional steel pipes. By focusing on advanced materials and manufacturing processes, Polyflow has carved out a strong niche in the RTP market, earning recognition for its high-quality and dependable solutions.

6. TechnipFMC (Technip Energies)

TechnipFMC, through its Technip Energies division, is a major player in the reinforced thermoplastic pipe market. The company provides innovative RTP solutions tailored to the needs of the oil and gas, chemical, and renewable energy sectors. TechnipFMC’s RTP products are designed to meet rigorous performance standards, delivering high reliability, long service life, and resistance to harsh environmental conditions. With a global reach and a solid track record in project execution, the company continues to expand its presence in the RTP market by leveraging its engineering expertise and commitment to sustainability.

7. PPG Industries

PPG Industries, a leading global supplier of coatings and specialty materials, also manufactures advanced RTP solutions. The company’s reinforced thermoplastic pipe products are developed to offer superior mechanical properties, chemical resistance, and ease of installation. PPG’s RTP offerings are used in various applications, including oil and gas, industrial processes, and water distribution. By leveraging its material science expertise and global manufacturing footprint, PPG Industries remains a competitive player in the RTP market, consistently delivering high-performance products that meet the demanding requirements of its customers.

8. Evonik Industries

Evonik Industries, a world leader in specialty chemicals, is a key supplier of high-performance materials used in reinforced thermoplastic pipes. While not a direct manufacturer of RTP systems, Evonik’s advanced polymers, such as polyamide and polyether ether ketone (PEEK), are widely used in the production of RTPs. The company’s materials provide excellent strength, durability, and resistance to harsh chemicals, making them essential components of modern RTP designs. By continuing to innovate and develop cutting-edge polymer solutions, Evonik supports the growth and advancement of the RTP market worldwide.

9. Baker Hughes

Baker Hughes, a global energy technology company, is recognized for its portfolio of composite and flexible pipe solutions. The company’s RTP products are designed to address the unique challenges of oil and gas production, including corrosion, high pressure, and temperature extremes. Baker Hughes leverages its extensive expertise in materials science and engineering to produce RTP solutions that enhance operational efficiency and reduce total lifecycle costs. With a strong focus on reliability, performance, and sustainability, Baker Hughes is a well-respected provider in the RTP market.

10. GE Oil & Gas (now part of Baker Hughes)

GE Oil & Gas, now integrated into Baker Hughes, remains a significant contributor to the RTP market through its composite and thermoplastic pipe offerings. The company’s reinforced thermoplastic pipe systems are used in a variety of oilfield applications, delivering benefits such as improved safety, reduced maintenance requirements, and lower environmental impact. By combining the resources and expertise of GE Oil & Gas with Baker Hughes’ broader capabilities, the company continues to develop and deliver advanced RTP solutions that meet the evolving needs of the energy industry.

The report provides a detailed analysis of the Reinforced Thermoplastic Pipes (RTP) market across various regions, highlighting the unique market dynamics and growth opportunities in each region.

- US

- Canada

- Mexico

- UK

- Germany

- France

- Italy

- Russia

- Spain

- Switzerland

- Austria

- Belgium

- Rest of Europe

- China

- Japan

- South Korea

- Indonesia

- Vietnam

- Philippines

- Australia

- Thailand

- Singapore

- Rest of APAC

- UAE

- Saudi Arabia

- Egypt

- South Africa

- Israel

- Rest of MEA

- Brazil

- Argentina

- Rest of Latin America

>>> Need A Different Region Or Segment? Download PDF Sample

Key Takeaways

- The global Reinforced Thermoplastic Pipes (RTP) market is expected to grow significantly from 2024 to 2032, driven by technological advancements, increasing demand, and government investments in urbanization.

- The market is characterized by a diverse range of manufacturers, product types, and applications, catering to different consumer needs and preferences.

- Regional insights highlight the unique market dynamics and growth opportunities in various regions, including North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

- The competitive landscape features key players who have created a dynamic and diverse market environment through collaborations, mergers and acquisitions, and innovative product developments.

- Market trends such as technological advancements, sustainability, customization, and digital transformation are shaping the growth and development of the Reinforced Thermoplastic Pipes (RTP) market.

- Despite the positive outlook, the market faces challenges such as regulatory compliance, high initial investment costs, and economic uncertainties.

- The report provides comprehensive coverage of market size, market share, growth factors, and strategic insights to help businesses navigate the dynamic Reinforced Thermoplastic Pipes (RTP) market and achieve long-term success.

By leveraging the information provided in this report, businesses can develop effective strategies, address market challenges, and capitalize on growth opportunities to ensure sustainable growth and long-term success in the global Reinforced Thermoplastic Pipes (RTP) market.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Currency

- Key Target Audience

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Restraints

- Opportunities

- Challenges

- Global Reinforced Thermoplastic Pipes (RTP) Market Analysis and Projection, By Companies

- Segment Overview

- Technip

- GE Oil & Gas(Wellstream)

- National Oilwell Varco(NKT Flexibles)

- Shawcor(Flexpipe Systems)

- FlexSteel

- SoluForce (Pipelife)

- H.A.T-FLEX

- Polyflow, LLC

- Prysmian

- Aerosun Corporation

- Changchun GaoXiang Special pipe

- PES.TEC

- Airborne Oil & Gas

- Global Reinforced Thermoplastic Pipes (RTP) Market Analysis and Projection, By Type

- Segment Overview

- Non-metallic RTP

- Metallic RTP

- Global Reinforced Thermoplastic Pipes (RTP) Market Analysis and Projection, By Application

- Segment Overview

- Oil Flow Lines

- Gas Distribution Networks

- Water Injection Lines

- Others

- Global Reinforced Thermoplastic Pipes (RTP) Market Analysis and Projection, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Russia

- Spain

- Switzerland

- Austria

- Belgium

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Vietnam

- Philippines

- Australia

- Thailand

- Singapore

- Rest of APAC

- Middle East

- UAE

- Saudi Arabia

- Egypt

- South Africa

- Israel

- Rest of MEA

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Global Reinforced Thermoplastic Pipes (RTP) Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Reinforced Thermoplastic Pipes (RTP) Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Coverage Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Technip

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- GE Oil & Gas(Wellstream)

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- National Oilwell Varco(NKT Flexibles)

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Shawcor(Flexpipe Systems)

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- FlexSteel

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- SoluForce (Pipelife)

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- H.A.T-FLEX

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Polyflow, LLC

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Prysmian

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Aerosun Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Changchun GaoXiang Special pipe

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- PES.TEC

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Airborne Oil & Gas

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

List of Table

- Drivers of Global Reinforced Thermoplastic Pipes (RTP) Market: Impact Analysis

- Restraints of Global Reinforced Thermoplastic Pipes (RTP) Market: Impact Analysis

- Global Reinforced Thermoplastic Pipes (RTP) Market, By Technology, 2023-2032(USD Billion)

- global Non-metallic RTP, Reinforced Thermoplastic Pipes (RTP) Market, By Region, 2023-2032(USD Billion)

- global Metallic RTP, Reinforced Thermoplastic Pipes (RTP) Market, By Region, 2023-2032(USD Billion)

- global Oil Flow Lines, Reinforced Thermoplastic Pipes (RTP) Market, By Region, 2023-2032(USD Billion)

- global Gas Distribution Networks, Reinforced Thermoplastic Pipes (RTP) Market, By Region, 2023-2032(USD Billion)

- global Water Injection Lines, Reinforced Thermoplastic Pipes (RTP) Market, By Region, 2023-2032(USD Billion)

- global Others, Reinforced Thermoplastic Pipes (RTP) Market, By Region, 2023-2032(USD Billion)

List of Figures

- Global Reinforced Thermoplastic Pipes (RTP) Market Segmentation

- Reinforced Thermoplastic Pipes (RTP) Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top investment pocket in the Reinforced Thermoplastic Pipes (RTP) Market

- Top Winning Strategies, 2023-2032

- Top Winning Strategies, By Development, 2023-2032(%)

- Top Winning Strategies, By Company, 2023-2032

- Moderate Bargaining power of Buyers

- Moderate Bargaining power of Suppliers

- Moderate Bargaining power of New Entrants

- Low threat of Substitution

- High Competitive Rivalry

- Restraint and Drivers: Reinforced Thermoplastic Pipes (RTP) Market

- Reinforced Thermoplastic Pipes (RTP) Market Segmentation, By Technology

- Reinforced Thermoplastic Pipes (RTP) Market For Live Attenuated, By Region, 2023-2033 ($ Billion)

- Global Reinforced Thermoplastic Pipes (RTP) Market, By Technology, 2023-2032(USD Billion)

- global Non-metallic RTP, Reinforced Thermoplastic Pipes (RTP) Market, By Region, 2023-2032(USD Billion)

- global Metallic RTP, Reinforced Thermoplastic Pipes (RTP) Market, By Region, 2023-2032(USD Billion)

- global Oil Flow Lines, Reinforced Thermoplastic Pipes (RTP) Market, By Region, 2023-2032(USD Billion)

- global Gas Distribution Networks, Reinforced Thermoplastic Pipes (RTP) Market, By Region, 2023-2032(USD Billion)

- global Water Injection Lines, Reinforced Thermoplastic Pipes (RTP) Market, By Region, 2023-2032(USD Billion)

- global Others, Reinforced Thermoplastic Pipes (RTP) Market, By Region, 2023-2032(USD Billion)

- Technip: Net Sales, 2023-2033 ($ Billion)

- Technip: Revenue Share, By Segment, 2023 (%)

- Technip: Revenue Share, By Region, 2023 (%)

- GE Oil & Gas(Wellstream): Net Sales, 2023-2033 ($ Billion)

- GE Oil & Gas(Wellstream): Revenue Share, By Segment, 2023 (%)

- GE Oil & Gas(Wellstream): Revenue Share, By Region, 2023 (%)

- National Oilwell Varco(NKT Flexibles): Net Sales, 2023-2033 ($ Billion)

- National Oilwell Varco(NKT Flexibles): Revenue Share, By Segment, 2023 (%)

- National Oilwell Varco(NKT Flexibles): Revenue Share, By Region, 2023 (%)

- Shawcor(Flexpipe Systems): Net Sales, 2023-2033 ($ Billion)

- Shawcor(Flexpipe Systems): Revenue Share, By Segment, 2023 (%)

- Shawcor(Flexpipe Systems): Revenue Share, By Region, 2023 (%)

- FlexSteel: Net Sales, 2023-2033 ($ Billion)

- FlexSteel: Revenue Share, By Segment, 2023 (%)

- FlexSteel: Revenue Share, By Region, 2023 (%)

- SoluForce (Pipelife): Net Sales, 2023-2033 ($ Billion)

- SoluForce (Pipelife): Revenue Share, By Segment, 2023 (%)

- SoluForce (Pipelife): Revenue Share, By Region, 2023 (%)

- H.A.T-FLEX: Net Sales, 2023-2033 ($ Billion)

- H.A.T-FLEX: Revenue Share, By Segment, 2023 (%)

- H.A.T-FLEX: Revenue Share, By Region, 2023 (%)

- Polyflow, LLC: Net Sales, 2023-2033 ($ Billion)

- Polyflow, LLC: Revenue Share, By Segment, 2023 (%)

- Polyflow, LLC: Revenue Share, By Region, 2023 (%)

- Prysmian: Net Sales, 2023-2033 ($ Billion)

- Prysmian: Revenue Share, By Segment, 2023 (%)

- Prysmian: Revenue Share, By Region, 2023 (%)

- Aerosun Corporation: Net Sales, 2023-2033 ($ Billion)

- Aerosun Corporation: Revenue Share, By Segment, 2023 (%)

- Aerosun Corporation: Revenue Share, By Region, 2023 (%)

- Changchun GaoXiang Special pipe: Net Sales, 2023-2033 ($ Billion)

- Changchun GaoXiang Special pipe: Revenue Share, By Segment, 2023 (%)

- Changchun GaoXiang Special pipe: Revenue Share, By Region, 2023 (%)

- PES.TEC: Net Sales, 2023-2033 ($ Billion)

- PES.TEC: Revenue Share, By Segment, 2023 (%)

- PES.TEC: Revenue Share, By Region, 2023 (%)

- Airborne Oil & Gas: Net Sales, 2023-2033 ($ Billion)

- Airborne Oil & Gas: Revenue Share, By Segment, 2023 (%)

- Airborne Oil & Gas: Revenue Share, By Region, 2023 (%)

Infinitive Data Research provides comprehensive market research, offering in-depth market analysis to help companies understand their target market and industry competition. This research predicts the market acceptance of your brand and products, ensuring informed decision-making for business success.

Competitor Analysis in the Reinforced Thermoplastic Pipes (RTP) Industry

Conducting a competitor analysis involves identifying competitors within the Reinforced Thermoplastic Pipes (RTP) industry and studying their various marketing strategies. This comparative data allows you to assess your company's strengths and weaknesses relative to competitors, providing insights to enhance your market position.

Importance of Continuous Market Research

Consistently conducting market research is essential for minimizing risk at every stage of business operations. Reinforced Thermoplastic Pipes (RTP) market research enables you to collect qualitative and quantitative data, which, when properly analyzed, leads to wise decisions that align with user and customer needs. Below are some crucial lessons learned through the Reinforced Thermoplastic Pipes (RTP) market research process:

Key Dimensions of Reinforced Thermoplastic Pipes (RTP) Market Analysis

- Trend and Pattern Identification: Analyzing data to spot market trends and patterns.

- Pricing Analysis: Assessing keyword pricing strategies.

- Actionable Insights: Implementing insights derived from data analysis.

- Market Potential: Evaluating the potential of the Reinforced Thermoplastic Pipes (RTP) market.

- Competitor Analysis: Studying competitors' strategies and performance.

- Location Analysis: Assessing optimal locations for market penetration.

- Distribution Channels Analysis: Evaluating the effectiveness of distribution channels.

- Market Size and Growth Rate: Measuring market size and growth potential.

- Market Profitability: Assessing profitability prospects.

- Key Success Factors: Identifying critical factors for success.

- Cost Structure: Understanding the cost structure within the Reinforced Thermoplastic Pipes (RTP) industry.

Target Audience for the Report

This report is valuable for a diverse audience, including:

- Reinforced Thermoplastic Pipes (RTP) Market Manufacturers: To understand market dynamics and enhance production strategies.

- Investors and Financing Companies: To assess investment opportunities and risks.

- Reinforced Thermoplastic Pipes (RTP) Market Suppliers: To identify market demands and supply chain efficiencies.

Necessity of the Report

Making Crucial Business Decisions

Understanding the Reinforced Thermoplastic Pipes (RTP) market, competition, and industry landscape is vital for making informed business decisions. Without current and relevant market research, decisions may be based on outdated or irrelevant information, potentially harming the business.

Securing Investment Funds

Attracting investors requires demonstrating thorough market research. Investors need assurance that you understand the sector, current and potential competition, and whether your idea addresses a market need.

Identifying New Business Opportunities

Reinforced Thermoplastic Pipes (RTP) market research goes beyond understanding trends and consumer behavior. It identifies new revenue streams and opportunities for business pivots. These insights can lead to strategic changes in the business model, promoting growth and adapting to market challenges.

Avoiding Business Failures

Market research also plays a crucial role in risk mitigation. It can reveal when not to pursue certain actions, saving the company from potential losses in revenue, brand image, and more. This proactive approach is often overlooked but is essential for long-term success.

Conclusion

Infinitive Data Research's comprehensive Reinforced Thermoplastic Pipes (RTP) market research provides critical insights for making solid business decisions, securing investments, identifying new opportunities, and avoiding potential failures. Understanding market dynamics through continuous research ensures your company remains competitive and thrives in the Reinforced Thermoplastic Pipes (RTP) industry.