Online Grocery Market Growth CAGR Overview

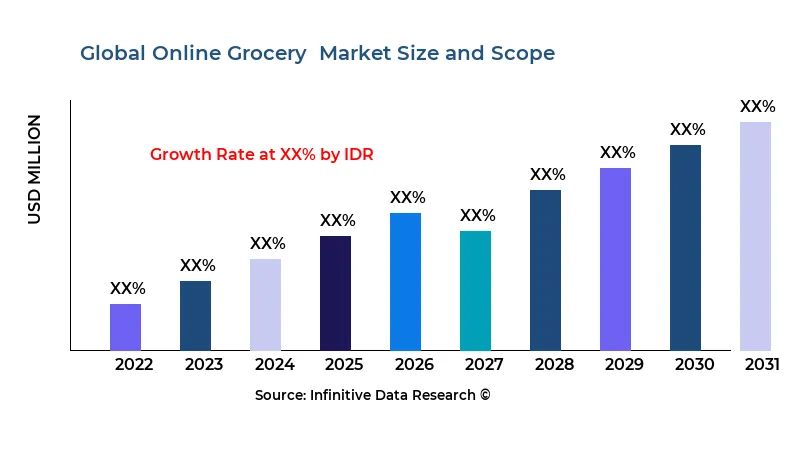

According to research by Infinitive Data Research, the global Online Grocery Market size was valued at USD 59.51 Bln (billion) in 2024 and is Calculated to reach USD 625.3 Bln (billion) by the end of 2032, growing at an anticipated compound annual growth rate (CAGR) of 27.63% during the forecast period 2024 to 2032. This projected growth is driven by its increasing adoption across Telecommunications industries such as Personal Shoppers, Business CustomersThe online grocery market has seen significant growth over the past decade, driven by the increasing convenience that e-commerce platforms offer consumers. With the rise of mobile shopping, consumers can now easily browse through a wide selection of products, compare prices, and have groceries delivered to their doorstep within hours. This shift in consumer behavior has been further fueled by technological advancements, such as AI and data analytics, which allow companies to better predict consumer preferences, optimize inventory, and enhance delivery logistics. As a result, the online grocery market has expanded rapidly, attracting both established retailers and new startups aiming to capture a share of the growing demand.

Consumer expectations for fast delivery, low prices, and high-quality products have led to increased competition among online grocery retailers. Many companies now offer same-day or next-day delivery services, catering to a market that values speed and convenience. At the same time, the rise of subscription-based services and personalized shopping experiences has also gained traction. Retailers are investing heavily in their digital platforms and logistics to streamline operations and offer a more seamless shopping experience. As grocery shopping moves further online, there is a constant focus on improving customer satisfaction and meeting the evolving demands of tech-savvy shoppers.

Despite its growth, the online grocery market still faces challenges such as high operational costs and logistical complexities. Ensuring that fresh produce, frozen goods, and other perishable items are delivered in optimal condition remains a critical hurdle for many companies. Additionally, issues related to last-mile delivery, fulfillment costs, and customer acquisition costs continue to affect profitability. However, the market's long-term prospects are promising, as innovations in delivery methods, automation, and supply chain management have the potential to mitigate these challenges. The growing trend toward sustainability and eco-friendly practices is also influencing the market, with many companies aiming to reduce their carbon footprint and offer more sustainable packaging options.

>>> Understand The Key Trends Shaping This Market:- Download PDF Sample

Online Grocery Market Growth Factors

The online grocery market has witnessed significant growth in recent years, driven by changing consumer behaviors and advancements in technology. One of the main factors contributing to this growth is the increasing adoption of e-commerce platforms for everyday purchases. As consumers become more comfortable with online shopping, they are extending this behavior to groceries, seeking the convenience of browsing and purchasing from the comfort of their homes. This trend has been further accelerated by the ease of use and personalized shopping experiences provided by online grocery platforms, making it simpler for customers to find what they need and have it delivered directly to their doorsteps.

Another important factor in the growth of the online grocery market is the rising demand for convenience. With busy lifestyles, many consumers are seeking ways to save time, and online grocery shopping offers a quick and efficient alternative to traditional brick-and-mortar stores. The availability of same-day or next-day delivery services has made it even more appealing, as it allows consumers to receive fresh groceries without leaving their homes. Additionally, the option to schedule deliveries according to their availability has contributed to the market’s popularity among urban dwellers and working professionals.

The ongoing advancements in technology and logistics are also crucial in fueling the expansion of the online grocery market. Companies are leveraging innovative technologies such as artificial intelligence (AI) and machine learning to streamline inventory management, enhance personalization, and improve customer service. Moreover, the development of sophisticated delivery networks and the integration of smart delivery solutions have made the entire process more efficient. As these technologies continue to evolve, online grocery shopping will become an increasingly seamless experience for consumers, driving further growth in the market.

Market Analysis By Competitors

- Carrefour

- Kroger

- Tesco

- Walmart

- Amazon

- Target

- ALDI

- Coles Online

- BigBasket

- Longo

- Schwan Food

- FreshDirect

- Honestbee

- Alibaba

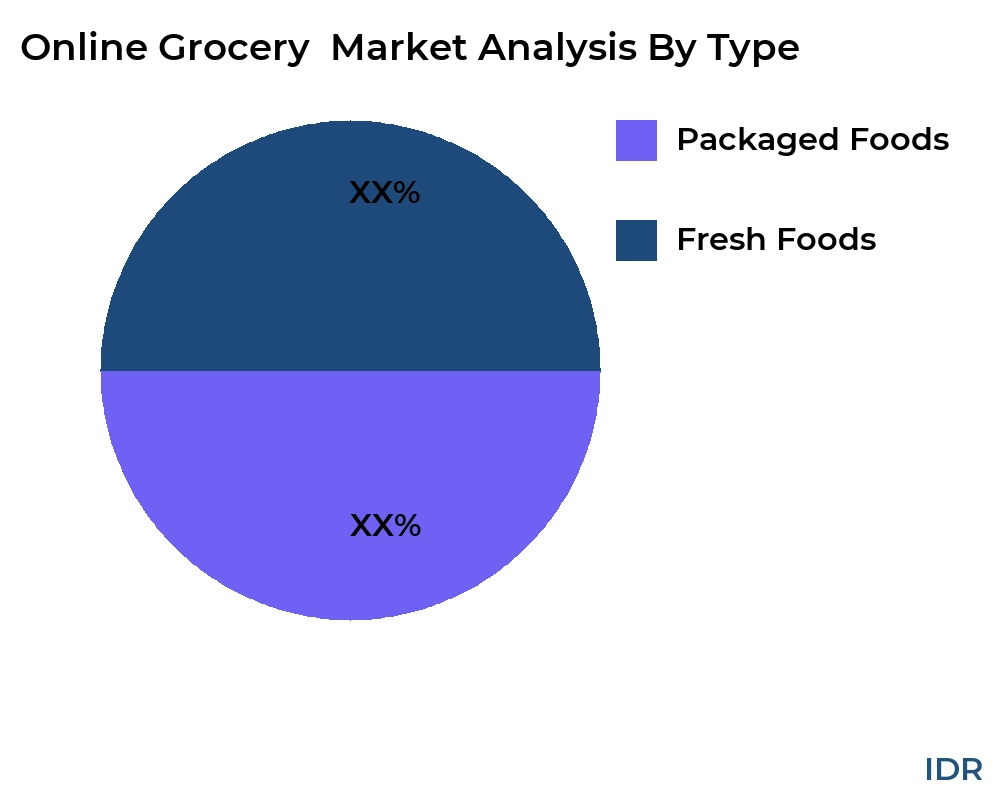

By Product Type

- Packaged Foods

- Fresh Foods

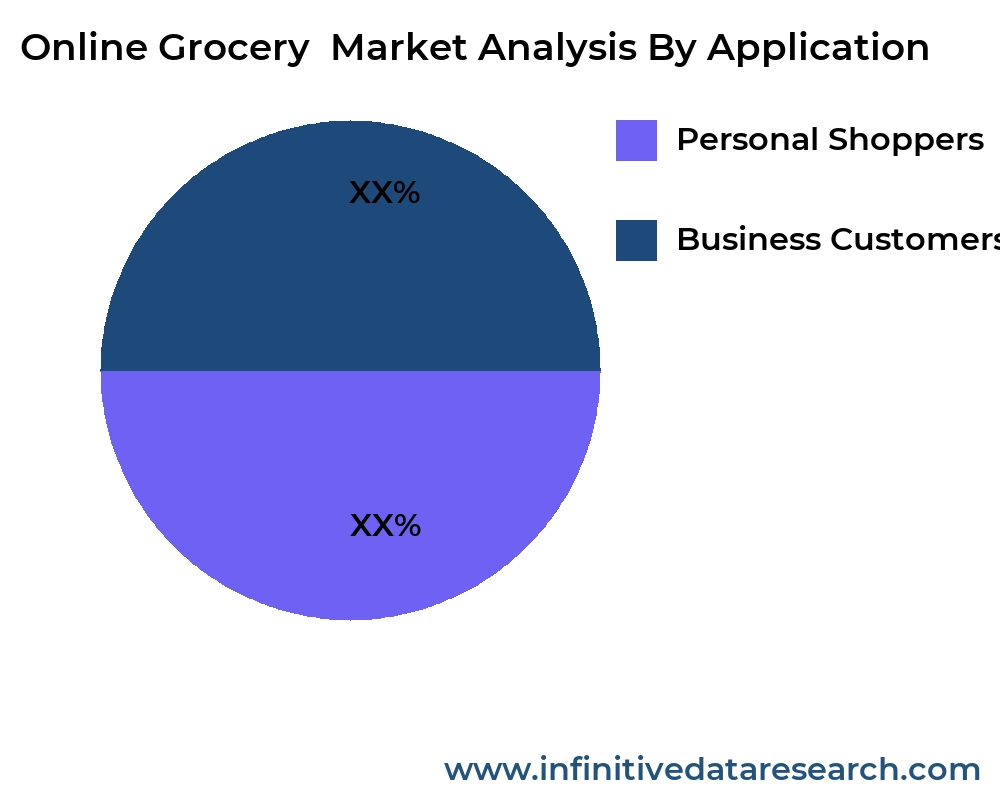

By Application

- Personal Shoppers

- Business Customers

>>> Understand The Key Trends Shaping This Market:- Understand The Key Trends Shaping This Market:-

Online Grocery Market Segment Analysis

The online grocery market has experienced significant growth in recent years, driven by consumer demand for convenience, time savings, and a wider selection of products. Below is an analysis of the market segmented by distribution channel, compatibility, price range, and product type.

1. Market Segmentation by Distribution ChannelOnline grocery distribution channels refer to the ways in which grocery stores and e-commerce platforms reach their customers. The main distribution channels in the online grocery market include:

- Direct-to-Consumer (D2C): Groceries are sold directly by brands or stores through their websites or apps, such as Walmart or Amazon Fresh.

- Third-Party Marketplaces: Platforms like Instacart, BigBasket, or Ocado act as intermediaries, connecting customers to a wide range of grocery retailers.

- Delivery Apps: Services such as Postmates, UberEats, and DoorDash also offer grocery delivery, usually as an additional service alongside meal delivery.

Trends:

- Increased demand for faster delivery services (same-day or one-hour delivery).

- Growth in subscription models (e.g., weekly or monthly grocery boxes).

- An increase in partnerships between online platforms and local grocery stores.

Compatibility in the online grocery market refers to how seamlessly the online grocery service integrates with various customer preferences, devices, and technology.

- Mobile-Friendly Platforms: With the rise in smartphone usage, grocery delivery platforms must be mobile-compatible, offering apps or mobile-friendly websites.

- Integration with Smart Devices: Some online grocery services are integrating with smart home devices like Amazon Echo or Google Home for easy voice-activated orders.

- Payment Compatibility: The platforms must also support various payment methods, including credit/debit cards, digital wallets (Apple Pay, Google Pay), and Buy Now Pay Later (BNPL) services.

Trends:

- Widespread use of mobile apps for placing orders.

- Integration of AI and machine learning to offer personalized grocery recommendations.

- Seamless integration with voice-activated assistants for convenience.

Price range segmentation in the online grocery market typically reflects the differences in customer budgets and expectations.

- Low-Cost: These are budget-friendly options, usually including private label or generic products. Popular among customers seeking basic essentials at affordable prices.

- Mid-Range: These platforms offer a wider selection of branded products and focus on quality alongside affordability.

- Premium or High-End: These services focus on offering high-quality organic, gourmet, or luxury grocery items. They may offer more convenient or specialized services, like same-day delivery or curated meal kits.

Trends:

- Price-sensitive consumers are pushing online grocery stores to compete on price, with many platforms offering loyalty programs and discounts.

- There is also a demand for premium or organic products, particularly in higher-income regions.

The online grocery market is further divided by the types of products being sold:

- Fresh Produce: This includes fruits, vegetables, and herbs. Fresh produce is a key category driving online grocery shopping, as customers seek high-quality and fresh options delivered to their doorsteps.

- Frozen Foods: Frozen meals, vegetables, and snacks are commonly purchased through online platforms, as they offer convenience and long shelf life.

- Dairy & Bakery: This includes milk, cheese, bread, and bakery items. Dairy and bakery products are integral to online grocery services.

- Packaged & Canned Goods: Non-perishable items such as cereals, pasta, canned vegetables, and snacks.

- Beverages: This includes soft drinks, alcohol (where applicable), juices, coffee, and bottled water.

- Health & Wellness Products: Including organic food, gluten-free, vegan, and dietary supplements.

- Household & Personal Care: Cleaning supplies, toiletries, and personal care products are also sold through online grocery platforms.

Trends:

- A rising preference for organic and health-conscious products like organic vegetables, gluten-free foods, and plant-based items.

- Ready-to-eat meals and meal kits are gaining popularity for customers seeking convenience.

- International and specialty foods are also in demand as consumers are more experimental in their grocery shopping habits.

| REPORT ATTRIBUTES | DETAILS |

|---|---|

| Study Period |

2019-2032 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Historical Period |

2019-2022 |

| Unit |

Value (USD Billion) |

| Key Companies Profiled |

Carrefour, Kroger, Tesco, Walmart, Amazon, Target, ALDI, Coles Online, BigBasket, Longo, Schwan Food, FreshDirect, Honestbee, Alibaba |

| Segments Covered |

By Product |

| Customization Scope |

Free report customization (equivalent to up to 3 analyst working days) with purchase. Addition or alteration to country, regional and segment scope |

>>> Overview of Market Analysis:- Download PDF Sample

Online Grocery Market Regional Analysis

The online grocery market has experienced significant growth in recent years, driven by increasing consumer demand for convenience and the rise of digital platforms. In North America, the market is particularly thriving, with a large segment of consumers opting for online grocery shopping due to its time-saving nature and the ability to avoid crowded stores. This shift in consumer behavior has led to the expansion of both established supermarket chains and newer, tech-savvy companies offering competitive delivery and pick-up services. As consumers in North America continue to prioritize convenience, the online grocery market is expected to see sustained growth, with advancements in delivery speed and more personalized services.

In Europe, the online grocery market is experiencing robust growth, with regions such as the UK and Germany being the primary drivers. The convenience of online grocery shopping, combined with the region's high levels of internet penetration and evolving payment systems, has contributed to the sector's success. In addition, changing consumer preferences toward healthier, sustainable food choices have led to an increased demand for organic and locally sourced products online. While online grocery shopping in Europe is still growing, the region is witnessing a diverse array of business models, from well-established supermarket brands to smaller, niche market players catering to specific customer needs.

Asia-Pacific presents a unique regional landscape for the online grocery market, marked by rapid urbanization, tech-savvy consumers, and a rising middle class. Countries like China and India are seeing an exponential increase in e-commerce adoption, including grocery shopping. However, challenges such as fragmented supply chains, logistical hurdles, and varying consumer behaviors across countries remain. Despite these challenges, the market is expanding rapidly due to the increasing availability of affordable smartphones, improved internet infrastructure, and the growing preference for contactless shopping, particularly during the pandemic. The region is expected to continue its growth trajectory, especially with innovations in last-mile delivery and partnerships between online grocery services and local retailers.

global Online Grocery market revenue (usd million) comparison by players 2024-2032

| Company/players | 2021 | 2022 | 2023 | 2024 | ... | (2032) |

|---|---|---|---|---|---|---|

| Carrefour | XX | XX | XX | XX | XX | XX |

| Kroger | XX | XX | XX | XX | XX | XX |

| Tesco | XX | XX | XX | XX | XX | XX |

| Walmart | XX | XX | XX | XX | XX | XX |

| Amazon | XX | XX | XX | XX | XX | XX |

| Target | XX | XX | XX | XX | XX | XX |

| ALDI | XX | XX | XX | XX | XX | XX |

| Coles Online | XX | XX | XX | XX | XX | XX |

| BigBasket | XX | XX | XX | XX | XX | XX |

| Longo | XX | XX | XX | XX | XX | XX |

| Schwan Food | XX | XX | XX | XX | XX | XX |

| FreshDirect | XX | XX | XX | XX | XX | XX |

| Honestbee | XX | XX | XX | XX | XX | XX |

| Alibaba | XX | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX | XX |

global Online Grocery market revenue (usd million) comparison by product type 2024-2032

Product Type

2023

2024

...

2032

CAGR%(2024-32)

Packaged Foods

XX

XX

XX

XX

XX

Fresh Foods

XX

XX

XX

XX

XX

Total

XX

XX

XX

XX

XX

| Product Type | 2023 | 2024 | ... | 2032 | CAGR%(2024-32) |

|---|---|---|---|---|---|

| Packaged Foods | XX | XX | XX | XX | XX |

| Fresh Foods | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX |

global Online Grocery market revenue (usd million) comparison by application 2024-2032

Application

2023

2024

...

2032

CAGR%(2024-32)

Personal Shoppers

XX

XX

XX

XX

XX

Business Customers

XX

XX

XX

XX

XX

Total

XX

XX

XX

XX

XX

| Application | 2023 | 2024 | ... | 2032 | CAGR%(2024-32) |

|---|---|---|---|---|---|

| Personal Shoppers | XX | XX | XX | XX | XX |

| Business Customers | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX |

>>> Market Understand Through Graph And Chart:- Download PDF Sample

Online Grocery Market Competitive Insights

The online grocery market has been experiencing significant growth, driven by the increasing consumer demand for convenience, speed, and a broad range of products available at their fingertips. The COVID-19 pandemic accelerated this trend, pushing consumers to shift from traditional brick-and-mortar grocery shopping to e-commerce platforms. This shift has led to an increased focus on improving user experiences, offering competitive pricing, and ensuring fast and reliable delivery services. Many online grocery platforms have also invested in technological advancements such as artificial intelligence and machine learning to better predict consumer needs, optimize inventory, and enhance customer service.

As the market continues to expand, competition among players has become fierce. Key players in the market include large e-commerce giants like Amazon Fresh and Walmart, as well as dedicated grocery delivery services like Instacart, which have built strong relationships with grocery chains to offer a wide range of products. These competitors are focusing not only on improving their digital platforms and customer experiences but also on expanding their supply chain capabilities. To remain competitive, they are increasingly investing in last-mile delivery infrastructure, leveraging local warehouses, and utilizing third-party logistics services to ensure faster and more efficient delivery to consumers.

Moreover, there is a rising trend toward sustainability and eco-conscious choices, with consumers seeking organic, locally sourced, or environmentally friendly products. This has led online grocery services to expand their offerings in these areas, aligning with changing consumer preferences. As the market matures, new opportunities are emerging, such as personalized shopping experiences, subscription-based models, and partnerships with local farmers or smaller grocery chains, all of which offer competitive differentiation. The online grocery market is expected to keep evolving as technological innovation, consumer demands, and market dynamics shape its future trajectory.

Online Grocery Market Competitors

United States:

- Amazon Fresh

- Walmart

- Instacart

- Kroger

- Whole Foods Market

- Shipt

- Thrive Market

- FreshDirect

- Safeway

- Costco Wholesale Corporation

United Kingdom:

- Tesco

- Sainsbury's

- Asda

- Morrisons

- Waitrose

France:

- Carrefour

- E.Leclerc

- Auchan

Germany:

- Edeka

- REWE

- Lidl

Netherlands:

- Albert Heijn

- Jumbo

Spain:

- Mercadona

- Carrefour Spain

Italy:

- Coop Italia

- Esselunga

Canada:

- Loblaw Companies Limited

- Metro Inc.

Australia:

- Woolworths

- Coles

India:

- BigBasket

- Grofers

China:

- Alibaba's Freshippo (Hema)

- JD Daojia (JDDJ)

Japan:

- Rakuten Seiyu Netsuper

- Aeon Online Grocery

South Korea:

- Coupang Fresh

- SSG.com

Brazil:

- Pão de Açúcar Online

- Carrefour Brazil

Mexico:

- Walmart Mexico Online

- Soriana Online

Russia:

- Utkonos

- Ozon

South Africa:

- Woolworths Online

- Pick n Pay Online

United Arab Emirates:

- Carrefour UAE Online

- Lulu Hypermarket Online

Saudi Arabia:

- Carrefour Saudi Arabia Online

- Panda Retail Online

Singapore:

- RedMart

- FairPrice Online

Malaysia:

- Tesco Malaysia Online

- HappyFresh

Thailand:

- Tesco Lotus Online

- Tops Online

Indonesia:

- HappyFresh

- Tokopedia Groceries

Vietnam:

- VinMart Online

- Tiki.vn Groceries

Philippines:

- MetroMart

- Lazada Groceries

South Korea:

- Coupang Fresh

- SSG.com

Taiwan:

- PX Mart Online

- Carrefour Taiwan Online

Hong Kong:

- ParknShop Online

- Wellcome Online

Online Grocery Market Top Competitors

The online grocery market has seen tremendous growth in recent years, fueled by changes in consumer behavior, convenience demands, and technological advancements. Below are the top 10 competitors in the online grocery sector, each with its own unique position in the market:

Amazon Fresh Amazon Fresh is one of the leading players in the online grocery market, thanks to its integration with Amazon's e-commerce platform and fast delivery service. Amazon's vast distribution network and strong customer base provide a solid foundation for Fresh to expand globally. The service offers a wide range of groceries, from fresh produce to household essentials, often with same-day or next-day delivery. With its focus on competitive pricing and extensive product selection, Amazon Fresh continues to be a top contender in the grocery delivery space.

Walmart Grocery Walmart has long been a dominant player in brick-and-mortar retail, and its online grocery segment is no different. Walmart Grocery offers online ordering with in-store pickup and delivery options, catering to a wide variety of customers. Walmart's ability to combine its vast network of physical stores with its online platform has made it a strong competitor in the space. The company's strong logistics infrastructure allows it to keep prices competitive and provide quick service, making it one of the largest online grocery retailers globally.

Instacart Instacart is one of the most prominent players in the online grocery delivery space in North America. The platform partners with major retailers such as Costco, Safeway, and Kroger, providing a range of groceries and household items for delivery. Instacart's model is based on connecting customers with personal shoppers who hand-pick and deliver their groceries. The company has been growing rapidly and has expanded into new regions, benefiting from increasing demand for contactless shopping and home delivery services.

Kroger As one of the largest grocery chains in the United States, Kroger has made significant strides in the online grocery market. It offers services such as curbside pickup and home delivery through its own infrastructure and partnerships with third-party delivery services. Kroger’s focus on improving its digital experience, investing in technology, and expanding its fulfillment centers has solidified its position as a strong player in the sector. The company continues to invest heavily in e-commerce to enhance customer experience and meet growing demand.

Shipt Acquired by Target in 2017, Shipt has emerged as a major competitor in the online grocery space. Shipt operates on a similar model to Instacart, allowing customers to order groceries from stores like Target, Costco, and more, with the added benefit of fast delivery. Shipt is well-known for its same-day delivery option, which has helped it carve out a niche in the market. With Target’s backing, Shipt has expanded its reach, offering customers a seamless shopping experience and maintaining a strong foothold in the online grocery sector.

Target (Target Plus) Target has been a formidable player in the e-commerce space for years, and with its grocery delivery services, it has become a top competitor in the online grocery market. Through partnerships with Shipt, Target offers same-day delivery and in-store pickup of groceries. The company has continued to expand its grocery offerings and improve its online platform. Target's combination of high-quality products, customer loyalty, and ease of access to its physical stores gives it a competitive edge in the digital grocery sector.

Peapod Peapod, owned by Ahold Delhaize, is one of the pioneers of online grocery shopping in the United States. It has been serving customers for over 30 years and remains a major competitor in the sector, especially in the Northeast and Midwest regions of the U.S. Peapod has built a reputation for offering fresh food and groceries with a focus on convenience, reliability, and quality. It continues to innovate, investing in technology to improve its delivery services and expand its market reach, particularly in urban areas.

FreshDirect FreshDirect is a leading online grocer focused on offering fresh, high-quality food, including organic and specialty items. Operating primarily in the Northeastern U.S., the company has built a loyal customer base by providing high-quality groceries and an easy-to-navigate online shopping experience. FreshDirect differentiates itself by offering a wide variety of fresh produce, dairy, and meats. The company's focus on quality and customer service has allowed it to stay competitive and grow its market share, particularly in urban areas where demand for online grocery shopping is growing.

Ocado Based in the UK, Ocado is a major online-only grocery retailer, specializing in delivering groceries straight to customers' doors. The company has developed a unique business model, relying on automated warehouses and cutting-edge technology to fulfill orders. Ocado’s focus on innovation in logistics and technology has helped it maintain its position as a leader in online grocery shopping in the UK. The company has also started expanding into international markets, including partnerships with retailers in countries like Canada and Sweden.

Delivery Hero (Gorillas) Delivery Hero, known for its delivery service, has expanded into the online grocery space with its acquisition of the startup Gorillas. This service specializes in rapid delivery, offering groceries within a 10-minute window in certain markets. The company is positioning itself as a leader in ultra-fast grocery delivery, catering to urban populations looking for convenience and speed. Delivery Hero’s significant funding and international presence have helped it scale quickly, and it continues to innovate in the area of delivery logistics.

Each of these companies has built its competitive edge through a combination of technological innovation, customer convenience, and strategic partnerships, solidifying their position in a rapidly evolving and highly competitive online grocery market.

The report provides a detailed analysis of the Online Grocery market across various regions, highlighting the unique market dynamics and growth opportunities in each region.

- US

- Canada

- Mexico

- UK

- Germany

- France

- Italy

- Russia

- Spain

- Switzerland

- Austria

- Belgium

- Rest of Europe

- China

- Japan

- South Korea

- Indonesia

- Vietnam

- Philippines

- Australia

- Thailand

- Singapore

- Rest of APAC

- UAE

- Saudi Arabia

- Egypt

- South Africa

- Israel

- Rest of MEA

- Brazil

- Argentina

- Rest of Latin America

>>> Need A Different Region Or Segment? Download PDF Sample

Key Takeaways

- The global Online Grocery market is expected to grow significantly from 2024 to 2032, driven by technological advancements, increasing demand, and government investments in urbanization.

- The market is characterized by a diverse range of manufacturers, product types, and applications, catering to different consumer needs and preferences.

- Regional insights highlight the unique market dynamics and growth opportunities in various regions, including North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

- The competitive landscape features key players who have created a dynamic and diverse market environment through collaborations, mergers and acquisitions, and innovative product developments.

- Market trends such as technological advancements, sustainability, customization, and digital transformation are shaping the growth and development of the Online Grocery market.

- Despite the positive outlook, the market faces challenges such as regulatory compliance, high initial investment costs, and economic uncertainties.

- The report provides comprehensive coverage of market size, market share, growth factors, and strategic insights to help businesses navigate the dynamic Online Grocery market and achieve long-term success.

By leveraging the information provided in this report, businesses can develop effective strategies, address market challenges, and capitalize on growth opportunities to ensure sustainable growth and long-term success in the global Online Grocery market.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Currency

- Key Target Audience

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Restraints

- Opportunities

- Challenges

- Global Online Grocery Market Analysis and Projection, By Companies

- Segment Overview

- Carrefour

- Kroger

- Tesco

- Walmart

- Amazon

- Target

- ALDI

- Coles Online

- BigBasket

- Longo

- Schwan Food

- FreshDirect

- Honestbee

- Alibaba

- Global Online Grocery Market Analysis and Projection, By Type

- Segment Overview

- Packaged Foods

- Fresh Foods

- Global Online Grocery Market Analysis and Projection, By Application

- Segment Overview

- Personal Shoppers

- Business Customers

- Global Online Grocery Market Analysis and Projection, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Russia

- Spain

- Switzerland

- Austria

- Belgium

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Vietnam

- Philippines

- Australia

- Thailand

- Singapore

- Rest of APAC

- Middle East

- UAE

- Saudi Arabia

- Egypt

- South Africa

- Israel

- Rest of MEA

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Global Online Grocery Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Online Grocery Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Coverage Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Carrefour

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Kroger

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Tesco

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Walmart

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Amazon

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Target

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- ALDI

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Coles Online

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- BigBasket

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Longo

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Schwan Food

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- FreshDirect

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Honestbee

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Alibaba

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

List of Table

- Drivers of Global Online Grocery Market: Impact Analysis

- Restraints of Global Online Grocery Market: Impact Analysis

- Global Online Grocery Market, By Technology, 2023-2032(USD Billion)

- global Packaged Foods, Online Grocery Market, By Region, 2023-2032(USD Billion)

- global Fresh Foods, Online Grocery Market, By Region, 2023-2032(USD Billion)

- global Personal Shoppers, Online Grocery Market, By Region, 2023-2032(USD Billion)

- global Business Customers, Online Grocery Market, By Region, 2023-2032(USD Billion)

List of Figures

- Global Online Grocery Market Segmentation

- Online Grocery Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top investment pocket in the Online Grocery Market

- Top Winning Strategies, 2023-2032

- Top Winning Strategies, By Development, 2023-2032(%)

- Top Winning Strategies, By Company, 2023-2032

- Moderate Bargaining power of Buyers

- Moderate Bargaining power of Suppliers

- Moderate Bargaining power of New Entrants

- Low threat of Substitution

- High Competitive Rivalry

- Restraint and Drivers: Online Grocery Market

- Online Grocery Market Segmentation, By Technology

- Online Grocery Market For Live Attenuated, By Region, 2023-2033 ($ Billion)

- Global Online Grocery Market, By Technology, 2023-2032(USD Billion)

- global Packaged Foods, Online Grocery Market, By Region, 2023-2032(USD Billion)

- global Fresh Foods, Online Grocery Market, By Region, 2023-2032(USD Billion)

- global Personal Shoppers, Online Grocery Market, By Region, 2023-2032(USD Billion)

- global Business Customers, Online Grocery Market, By Region, 2023-2032(USD Billion)

- Carrefour: Net Sales, 2023-2033 ($ Billion)

- Carrefour: Revenue Share, By Segment, 2023 (%)

- Carrefour: Revenue Share, By Region, 2023 (%)

- Kroger: Net Sales, 2023-2033 ($ Billion)

- Kroger: Revenue Share, By Segment, 2023 (%)

- Kroger: Revenue Share, By Region, 2023 (%)

- Tesco: Net Sales, 2023-2033 ($ Billion)

- Tesco: Revenue Share, By Segment, 2023 (%)

- Tesco: Revenue Share, By Region, 2023 (%)

- Walmart: Net Sales, 2023-2033 ($ Billion)

- Walmart: Revenue Share, By Segment, 2023 (%)

- Walmart: Revenue Share, By Region, 2023 (%)

- Amazon: Net Sales, 2023-2033 ($ Billion)

- Amazon: Revenue Share, By Segment, 2023 (%)

- Amazon: Revenue Share, By Region, 2023 (%)

- Target: Net Sales, 2023-2033 ($ Billion)

- Target: Revenue Share, By Segment, 2023 (%)

- Target: Revenue Share, By Region, 2023 (%)

- ALDI: Net Sales, 2023-2033 ($ Billion)

- ALDI: Revenue Share, By Segment, 2023 (%)

- ALDI: Revenue Share, By Region, 2023 (%)

- Coles Online: Net Sales, 2023-2033 ($ Billion)

- Coles Online: Revenue Share, By Segment, 2023 (%)

- Coles Online: Revenue Share, By Region, 2023 (%)

- BigBasket: Net Sales, 2023-2033 ($ Billion)

- BigBasket: Revenue Share, By Segment, 2023 (%)

- BigBasket: Revenue Share, By Region, 2023 (%)

- Longo: Net Sales, 2023-2033 ($ Billion)

- Longo: Revenue Share, By Segment, 2023 (%)

- Longo: Revenue Share, By Region, 2023 (%)

- Schwan Food: Net Sales, 2023-2033 ($ Billion)

- Schwan Food: Revenue Share, By Segment, 2023 (%)

- Schwan Food: Revenue Share, By Region, 2023 (%)

- FreshDirect: Net Sales, 2023-2033 ($ Billion)

- FreshDirect: Revenue Share, By Segment, 2023 (%)

- FreshDirect: Revenue Share, By Region, 2023 (%)

- Honestbee: Net Sales, 2023-2033 ($ Billion)

- Honestbee: Revenue Share, By Segment, 2023 (%)

- Honestbee: Revenue Share, By Region, 2023 (%)

- Alibaba: Net Sales, 2023-2033 ($ Billion)

- Alibaba: Revenue Share, By Segment, 2023 (%)

- Alibaba: Revenue Share, By Region, 2023 (%)

Infinitive Data Research provides comprehensive market research, offering in-depth market analysis to help companies understand their target market and industry competition. This research predicts the market acceptance of your brand and products, ensuring informed decision-making for business success.

Competitor Analysis in the Online Grocery Industry

Conducting a competitor analysis involves identifying competitors within the Online Grocery industry and studying their various marketing strategies. This comparative data allows you to assess your company's strengths and weaknesses relative to competitors, providing insights to enhance your market position.

Importance of Continuous Market Research

Consistently conducting market research is essential for minimizing risk at every stage of business operations. Online Grocery market research enables you to collect qualitative and quantitative data, which, when properly analyzed, leads to wise decisions that align with user and customer needs. Below are some crucial lessons learned through the Online Grocery market research process:

Key Dimensions of Online Grocery Market Analysis

- Trend and Pattern Identification: Analyzing data to spot market trends and patterns.

- Pricing Analysis: Assessing keyword pricing strategies.

- Actionable Insights: Implementing insights derived from data analysis.

- Market Potential: Evaluating the potential of the Online Grocery market.

- Competitor Analysis: Studying competitors' strategies and performance.

- Location Analysis: Assessing optimal locations for market penetration.

- Distribution Channels Analysis: Evaluating the effectiveness of distribution channels.

- Market Size and Growth Rate: Measuring market size and growth potential.

- Market Profitability: Assessing profitability prospects.

- Key Success Factors: Identifying critical factors for success.

- Cost Structure: Understanding the cost structure within the Online Grocery industry.

Target Audience for the Report

This report is valuable for a diverse audience, including:

- Online Grocery Market Manufacturers: To understand market dynamics and enhance production strategies.

- Investors and Financing Companies: To assess investment opportunities and risks.

- Online Grocery Market Suppliers: To identify market demands and supply chain efficiencies.

Necessity of the Report

Making Crucial Business Decisions

Understanding the Online Grocery market, competition, and industry landscape is vital for making informed business decisions. Without current and relevant market research, decisions may be based on outdated or irrelevant information, potentially harming the business.

Securing Investment Funds

Attracting investors requires demonstrating thorough market research. Investors need assurance that you understand the sector, current and potential competition, and whether your idea addresses a market need.

Identifying New Business Opportunities

Online Grocery market research goes beyond understanding trends and consumer behavior. It identifies new revenue streams and opportunities for business pivots. These insights can lead to strategic changes in the business model, promoting growth and adapting to market challenges.

Avoiding Business Failures

Market research also plays a crucial role in risk mitigation. It can reveal when not to pursue certain actions, saving the company from potential losses in revenue, brand image, and more. This proactive approach is often overlooked but is essential for long-term success.

Conclusion

Infinitive Data Research's comprehensive Online Grocery market research provides critical insights for making solid business decisions, securing investments, identifying new opportunities, and avoiding potential failures. Understanding market dynamics through continuous research ensures your company remains competitive and thrives in the Online Grocery industry.