Overview

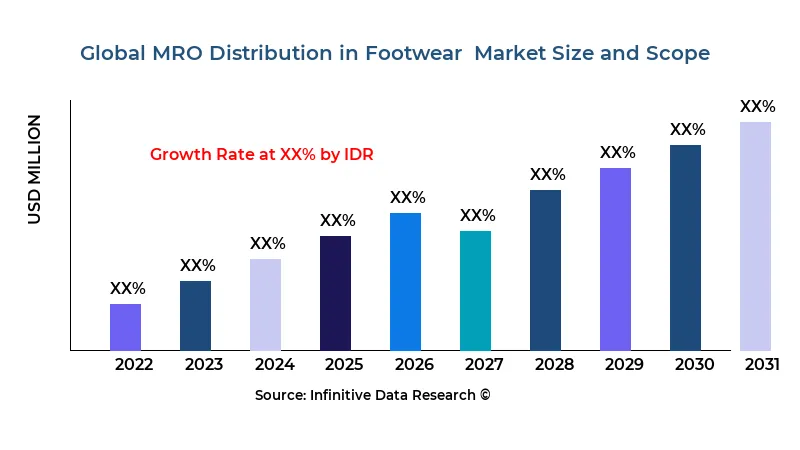

The global mro distribution in footwear market report from 2024 to 2032 offers a detailed examination of the market's size, historical and projected growth, revenue share, current and emerging trends, investment strategies, and business expansions. The global mro distribution in footwear market is an ever-evolving landscape, reflecting the dynamic interplay of technological advancements, consumer preferences, and economic forces. The report delves into key growth factors such as import/export activities, product manufacturing, technological innovations, supply chain dynamics, and marketing networks. The mro distribution in footwear market was valued at US$ XXX.XX million in 2023 and is expected to reach US$ XXX.XX million by 2032, showcasing a robust CAGR throughout the forecast period.

This report aims to provide businesses with strategic insights and a solid contingency plan for operating within the mro distribution in footwear market. It includes concise information on market standing and long-term objectives to assist new businesses in planning effectively. Additionally, the report explores applications and consumers utilizing the services offered by the mro distribution in footwear market.

>>> Understand The Key Trends Shaping This Market:- Download PDF Sample

Market Segmentation

The study meticulously examines the mro distribution in footwear market based on various segments, including manufacturers, type, application, region, and country. This segmentation allows for a detailed understanding of market dynamics and aids in identifying growth opportunities.

By manufacturers, the market is characterized by a diverse range of players, each contributing uniquely to the competitive landscape. Key players include Cromwell Group (Holdings) Limited (Grainger), known for its innovative product range and strong market presence; Graco Inc., which specializes in Software & Services technologies and boasts a significant global footprint; and WABCO (ZF), which focuses on high-quality manufacturing processes and customer-centric solutions same analysis for remaining players we will discuss.

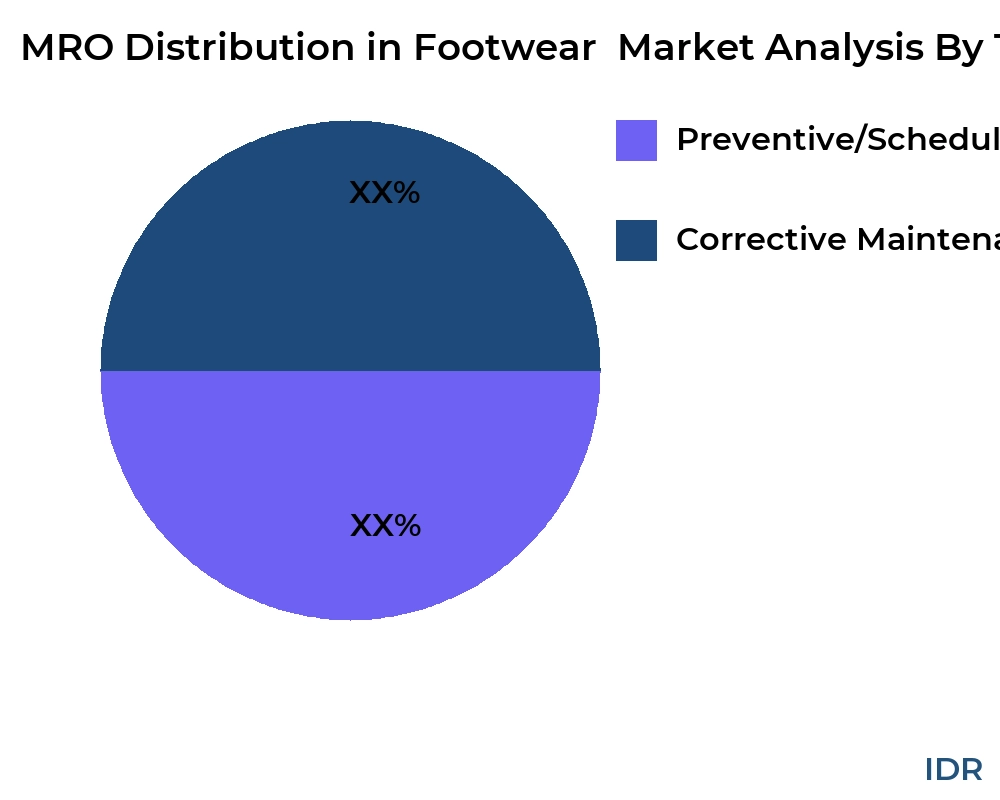

In terms of product type, the mro distribution in footwear market offers a variety of options catering to different consumer needs and preferences. Key product types include Preventive/Scheduled Maintenance, widely recognized for its reliability and efficiency in Software & Services; Corrective Maintenance, celebrated for its advanced features and superior performance; and Type 3, popular due to its cost-effectiveness and versatility same analysis for remaining type we will be discuss.

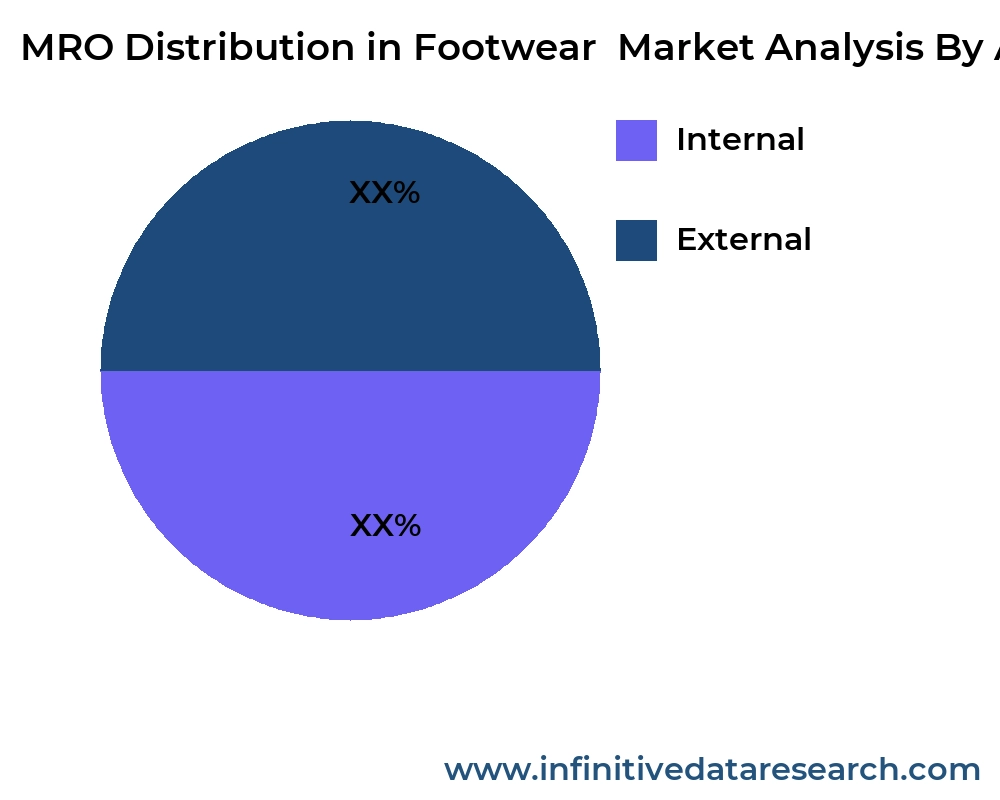

The market also caters to a broad spectrum of applications, ensuring its relevance across different sectors. Key applications include Internal, extensively utilized in industrial settings for its robustness; External, preferred in Software & Services environments and Application 3, commonly found in Software & Services areas due to its affordability and ease of use, same analysis for remaining application we will discuss.

Geographically, the segmentation provides insights into regional market dynamics by considering political, economic, geographical, and social influences. This comprehensive approach helps identify regional growth opportunities and challenges, ensuring a nuanced understanding of the market across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Each region presents unique market dynamics, driven by factors such as technological adoption, regulatory frameworks, economic conditions, and consumer preferences, which collectively shape the global landscape of the mro distribution in footwear market.

Market Analysis By Competitors

- Cromwell Group (Holdings) Limited (Grainger)

- Graco Inc.

- WABCO (ZF)

- Mento AS

- Valeo Service UK Ltd

- Ascendum

- Bodo M�ller Chemie GmbH

- Lindberg & Lund AS (Biesterfeld)

- Neumo-Egmo Spain SL

- Gazechim Composites Norden AB

- ABB Group

- Rohde & Schwarz

- Schneider Electric

By Product Type

- Preventive/Scheduled Maintenance

- Corrective Maintenance

By Application

- Internal

- External

>>> Understand The Key Trends Shaping This Market:- Understand The Key Trends Shaping This Market:-

Research Methodology

The market size and growth projections are determined by analyzing the revenue generated by leading companies in the mro distribution in footwear industry. Our research methodology combines primary and secondary research supported by industry specialists. The analysis involves 81 to 84% primary research and 13 to 16% secondary research. Primary research includes interviews with key executives such as VPs, CEOs, Marketing Directors, and Business Development Managers from major market participants. This ensures accuracy and reliability in our data.

| REPORT ATTRIBUTES | DETAILS |

|---|---|

| Study Period |

2020-2033 |

| Base Year |

2024 |

| Forecast Period |

2025-2033 |

| Historical Period |

2020-2024 |

| Unit |

Value (USD Billion) |

| Key Companies Profiled |

Cromwell Group (Holdings) Limited (Grainger), Graco Inc., WABCO (ZF), Mento AS, Valeo Service UK Ltd, Ascendum, Bodo M�ller Chemie GmbH, Lindberg & Lund AS (Biesterfeld), Neumo-Egmo Spain SL, Gazechim Composites Norden AB, ABB Group, Rohde & Schwarz, Schneider Electric |

| Segments Covered |

By Product |

| Customization Scope |

Free report customization (equivalent to up to 3 analyst working days) with purchase. Addition or alteration to country, regional and segment scope |

>>> Overview of Market Analysis:- Download PDF Sample

Competitive Landscape

The competitive landscape of the mro distribution in footwear market is characterized by the presence of key players who have created a diverse and dynamic market environment. The report provides detailed information on the primary competitors and their regional footprints. It describes how the market adapts to continuous change and how consumers respond to these changes. Key aspects of the competitive landscape include:

- Collaborations and Partnerships: Companies are forming strategic collaborations and partnerships to enhance their market presence and expand their product offerings.

- Mergers and Acquisitions: Mergers and acquisitions are common strategies employed by companies to strengthen their market position and achieve growth.

- Innovative Product Developments: mro distribution in footwear market Companies are focusing on developing innovative products to meet the evolving needs of consumers and stay ahead of the competition.

- Market Positioning: Companies are strategically positioning themselves in the market by leveraging their strengths and addressing market challenges.

global MRO Distribution in Footwear market revenue (usd million) comparison by players 2025-2033

| Company/players | 2021 | 2022 | 2023 | 2024 | ... | (2032) |

|---|---|---|---|---|---|---|

| Cromwell Group (Holdings) Limited (Grainger) | XX | XX | XX | XX | XX | XX |

| Graco Inc. | XX | XX | XX | XX | XX | XX |

| WABCO (ZF) | XX | XX | XX | XX | XX | XX |

| Mento AS | XX | XX | XX | XX | XX | XX |

| Valeo Service UK Ltd | XX | XX | XX | XX | XX | XX |

| Ascendum | XX | XX | XX | XX | XX | XX |

| Bodo M�ller Chemie GmbH | XX | XX | XX | XX | XX | XX |

| Lindberg & Lund AS (Biesterfeld) | XX | XX | XX | XX | XX | XX |

| Neumo-Egmo Spain SL | XX | XX | XX | XX | XX | XX |

| Gazechim Composites Norden AB | XX | XX | XX | XX | XX | XX |

| ABB Group | XX | XX | XX | XX | XX | XX |

| Rohde & Schwarz | XX | XX | XX | XX | XX | XX |

| Schneider Electric | XX | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX | XX |

global MRO Distribution in Footwear market revenue (usd million) comparison by product type 2025-2033

Product Type

2023

2024

...

2032

CAGR%(2024-32)

Preventive/Scheduled Maintenance

XX

XX

XX

XX

XX

Corrective Maintenance

XX

XX

XX

XX

XX

Total

XX

XX

XX

XX

XX

| Product Type | 2023 | 2024 | ... | 2032 | CAGR%(2024-32) |

|---|---|---|---|---|---|

| Preventive/Scheduled Maintenance | XX | XX | XX | XX | XX |

| Corrective Maintenance | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX |

global MRO Distribution in Footwear market revenue (usd million) comparison by application 2025-2033

Application

2023

2024

...

2032

CAGR%(2024-32)

Internal

XX

XX

XX

XX

XX

External

XX

XX

XX

XX

XX

Total

XX

XX

XX

XX

XX

| Application | 2023 | 2024 | ... | 2032 | CAGR%(2024-32) |

|---|---|---|---|---|---|

| Internal | XX | XX | XX | XX | XX |

| External | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX |

>>> Market Understand Through Graph And Chart:- Download PDF Sample

Market Dynamics

The mro distribution in footwear market is influenced by various dynamic factors that shape its growth and development. These factors include market trends, growth drivers, restraining factors, and regional insights.

Market Trends

- Technological Advancements: The integration of AI and IoT technologies has revolutionized the mro distribution in footwear market, leading to improved efficiency, enhanced performance, and cost-effectiveness.

- Sustainability and Green Technologies: There is a growing emphasis on eco-friendly products and sustainable practices, driven by regulatory requirements and consumer preferences.

- Customization and Personalization: Manufacturers are focusing on offering customized solutions to meet specific consumer needs, enhancing user experience and satisfaction.

- Digital Transformation: The adoption of digital tools and platforms is streamlining operations, improving supply chain management, and enhancing customer engagement.

Market Growth Factors

- Increasing Demand: The rising demand for mro distribution in footwear products and services across various sectors is a significant growth driver.

- Technological Innovations: Continuous advancements in technology are enabling the development of innovative products, driving market growth.

- Government Investments: Investments in urbanization and infrastructure development by governments worldwide are supporting market expansion.

- Globalization of Business: The globalization of business activities is leading to increased demand for mro distribution in footwear products and services, creating new market opportunities.

Restraining Factors

- Regulatory Challenges: Compliance with stringent regulatory requirements can be challenging for manufacturers, affecting market growth.

- High Initial Investment Costs: The high cost of initial investments in technology and infrastructure can be a barrier for new entrants.

- Economic Uncertainty: Economic fluctuations and uncertainties can impact market stability and growth prospects.

Report Coverage

The report covers all relevant information influencing the development of the mro distribution in footwear industry. It includes company portfolios, growth opportunities, obstacles, and strategic plans. The objective is to provide businesses with multiple strategies and a solid contingency plan for the mro distribution in footwear business. The report also offers insights into market size, market share, and the significance of their global market presence.

Report Coverage

The report covers all relevant information influencing the development of the mro distribution in footwear industry. It includes company portfolios, growth opportunities, obstacles, and strategic plans. The objective is to provide businesses with multiple strategies and a solid contingency plan for the mro distribution in footwear business. The report also offers insights into market size, market share, and the significance of their global market presence.

The report provides a detailed analysis of the mro distribution in footwear market across various regions, highlighting the unique market dynamics and growth opportunities in each region.

- US

- Canada

- Mexico

- UK

- Germany

- France

- Italy

- Russia

- Spain

- Switzerland

- Austria

- Belgium

- Rest of Europe

- China

- Japan

- South Korea

- Indonesia

- Vietnam

- Philippines

- Australia

- Thailand

- Singapore

- Rest of APAC

- UAE

- Saudi Arabia

- Egypt

- South Africa

- Israel

- Rest of MEA

- Brazil

- Argentina

- Rest of Latin America

>>> Need A Different Region Or Segment? Download PDF Sample

Key Takeaways

- The global mro distribution in footwear market is expected to grow significantly from 2024 to 2032, driven by technological advancements, increasing demand, and government investments in urbanization.

- The market is characterized by a diverse range of manufacturers, product types, and applications, catering to different consumer needs and preferences.

- Regional insights highlight the unique market dynamics and growth opportunities in various regions, including North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

- The competitive landscape features key players who have created a dynamic and diverse market environment through collaborations, mergers and acquisitions, and innovative product developments.

- Market trends such as technological advancements, sustainability, customization, and digital transformation are shaping the growth and development of the mro distribution in footwear market.

- Despite the positive outlook, the market faces challenges such as regulatory compliance, high initial investment costs, and economic uncertainties.

- The report provides comprehensive coverage of market size, market share, growth factors, and strategic insights to help businesses navigate the dynamic mro distribution in footwear market and achieve long-term success.

By leveraging the information provided in this report, businesses can develop effective strategies, address market challenges, and capitalize on growth opportunities to ensure sustainable growth and long-term success in the global mro distribution in footwear market.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Currency

- Key Target Audience

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Restraints

- Opportunities

- Challenges

- Global MRO Distribution in Footwear Market Analysis and Projection, By Companies

- Segment Overview

- Cromwell Group (Holdings) Limited (Grainger)

- Graco Inc.

- WABCO (ZF)

- Mento AS

- Valeo Service UK Ltd

- Ascendum

- Bodo M�ller Chemie GmbH

- Lindberg & Lund AS (Biesterfeld)

- Neumo-Egmo Spain SL

- Gazechim Composites Norden AB

- ABB Group

- Rohde & Schwarz

- Schneider Electric

- Global MRO Distribution in Footwear Market Analysis and Projection, By Type

- Segment Overview

- Preventive/Scheduled Maintenance

- Corrective Maintenance

- Global MRO Distribution in Footwear Market Analysis and Projection, By Application

- Segment Overview

- Internal

- External

- Global MRO Distribution in Footwear Market Analysis and Projection, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Russia

- Spain

- Switzerland

- Austria

- Belgium

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Vietnam

- Philippines

- Australia

- Thailand

- Singapore

- Rest of APAC

- Middle East

- UAE

- Saudi Arabia

- Egypt

- South Africa

- Israel

- Rest of MEA

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Global MRO Distribution in Footwear Market-Competitive Landscape

- Overview

- Market Share of Key Players in the MRO Distribution in Footwear Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Coverage Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Cromwell Group (Holdings) Limited (Grainger)

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Graco Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- WABCO (ZF)

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Mento AS

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Valeo Service UK Ltd

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Ascendum

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Bodo M�ller Chemie GmbH

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Lindberg & Lund AS (Biesterfeld)

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Neumo-Egmo Spain SL

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Gazechim Composites Norden AB

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- ABB Group

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Rohde & Schwarz

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Schneider Electric

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

List of Table

- Drivers of Global MRO Distribution in Footwear Market: Impact Analysis

- Restraints of Global MRO Distribution in Footwear Market: Impact Analysis

- Global MRO Distribution in Footwear Market, By Technology, 2023-2032(USD Billion)

- global Preventive/Scheduled Maintenance, MRO Distribution in Footwear Market, By Region, 2023-2032(USD Billion)

- global Corrective Maintenance, MRO Distribution in Footwear Market, By Region, 2023-2032(USD Billion)

- global Internal, MRO Distribution in Footwear Market, By Region, 2023-2032(USD Billion)

- global External, MRO Distribution in Footwear Market, By Region, 2023-2032(USD Billion)

List of Figures

- Global MRO Distribution in Footwear Market Segmentation

- MRO Distribution in Footwear Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top investment pocket in the MRO Distribution in Footwear Market

- Top Winning Strategies, 2023-2032

- Top Winning Strategies, By Development, 2023-2032(%)

- Top Winning Strategies, By Company, 2023-2032

- Moderate Bargaining power of Buyers

- Moderate Bargaining power of Suppliers

- Moderate Bargaining power of New Entrants

- Low threat of Substitution

- High Competitive Rivalry

- Restraint and Drivers: MRO Distribution in Footwear Market

- MRO Distribution in Footwear Market Segmentation, By Technology

- MRO Distribution in Footwear Market For Live Attenuated, By Region, 2023-2033 ($ Billion)

- Global MRO Distribution in Footwear Market, By Technology, 2023-2032(USD Billion)

- global Preventive/Scheduled Maintenance, MRO Distribution in Footwear Market, By Region, 2023-2032(USD Billion)

- global Corrective Maintenance, MRO Distribution in Footwear Market, By Region, 2023-2032(USD Billion)

- global Internal, MRO Distribution in Footwear Market, By Region, 2023-2032(USD Billion)

- global External, MRO Distribution in Footwear Market, By Region, 2023-2032(USD Billion)

- Cromwell Group (Holdings) Limited (Grainger): Net Sales, 2023-2033 ($ Billion)

- Cromwell Group (Holdings) Limited (Grainger): Revenue Share, By Segment, 2023 (%)

- Cromwell Group (Holdings) Limited (Grainger): Revenue Share, By Region, 2023 (%)

- Graco Inc.: Net Sales, 2023-2033 ($ Billion)

- Graco Inc.: Revenue Share, By Segment, 2023 (%)

- Graco Inc.: Revenue Share, By Region, 2023 (%)

- WABCO (ZF): Net Sales, 2023-2033 ($ Billion)

- WABCO (ZF): Revenue Share, By Segment, 2023 (%)

- WABCO (ZF): Revenue Share, By Region, 2023 (%)

- Mento AS: Net Sales, 2023-2033 ($ Billion)

- Mento AS: Revenue Share, By Segment, 2023 (%)

- Mento AS: Revenue Share, By Region, 2023 (%)

- Valeo Service UK Ltd: Net Sales, 2023-2033 ($ Billion)

- Valeo Service UK Ltd: Revenue Share, By Segment, 2023 (%)

- Valeo Service UK Ltd: Revenue Share, By Region, 2023 (%)

- Ascendum: Net Sales, 2023-2033 ($ Billion)

- Ascendum: Revenue Share, By Segment, 2023 (%)

- Ascendum: Revenue Share, By Region, 2023 (%)

- Bodo M�ller Chemie GmbH: Net Sales, 2023-2033 ($ Billion)

- Bodo M�ller Chemie GmbH: Revenue Share, By Segment, 2023 (%)

- Bodo M�ller Chemie GmbH: Revenue Share, By Region, 2023 (%)

- Lindberg & Lund AS (Biesterfeld): Net Sales, 2023-2033 ($ Billion)

- Lindberg & Lund AS (Biesterfeld): Revenue Share, By Segment, 2023 (%)

- Lindberg & Lund AS (Biesterfeld): Revenue Share, By Region, 2023 (%)

- Neumo-Egmo Spain SL: Net Sales, 2023-2033 ($ Billion)

- Neumo-Egmo Spain SL: Revenue Share, By Segment, 2023 (%)

- Neumo-Egmo Spain SL: Revenue Share, By Region, 2023 (%)

- Gazechim Composites Norden AB: Net Sales, 2023-2033 ($ Billion)

- Gazechim Composites Norden AB: Revenue Share, By Segment, 2023 (%)

- Gazechim Composites Norden AB: Revenue Share, By Region, 2023 (%)

- ABB Group: Net Sales, 2023-2033 ($ Billion)

- ABB Group: Revenue Share, By Segment, 2023 (%)

- ABB Group: Revenue Share, By Region, 2023 (%)

- Rohde & Schwarz: Net Sales, 2023-2033 ($ Billion)

- Rohde & Schwarz: Revenue Share, By Segment, 2023 (%)

- Rohde & Schwarz: Revenue Share, By Region, 2023 (%)

- Schneider Electric: Net Sales, 2023-2033 ($ Billion)

- Schneider Electric: Revenue Share, By Segment, 2023 (%)

- Schneider Electric: Revenue Share, By Region, 2023 (%)

Infinitive Data Research provides comprehensive market research, offering in-depth market analysis to help companies understand their target market and industry competition. This research predicts the market acceptance of your brand and products, ensuring informed decision-making for business success.

Competitor Analysis in the MRO Distribution in Footwear Industry

Conducting a competitor analysis involves identifying competitors within the MRO Distribution in Footwear industry and studying their various marketing strategies. This comparative data allows you to assess your company's strengths and weaknesses relative to competitors, providing insights to enhance your market position.

Importance of Continuous Market Research

Consistently conducting market research is essential for minimizing risk at every stage of business operations. MRO Distribution in Footwear market research enables you to collect qualitative and quantitative data, which, when properly analyzed, leads to wise decisions that align with user and customer needs. Below are some crucial lessons learned through the MRO Distribution in Footwear market research process:

Key Dimensions of MRO Distribution in Footwear Market Analysis

- Trend and Pattern Identification: Analyzing data to spot market trends and patterns.

- Pricing Analysis: Assessing keyword pricing strategies.

- Actionable Insights: Implementing insights derived from data analysis.

- Market Potential: Evaluating the potential of the MRO Distribution in Footwear market.

- Competitor Analysis: Studying competitors' strategies and performance.

- Location Analysis: Assessing optimal locations for market penetration.

- Distribution Channels Analysis: Evaluating the effectiveness of distribution channels.

- Market Size and Growth Rate: Measuring market size and growth potential.

- Market Profitability: Assessing profitability prospects.

- Key Success Factors: Identifying critical factors for success.

- Cost Structure: Understanding the cost structure within the MRO Distribution in Footwear industry.

Target Audience for the Report

This report is valuable for a diverse audience, including:

- MRO Distribution in Footwear Market Manufacturers: To understand market dynamics and enhance production strategies.

- Investors and Financing Companies: To assess investment opportunities and risks.

- MRO Distribution in Footwear Market Suppliers: To identify market demands and supply chain efficiencies.

Necessity of the Report

Making Crucial Business Decisions

Understanding the MRO Distribution in Footwear market, competition, and industry landscape is vital for making informed business decisions. Without current and relevant market research, decisions may be based on outdated or irrelevant information, potentially harming the business.

Securing Investment Funds

Attracting investors requires demonstrating thorough market research. Investors need assurance that you understand the sector, current and potential competition, and whether your idea addresses a market need.

Identifying New Business Opportunities

MRO Distribution in Footwear market research goes beyond understanding trends and consumer behavior. It identifies new revenue streams and opportunities for business pivots. These insights can lead to strategic changes in the business model, promoting growth and adapting to market challenges.

Avoiding Business Failures

Market research also plays a crucial role in risk mitigation. It can reveal when not to pursue certain actions, saving the company from potential losses in revenue, brand image, and more. This proactive approach is often overlooked but is essential for long-term success.

Conclusion

Infinitive Data Research's comprehensive MRO Distribution in Footwear market research provides critical insights for making solid business decisions, securing investments, identifying new opportunities, and avoiding potential failures. Understanding market dynamics through continuous research ensures your company remains competitive and thrives in the MRO Distribution in Footwear industry.