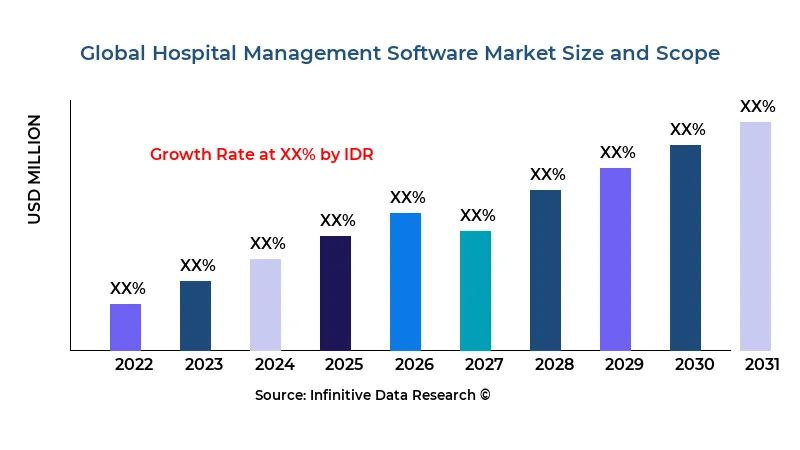

Hospital Management Software Market Growth CAGR Overview

According to research by Infinitive Data Research, the global Hospital Management Software Market size was valued at USD 30.93 Bln (billion) in 2024 and is Calculated to reach USD 55.8 Bln (billion) by the end of 2032, growing at an anticipated compound annual growth rate (CAGR) of 7.13% during the forecast period 2024 to 2032. This projected growth is driven by its increasing adoption across Software & Services industries such as Hospital, Clinics, OthersThe hospital management software market is characterized by an accelerating shift towards digitization of clinical and administrative processes. Healthcare providers are under growing pressure to enhance patient outcomes, reduce operational costs, and comply with stringent regulatory frameworks. As a result, integrated software suites that consolidate patient records, billing, inventory, and reporting are rapidly displacing legacy systems.

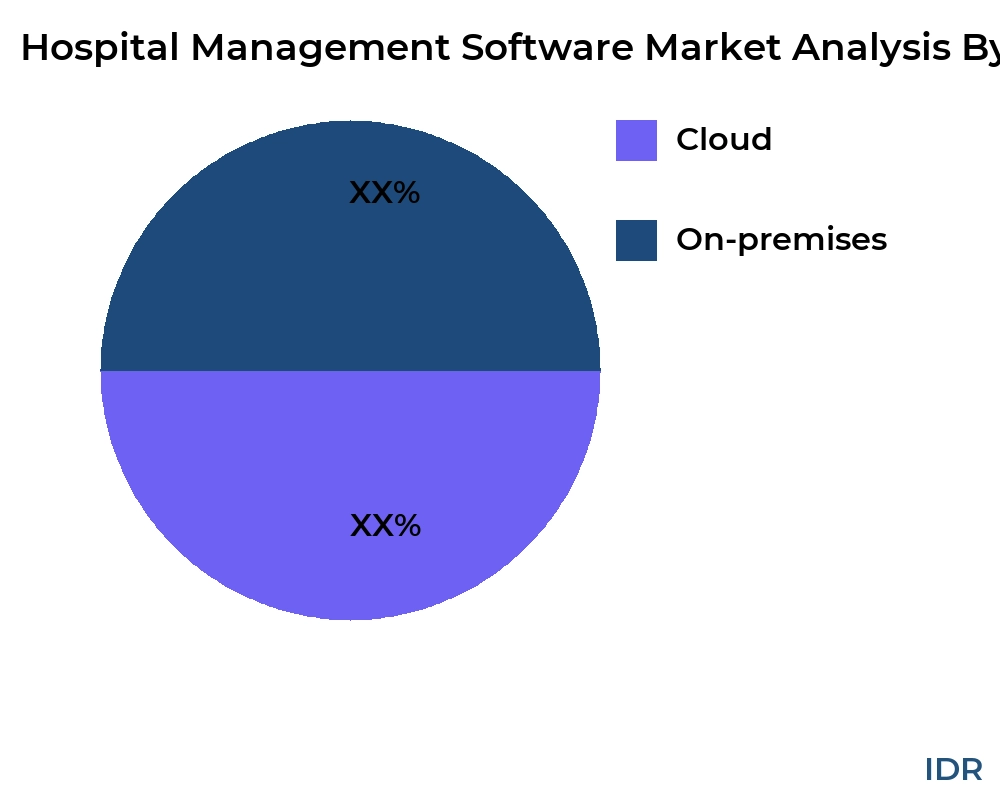

Simultaneously, the rising volume of healthcare data—driven by electronic health records (EHRs), telemedicine, and remote monitoring—has created a demand for scalable, secure platforms capable of real‑time analytics. Cloud‑based deployments are gaining traction for their lower upfront costs and easier maintenance, though on‑premise solutions remain preferred in regions with strict data sovereignty laws.

Interoperability among disparate systems continues to be both a challenge and an opportunity. Hospitals seek solutions that seamlessly exchange data with laboratory instruments, pharmacy management systems, and national health information exchanges. Vendors that can demonstrate robust API frameworks and adherence to standards like HL7 and FHIR are positioned to capture a larger share of the market.

Finally, as patient‑centric care models proliferate, there is a marked emphasis on user experience. Mobile‑friendly portals, patient engagement tools, and telehealth integrations are now critical differentiators. Platforms that enable scheduling, virtual consultations, and secure messaging directly with care teams are redefining the scope of hospital management software beyond administrative duties into full lifecycle patient engagement.

>>> Understand The Key Trends Shaping This Market:- Download PDF Sample

Hospital Management Software Market Growth Factors

A primary growth driver is the global shortage of skilled healthcare personnel. With clinician burnout on the rise, hospitals are turning to automation to handle routine tasks such as appointment reminders, billing reconciliation, and inventory reordering. By reducing manual workloads, software solutions free up staff to focus on patient care, leading to higher adoption rates of comprehensive management platforms.

Government initiatives also play a significant role. Incentive programs and funding for health IT modernization—such as digital health missions and subsidies for EHR adoption—have accelerated software procurement across public and private hospitals. Regions with favorable reimbursement policies for telemedicine and remote diagnostics are particularly attractive growth markets for vendors offering integrated telehealth modules.

The COVID‑19 pandemic underscored the necessity of flexible, cloud‑enabled software capable of supporting remote operations and large‑scale data analytics. Hospitals that invested in robust management systems were better equipped to track patient surges, allocate resources, and manage supply chains during the crisis. This real‑world validation has solidified long‑term budget commitments to IT upgrades.

Finally, strategic partnerships between software vendors and medical device manufacturers are fueling innovation in clinical decision support. Embedded analytics, AI‑driven diagnostic tools, and predictive insights for patient deterioration are being integrated into management suites, creating value‑added propositions that justify premium pricing and drive competitive differentiation.

Market Analysis By Competitors

- JVS Group

- Meditab Software

- Practo Technologies

- eVisit

- Availity

- Adroit Infosystems

- Pinaacle Technologies

- Khabeer

- Uniwide Consultancy & Services

- Pwave Tech

- NantHealth

- ProEmTech Infosystems

- Dharma Healthcare

- Akshar Technosoft

- OrcaSys

By Product Type

- Cloud

- On-premises

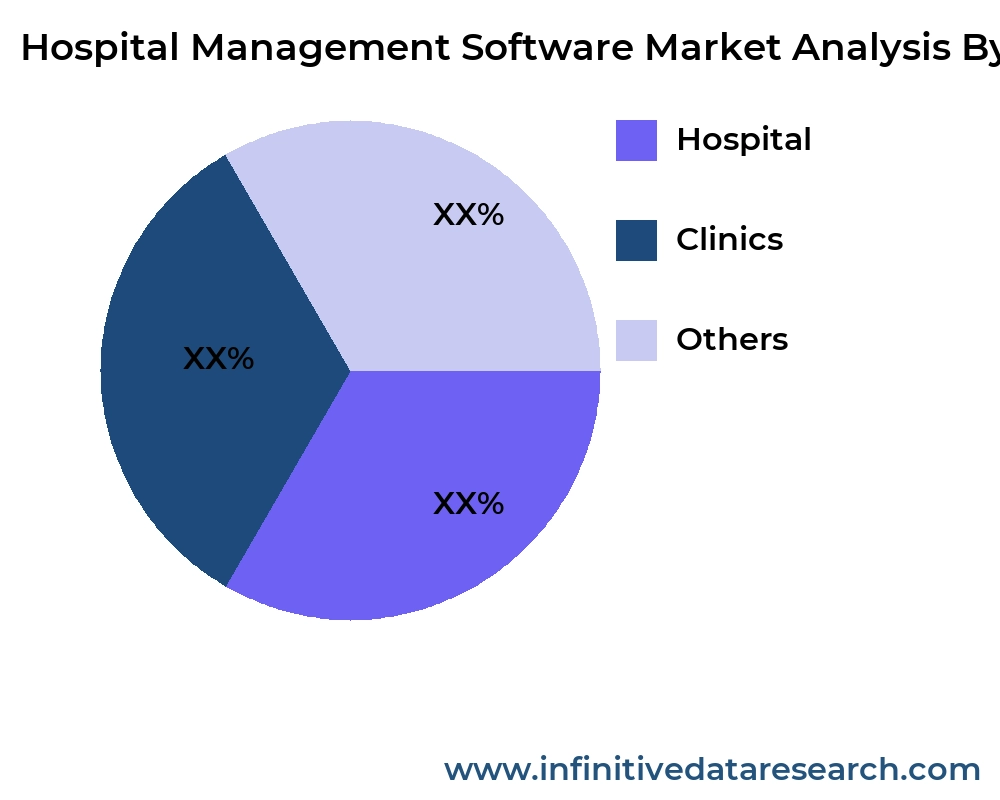

By Application

- Hospital

- Clinics

- Others

>>> Understand The Key Trends Shaping This Market:- Understand The Key Trends Shaping This Market:-

Hospital Management Software Market Segment Analysis

Distribution ChannelThe distribution channel segment bifurcates into direct sales and indirect channels (value‑added resellers, system integrators, and online marketplaces). Large healthcare networks and academic medical centers typically engage directly with leading vendors through negotiated contracts, ensuring bespoke implementations and comprehensive service agreements. Conversely, smaller hospitals and clinics often rely on channel partners for cost‑effective deployment, leveraging local integrators for tailored support and training. The rise of digital procurement platforms is also enabling mid‑market providers to identify, trial, and purchase solutions with minimal friction, expanding reach into underserved regions.

CompatibilityCompatibility segmentation distinguishes between standalone modules and fully integrated suites. Universities and multi‑specialty hospitals favor integrated platforms that cover patient management, billing, inventory, and analytics under a unified architecture. In contrast, specialized clinics or small practices may opt for standalone solutions, selecting only the modules they need—such as appointment scheduling or revenue cycle management—and integrating them with existing EHR systems. The ability to interoperate with legacy clinical devices and third‑party applications via standardized interfaces is a decisive factor in purchase decisions.

Price RangePricing tiers typically fall into basic, mid‑range, and enterprise categories. Entry‑level systems target small clinics with minimal functionalities—primarily scheduling and patient registration—at subscription rates under USD 1,000 per month. Mid‑range solutions, priced between USD 1,000 and USD 5,000 monthly, add billing, inventory, and basic analytics. Enterprise offerings, costing upwards of USD 5,000 per month (or high one‑time licensing fees), provide full EHR integration, advanced reporting, AI‑driven decision support, and comprehensive compliance modules. Flexible subscription‑based models and consumption‑based pricing are increasingly common, allowing institutions to scale costs in line with patient volumes.

Product TypeProduct types split into cloud‑based, on‑premise, and hybrid deployments. Cloud‑based products dominate growth due to their agility, lower maintenance overhead, and faster time‑to‑value—especially for multi‑site hospital chains. On‑premise software remains prevalent in regions with strict data residency requirements, larger institutions with existing IT infrastructures, or where connectivity is unreliable. Hybrid solutions blend on‑premise core modules with cloud‑hosted analytics and patient engagement portals, offering a compromise that addresses security concerns while enabling rapid feature updates. This segmentation is also driving innovation in edge computing and encrypted data synchronization for hybrid environments.

| REPORT ATTRIBUTES | DETAILS |

|---|---|

| Study Period |

2019-2032 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Historical Period |

2019-2022 |

| Unit |

Value (USD Billion) |

| Key Companies Profiled |

JVS Group, Meditab Software, Practo Technologies, eVisit, Availity, Adroit Infosystems, Pinaacle Technologies, Khabeer, Uniwide Consultancy & Services, Pwave Tech, NantHealth, ProEmTech Infosystems, Dharma Healthcare, Akshar Technosoft, OrcaSys |

| Segments Covered |

By Product |

| Customization Scope |

Free report customization (equivalent to up to 3 analyst working days) with purchase. Addition or alteration to country, regional and segment scope |

>>> Overview of Market Analysis:- Download PDF Sample

Hospital Management Software Market Regional Analysis

The North American market for hospital management software is characterized by high adoption rates driven by stringent regulatory requirements and substantial healthcare IT budgets. Large hospital networks and integrated delivery systems are investing heavily in interoperable platforms that streamline patient records, billing, and analytics. The presence of key vendors such as Epic and Cerner has fostered an environment of innovation, with cloud-based and AI-enabled modules becoming increasingly mainstream. Continued government incentives for electronic health record (EHR) adoption and a growing focus on value-based care are expected to sustain robust growth in this region over the next five years.

In Europe, the market exhibits significant variation across countries due to differing healthcare policies and funding models. Nations with socialized medicine, like the United Kingdom and Germany, emphasize cost-effective, standardized solutions that can operate at national scale, whereas more privatized systems in countries such as Switzerland and the Netherlands favor customizable, enterprise-grade platforms. Recent regulations under the GDPR have also propelled investments in secure, privacy-compliant systems. Pan‑European vendors and multinational IT consultancies are expanding their footprints by offering localized modules and multilingual support to meet diverse regional requirements.

The Asia‑Pacific region is emerging as the fastest‑growing market segment, fueled by rising healthcare expenditures, government modernization initiatives, and expansion of private hospital chains. China and India lead the surge, with large-scale digitization projects aimed at improving access to healthcare in rural areas. Southeast Asian countries, such as Malaysia and Indonesia, are investing in scalable cloud‑based solutions to overcome infrastructure constraints. Market entrants are focusing on modular, mobile‑friendly applications to cater to a broad spectrum of healthcare facilities, from small clinics to tertiary hospitals.

Latin America and the Middle East & Africa regions are in earlier stages of digital transformation but present considerable potential. Brazil and Mexico are seeing pilot implementations in major urban centers, while Gulf Cooperation Council (GCC) countries are adopting advanced systems to support medical tourism and large healthcare investments. Challenges such as limited IT infrastructure, skill shortages, and budget constraints remain, yet public‑private partnerships and international funding are helping to bridge these gaps. Overall, stakeholders anticipate accelerating growth as systems mature and stakeholders gain confidence in technology-driven efficiencies.

global Hospital Management Software market revenue (usd million) comparison by players 2024-2032

| Company/players | 2021 | 2022 | 2023 | 2024 | ... | (2032) |

|---|---|---|---|---|---|---|

| JVS Group | XX | XX | XX | XX | XX | XX |

| Meditab Software | XX | XX | XX | XX | XX | XX |

| Practo Technologies | XX | XX | XX | XX | XX | XX |

| eVisit | XX | XX | XX | XX | XX | XX |

| Availity | XX | XX | XX | XX | XX | XX |

| Adroit Infosystems | XX | XX | XX | XX | XX | XX |

| Pinaacle Technologies | XX | XX | XX | XX | XX | XX |

| Khabeer | XX | XX | XX | XX | XX | XX |

| Uniwide Consultancy & Services | XX | XX | XX | XX | XX | XX |

| Pwave Tech | XX | XX | XX | XX | XX | XX |

| NantHealth | XX | XX | XX | XX | XX | XX |

| ProEmTech Infosystems | XX | XX | XX | XX | XX | XX |

| Dharma Healthcare | XX | XX | XX | XX | XX | XX |

| Akshar Technosoft | XX | XX | XX | XX | XX | XX |

| OrcaSys | XX | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX | XX |

global Hospital Management Software market revenue (usd million) comparison by product type 2024-2032

Product Type

2023

2024

...

2032

CAGR%(2024-32)

Cloud

XX

XX

XX

XX

XX

On-premises

XX

XX

XX

XX

XX

Total

XX

XX

XX

XX

XX

| Product Type | 2023 | 2024 | ... | 2032 | CAGR%(2024-32) |

|---|---|---|---|---|---|

| Cloud | XX | XX | XX | XX | XX |

| On-premises | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX |

global Hospital Management Software market revenue (usd million) comparison by application 2024-2032

Application

2023

2024

...

2032

CAGR%(2024-32)

Hospital

XX

XX

XX

XX

XX

Clinics

XX

XX

XX

XX

XX

Others

XX

XX

XX

XX

XX

Total

XX

XX

XX

XX

XX

| Application | 2023 | 2024 | ... | 2032 | CAGR%(2024-32) |

|---|---|---|---|---|---|

| Hospital | XX | XX | XX | XX | XX |

| Clinics | XX | XX | XX | XX | XX |

| Others | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX |

>>> Market Understand Through Graph And Chart:- Download PDF Sample

Hospital Management Software Market Competitive Insights

Competition in the hospital management software market is intense, with a few global leaders commanding significant market share alongside numerous regional specialists. Leading vendors compete on the basis of functional breadth, interoperability, data analytics capabilities, and post‑implementation services. Strategic partnerships with consulting firms, cloud providers, and device manufacturers have become commonplace as companies aim to deliver end-to-end solutions spanning clinical, administrative, and financial workflows. Meanwhile, an increasing emphasis on patient engagement tools and telehealth modules is reshaping vendor roadmaps.

Smaller, regional vendors differentiate themselves through deep localization, offering tailored compliance with local regulations, language support, and integration with region‑specific insurance and billing systems. These companies often compete effectively against global players by providing lower total cost of ownership and agile customer support. As healthcare facilities in emerging markets seek cost‑effective alternatives, they are gravitating towards these nimble providers, forcing incumbents to reassess pricing strategies and accelerate feature rollouts.

Innovation is a key battleground, with rapid advances in artificial intelligence, machine learning, and predictive analytics being integrated into core hospital information systems. Vendors are embedding clinical decision support, risk stratification tools, and population health dashboards to enable proactive care management. Those who can demonstrate measurable improvements in quality outcomes and operational efficiency gain a competitive edge, earning opportunities for larger, multi-year contracts and cross‑selling of analytics services.

Consolidation through mergers and acquisitions continues to shape the competitive landscape. Large technology conglomerates and private equity firms are acquiring specialized vendors to broaden their portfolios and enter high‑growth segments such as telehealth and remote patient monitoring. While this trend offers customers more integrated offerings, it also introduces uncertainty around product roadmaps and support continuity. Healthcare organizations are increasingly conducting due diligence on vendor stability and long‑term viability before committing to new deployments.

Hospital Management Software Market Competitors

Market Top Competitive Companies by Country-

United States

-

Cerner Corporation

-

Epic Systems

-

Allscripts Healthcare Solutions

-

McKesson Corporation

-

NextGen Healthcare

-

-

United Kingdom

-

System C Healthcare

-

Allocate Software

-

IMS MAXIMS

-

DXC Technology

-

Cerner UK

-

-

Germany

-

CompuGroup Medical

-

SAP Healthcare

-

Cerner Deutschland

-

Nexus/Meierhofer

-

Dedalus Group

-

-

India

-

Tata Consultancy Services

-

Practo Technologies

-

Cerner India

-

Ramco Systems

-

Infosys

-

-

China

-

Winning Health Technology

-

Neusoft Corporation

-

Kingdee International

-

Inspur Group

-

Yonyou Healthcare

-

-

Australia

-

MedicalDirector

-

Genie Solutions

-

Hospital Management Software Market Top Competitors

1. Cerner Corporation

Cerner remains one of the preeminent global providers of hospital management and EHR solutions, with deployments in over 35 countries. The company is renowned for its scalable Millennium platform that supports large health systems and academic medical centers. Cerner’s ongoing investments in population health management and precision medicine initiatives have reinforced its reputation as an innovation leader. Its strong revenue base and diverse service offerings position it well against peers in both mature and developing markets. Recent strategic alliances with major cloud providers have further expanded its reach and technical capabilities.

2. Epic Systems

Epic is often regarded as the gold standard for integrated hospital and clinic management software in North America, commanding significant market share among U.S. academic medical centers and large hospital groups. Known for its unified suite, Epic delivers high levels of interoperability and patient engagement features, including its MyChart portal. The company’s focus on research collaborations and data analytics has strengthened its clinical decision support capabilities. Despite its premium pricing model, Epic’s strong customer loyalty and high switching costs underpin its dominant position.

3. Allscripts Healthcare Solutions

Allscripts offers a broad portfolio of solutions ranging from ambulatory EHRs to acute care hospital systems, targeting mid‑market and large healthcare organizations. The company has pivoted towards an open, platform‑based approach, fostering a developer ecosystem for third‑party integrations. Its acquisition strategy, including CarePort Health and ZappRx, has expanded its post‑acute care and specialty pharmacy footprint. While facing stiff competition, Allscripts’ emphasis on interoperability and value‑based care tools helps retain existing clients and attract new ones.

4. McKesson Corporation

McKesson leverages its extensive pharmaceutical distribution network to bundle hospital management software with supply chain and pharmacy solutions. Its Paragon and Horizon platforms serve community hospitals and larger health systems, respectively. McKesson’s end‑to‑end offerings, including revenue cycle management and analytics, provide a comprehensive value proposition. Ongoing divestitures and reorganizations aimed at focusing on core healthcare IT have streamlined operations, positioning McKesson to compete more directly with pure‑play software vendors.

5. MEDITECH

MEDITECH has long been a stalwart in the hospital information system space, particularly among community hospitals and mid‑sized health facilities. The company’s Expanse platform, available both on‑premises and in the cloud, emphasizes ease of use and cost efficiency. MEDITECH continues to innovate in mobile access and interoperability, participating in national health information exchanges. Its strong presence in North America and select international markets reflects its balance of robust functionality and affordability.

6. GE Healthcare

GE Healthcare, through its Centricity platform, offers integrated solutions for both hospital and ambulatory settings. The vendor’s strength lies in combining clinical imaging, monitoring hardware, and software, enabling deep integration of diagnostic data. Investment in AI‑driven imaging analytics and remote patient monitoring augments its hospital management suite. Although recent corporate restructuring has introduced some uncertainty, GE Healthcare’s global brand and capital resources underwrite its competitive prospects.

7. NextGen Healthcare

NextGen specializes in ambulatory EHR and practice management systems, with a growing presence in smaller hospital networks and outpatient clinics. The company has expanded its portfolio via acquisitions such as Medfusion (patient engagement) and OTTO Health (telehealth). NextGen’s agile, cloud‑native architecture appeals to cost‑conscious providers seeking rapid deployments. Its emphasis on specialty‑specific workflows and APIs for interoperability supports its steady growth trajectory.

8. Athenahealth

Athenahealth delivers cloud-based healthcare management services covering EHR, revenue cycle, and patient engagement. Its network-enabled model leverages aggregated data to drive benchmarking and performance insights. The company’s “athenaOne” suite is popular among ambulatory practices and smaller hospitals due to its ease of implementation and flexible pricing. As Athenahealth enhances its analytics and telehealth capabilities, it is carving out a niche in digital-first care delivery models.

9. SAP Healthcare

SAP’s healthcare solutions, built on its S/4HANA ERP platform, target large hospital systems seeking integrated financial, supply chain, and clinical operations management. SAP Healthcare emphasizes real‑time analytics, regulatory compliance, and enterprise‑scale process management. Its strong footing in the enterprise software arena allows healthcare organizations to unify hospital management with broader business processes. While not a traditional EHR vendor, SAP’s move into clinical data integration continues to gain traction among global health networks.

10. Siemens Healthineers

Siemens Healthineers has leveraged its medical imaging and diagnostics legacy to expand into hospital IT with platforms such as Soarian and RIS‑PACS integration. The vendor focuses on the convergence of imaging data, laboratory information, and patient records to enable precision diagnostics. Siemens’ global reach and trusted brand in clinical hardware provide a unique advantage in selling comprehensive enterprise medical solutions. Its strategic pivots towards service‑oriented models and digital health partnerships bolster its competitive stance in the HMS market.

The report provides a detailed analysis of the Hospital Management Software market across various regions, highlighting the unique market dynamics and growth opportunities in each region.

- US

- Canada

- Mexico

- UK

- Germany

- France

- Italy

- Russia

- Spain

- Switzerland

- Austria

- Belgium

- Rest of Europe

- China

- Japan

- South Korea

- Indonesia

- Vietnam

- Philippines

- Australia

- Thailand

- Singapore

- Rest of APAC

- UAE

- Saudi Arabia

- Egypt

- South Africa

- Israel

- Rest of MEA

- Brazil

- Argentina

- Rest of Latin America

>>> Need A Different Region Or Segment? Download PDF Sample

Key Takeaways

- The global Hospital Management Software market is expected to grow significantly from 2024 to 2032, driven by technological advancements, increasing demand, and government investments in urbanization.

- The market is characterized by a diverse range of manufacturers, product types, and applications, catering to different consumer needs and preferences.

- Regional insights highlight the unique market dynamics and growth opportunities in various regions, including North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

- The competitive landscape features key players who have created a dynamic and diverse market environment through collaborations, mergers and acquisitions, and innovative product developments.

- Market trends such as technological advancements, sustainability, customization, and digital transformation are shaping the growth and development of the Hospital Management Software market.

- Despite the positive outlook, the market faces challenges such as regulatory compliance, high initial investment costs, and economic uncertainties.

- The report provides comprehensive coverage of market size, market share, growth factors, and strategic insights to help businesses navigate the dynamic Hospital Management Software market and achieve long-term success.

By leveraging the information provided in this report, businesses can develop effective strategies, address market challenges, and capitalize on growth opportunities to ensure sustainable growth and long-term success in the global Hospital Management Software market.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Currency

- Key Target Audience

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Restraints

- Opportunities

- Challenges

- Global Hospital Management Software Market Analysis and Projection, By Companies

- Segment Overview

- JVS Group

- Meditab Software

- Practo Technologies

- eVisit

- Availity

- Adroit Infosystems

- Pinaacle Technologies

- Khabeer

- Uniwide Consultancy & Services

- Pwave Tech

- NantHealth

- ProEmTech Infosystems

- Dharma Healthcare

- Akshar Technosoft

- OrcaSys

- Global Hospital Management Software Market Analysis and Projection, By Type

- Segment Overview

- Cloud

- On-premises

- Global Hospital Management Software Market Analysis and Projection, By Application

- Segment Overview

- Hospital

- Clinics

- Others

- Global Hospital Management Software Market Analysis and Projection, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Russia

- Spain

- Switzerland

- Austria

- Belgium

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Vietnam

- Philippines

- Australia

- Thailand

- Singapore

- Rest of APAC

- Middle East

- UAE

- Saudi Arabia

- Egypt

- South Africa

- Israel

- Rest of MEA

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Global Hospital Management Software Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Hospital Management Software Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Coverage Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- JVS Group

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Meditab Software

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Practo Technologies

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- eVisit

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Availity

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Adroit Infosystems

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Pinaacle Technologies

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Khabeer

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Uniwide Consultancy & Services

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Pwave Tech

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- NantHealth

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- ProEmTech Infosystems

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Dharma Healthcare

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Akshar Technosoft

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- OrcaSys

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

List of Table

- Drivers of Global Hospital Management Software Market: Impact Analysis

- Restraints of Global Hospital Management Software Market: Impact Analysis

- Global Hospital Management Software Market, By Technology, 2023-2032(USD Billion)

- global Cloud, Hospital Management Software Market, By Region, 2023-2032(USD Billion)

- global On-premises, Hospital Management Software Market, By Region, 2023-2032(USD Billion)

- global Hospital, Hospital Management Software Market, By Region, 2023-2032(USD Billion)

- global Clinics, Hospital Management Software Market, By Region, 2023-2032(USD Billion)

- global Others, Hospital Management Software Market, By Region, 2023-2032(USD Billion)

List of Figures

- Global Hospital Management Software Market Segmentation

- Hospital Management Software Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top investment pocket in the Hospital Management Software Market

- Top Winning Strategies, 2023-2032

- Top Winning Strategies, By Development, 2023-2032(%)

- Top Winning Strategies, By Company, 2023-2032

- Moderate Bargaining power of Buyers

- Moderate Bargaining power of Suppliers

- Moderate Bargaining power of New Entrants

- Low threat of Substitution

- High Competitive Rivalry

- Restraint and Drivers: Hospital Management Software Market

- Hospital Management Software Market Segmentation, By Technology

- Hospital Management Software Market For Live Attenuated, By Region, 2023-2033 ($ Billion)

- Global Hospital Management Software Market, By Technology, 2023-2032(USD Billion)

- global Cloud, Hospital Management Software Market, By Region, 2023-2032(USD Billion)

- global On-premises, Hospital Management Software Market, By Region, 2023-2032(USD Billion)

- global Hospital, Hospital Management Software Market, By Region, 2023-2032(USD Billion)

- global Clinics, Hospital Management Software Market, By Region, 2023-2032(USD Billion)

- global Others, Hospital Management Software Market, By Region, 2023-2032(USD Billion)

- JVS Group: Net Sales, 2023-2033 ($ Billion)

- JVS Group: Revenue Share, By Segment, 2023 (%)

- JVS Group: Revenue Share, By Region, 2023 (%)

- Meditab Software: Net Sales, 2023-2033 ($ Billion)

- Meditab Software: Revenue Share, By Segment, 2023 (%)

- Meditab Software: Revenue Share, By Region, 2023 (%)

- Practo Technologies: Net Sales, 2023-2033 ($ Billion)

- Practo Technologies: Revenue Share, By Segment, 2023 (%)

- Practo Technologies: Revenue Share, By Region, 2023 (%)

- eVisit: Net Sales, 2023-2033 ($ Billion)

- eVisit: Revenue Share, By Segment, 2023 (%)

- eVisit: Revenue Share, By Region, 2023 (%)

- Availity: Net Sales, 2023-2033 ($ Billion)

- Availity: Revenue Share, By Segment, 2023 (%)

- Availity: Revenue Share, By Region, 2023 (%)

- Adroit Infosystems: Net Sales, 2023-2033 ($ Billion)

- Adroit Infosystems: Revenue Share, By Segment, 2023 (%)

- Adroit Infosystems: Revenue Share, By Region, 2023 (%)

- Pinaacle Technologies: Net Sales, 2023-2033 ($ Billion)

- Pinaacle Technologies: Revenue Share, By Segment, 2023 (%)

- Pinaacle Technologies: Revenue Share, By Region, 2023 (%)

- Khabeer: Net Sales, 2023-2033 ($ Billion)

- Khabeer: Revenue Share, By Segment, 2023 (%)

- Khabeer: Revenue Share, By Region, 2023 (%)

- Uniwide Consultancy & Services: Net Sales, 2023-2033 ($ Billion)

- Uniwide Consultancy & Services: Revenue Share, By Segment, 2023 (%)

- Uniwide Consultancy & Services: Revenue Share, By Region, 2023 (%)

- Pwave Tech: Net Sales, 2023-2033 ($ Billion)

- Pwave Tech: Revenue Share, By Segment, 2023 (%)

- Pwave Tech: Revenue Share, By Region, 2023 (%)

- NantHealth: Net Sales, 2023-2033 ($ Billion)

- NantHealth: Revenue Share, By Segment, 2023 (%)

- NantHealth: Revenue Share, By Region, 2023 (%)

- ProEmTech Infosystems: Net Sales, 2023-2033 ($ Billion)

- ProEmTech Infosystems: Revenue Share, By Segment, 2023 (%)

- ProEmTech Infosystems: Revenue Share, By Region, 2023 (%)

- Dharma Healthcare: Net Sales, 2023-2033 ($ Billion)

- Dharma Healthcare: Revenue Share, By Segment, 2023 (%)

- Dharma Healthcare: Revenue Share, By Region, 2023 (%)

- Akshar Technosoft: Net Sales, 2023-2033 ($ Billion)

- Akshar Technosoft: Revenue Share, By Segment, 2023 (%)

- Akshar Technosoft: Revenue Share, By Region, 2023 (%)

- OrcaSys: Net Sales, 2023-2033 ($ Billion)

- OrcaSys: Revenue Share, By Segment, 2023 (%)

- OrcaSys: Revenue Share, By Region, 2023 (%)

Infinitive Data Research provides comprehensive market research, offering in-depth market analysis to help companies understand their target market and industry competition. This research predicts the market acceptance of your brand and products, ensuring informed decision-making for business success.

Competitor Analysis in the Hospital Management Software Industry

Conducting a competitor analysis involves identifying competitors within the Hospital Management Software industry and studying their various marketing strategies. This comparative data allows you to assess your company's strengths and weaknesses relative to competitors, providing insights to enhance your market position.

Importance of Continuous Market Research

Consistently conducting market research is essential for minimizing risk at every stage of business operations. Hospital Management Software market research enables you to collect qualitative and quantitative data, which, when properly analyzed, leads to wise decisions that align with user and customer needs. Below are some crucial lessons learned through the Hospital Management Software market research process:

Key Dimensions of Hospital Management Software Market Analysis

- Trend and Pattern Identification: Analyzing data to spot market trends and patterns.

- Pricing Analysis: Assessing keyword pricing strategies.

- Actionable Insights: Implementing insights derived from data analysis.

- Market Potential: Evaluating the potential of the Hospital Management Software market.

- Competitor Analysis: Studying competitors' strategies and performance.

- Location Analysis: Assessing optimal locations for market penetration.

- Distribution Channels Analysis: Evaluating the effectiveness of distribution channels.

- Market Size and Growth Rate: Measuring market size and growth potential.

- Market Profitability: Assessing profitability prospects.

- Key Success Factors: Identifying critical factors for success.

- Cost Structure: Understanding the cost structure within the Hospital Management Software industry.

Target Audience for the Report

This report is valuable for a diverse audience, including:

- Hospital Management Software Market Manufacturers: To understand market dynamics and enhance production strategies.

- Investors and Financing Companies: To assess investment opportunities and risks.

- Hospital Management Software Market Suppliers: To identify market demands and supply chain efficiencies.

Necessity of the Report

Making Crucial Business Decisions

Understanding the Hospital Management Software market, competition, and industry landscape is vital for making informed business decisions. Without current and relevant market research, decisions may be based on outdated or irrelevant information, potentially harming the business.

Securing Investment Funds

Attracting investors requires demonstrating thorough market research. Investors need assurance that you understand the sector, current and potential competition, and whether your idea addresses a market need.

Identifying New Business Opportunities

Hospital Management Software market research goes beyond understanding trends and consumer behavior. It identifies new revenue streams and opportunities for business pivots. These insights can lead to strategic changes in the business model, promoting growth and adapting to market challenges.

Avoiding Business Failures

Market research also plays a crucial role in risk mitigation. It can reveal when not to pursue certain actions, saving the company from potential losses in revenue, brand image, and more. This proactive approach is often overlooked but is essential for long-term success.

Conclusion

Infinitive Data Research's comprehensive Hospital Management Software market research provides critical insights for making solid business decisions, securing investments, identifying new opportunities, and avoiding potential failures. Understanding market dynamics through continuous research ensures your company remains competitive and thrives in the Hospital Management Software industry.