Enameled Wire (Magnet Wire) Market Growth CAGR Overview

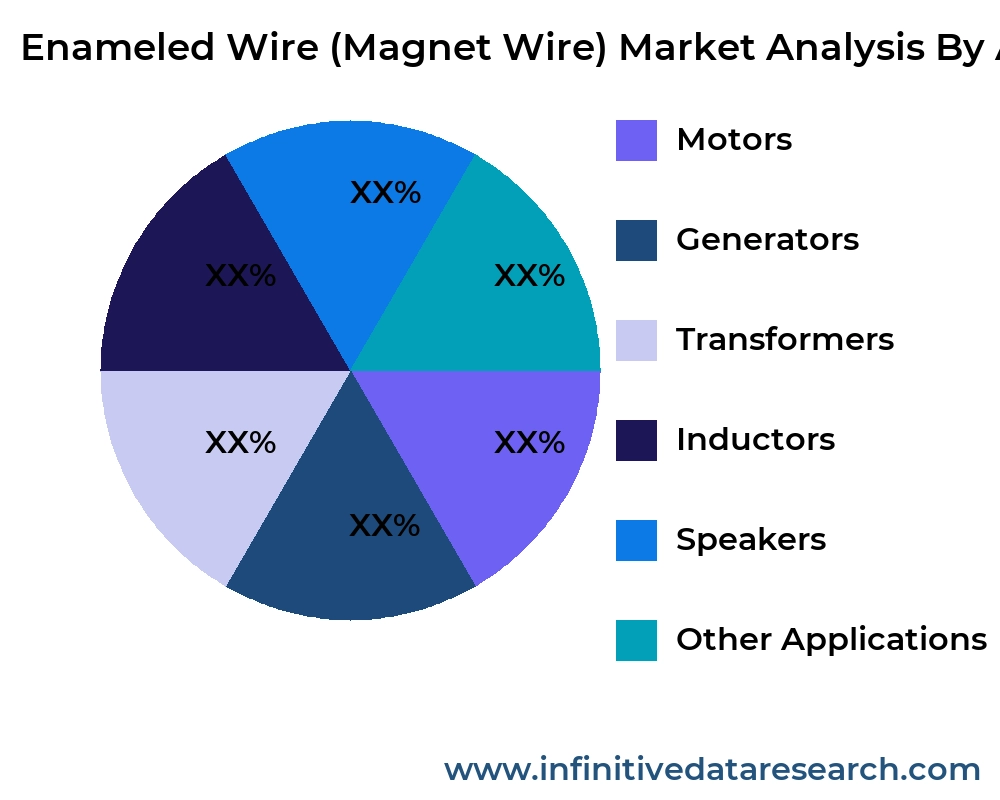

According to research by Infinitive Data Research, the global Enameled Wire (Magnet Wire) Market size was valued at USD 16.6 Bln (billion) in 2024 and is Calculated to reach USD 24.1 Bln (billion) by the end of 2032, growing at an anticipated compound annual growth rate (CAGR) of 6.8% during the forecast period 2024 to 2032. This projected growth is driven by its increasing adoption across Chemical & Materials industries such as Motors, Generators, Transformers, Inductors, Speakers, Other ApplicationsThe enameled wire market has been propelled by robust demand in electric motor manufacturing, where high-efficiency motors for industrial, automotive, and consumer appliances drive substantial wire consumption. Advances in insulation materials have enabled higher thermal performance, allowing motors to run hotter and more efficiently, which in turn increases the volume of magnet wire required per unit. This dynamic has helped manufacturers justify premium pricing for advanced wire grades, while also spurring investment in capacity expansions across established production hubs.

Simultaneously, electrification trends in the automotive industry have created a ripple effect throughout the supply chain. As electric vehicle (EV) adoption accelerates, the need for high-voltage, high-temperature–resistant enameled wire grows exponentially. Engine stators, battery cooling pumps, and onboard chargers all depend on reliable magnet wire, leading OEMs and Tier 1 suppliers to form long-term procurement partnerships. These collaborations are reshaping traditional trade flows, with Asia-Pacific producers increasingly supplying global automakers.

On the technology front, innovations in thin-film polymer enamels have improved fill factors in winding assemblies, reducing copper losses and boosting motor efficiency. These technical improvements have enabled motor designers to shrink package sizes without sacrificing power output, thereby increasing overall wire demand per horsepower. Concurrently, digital simulation tools are optimizing winding geometries and enamel thicknesses, further driving the need for specialty wires tailored to precise design specifications.

Lastly, regional policy initiatives aimed at energy efficiency and decarbonization are reinforcing market growth. Incentives for industrial electrification and stringent energy‑efficiency regulations for appliances and machinery have raised the bar for motor performance. This regulatory environment has pushed end‑users to specify higher‑grade enameled wire in new projects and retrofit applications, underlining a long‑term shift toward premium products and reinforcing the market’s upward trajectory.

>>> Understand The Key Trends Shaping This Market:- Download PDF Sample

Enameled Wire Magnet Wire Market Growth Factors

One major growth driver is the rapid expansion of the EV segment, where each vehicle uses significantly more magnet wire than a conventional ICE vehicle. As governments worldwide set aggressive EV penetration targets and phase out internal combustion engines, demand for high‑performance enameled wire is scaling accordingly. This transition has encouraged wire manufacturers to invest in specialized enamel chemistries that can withstand automotive thermal cycles and under‑hood chemical exposure, thereby supporting sustained growth.

Parallel to automotive, the renewable energy sector is driving demand for magnet wire in wind turbine generators and solar tracking motors. Utility‑scale wind turbines require miles of high‑temperature wire, and new installations continue to rise as part of global renewable energy commitments. The focus on reducing Levelized Cost of Energy (LCOE) has stimulated improvements in generator efficiency, which depend on superior wire insulation. As turbine unit sizes increase, so too does the volume of enameled wire, reinforcing a multiyear growth outlook.

Industrial automation and robotics represent another significant growth corridor. Factories across sectors are automating processes with servo motors and precision actuators that rely on fine‑gauge, high‑yield enameled wire. The proliferation of cobots in small and medium enterprises has further diversified wire applications, requiring smaller batches of specialized products with rapid turnaround times. These shifts have led wire producers to adopt flexible manufacturing lines and digital order‑management systems, boosting responsiveness and supporting broader market expansion.

Finally, the consumer appliance sector continues to evolve, with smart home devices and high‑efficiency HVAC systems driving incremental wire consumption. New appliance designs emphasize smaller footprints and quieter operation, both of which benefit from optimized winding configurations using thinner enamel layers. As consumer expectations around energy savings and noise reduction grow, appliance makers are specifying higher grades of magnet wire, thereby contributing to overall market volume gains.

Market Analysis By Competitors

- Superior Essex

- Tongling Jingda Special

- Rea Magnet Wire

- Sumitomo Electric

- Citychamp Dartong

- Elektrisola

- Fujikura

- Hitachi Metals

- Liljedahl Group

- LS Cable & System

- APWC

- IRCE

- TAI-I

- Jung Shing

- ZML Industries

- MWS Wire

- Shanghai Yuke

- SWCC

- Roshow Technology

- Magnekon

- Condumex

- Tongling Copper Crown Electrical

- Huayu Electromagnetism Line

- Jintian New Material

- Hongyuan Magnet Wire

- Ronsen Super Micro-Wire

- Shanghai Shenmao Magnet Wire

- Tianjin Jing Wei Electric Wire

By Product Type

- Copper Magnet Wire

- Aluminum Magnet Wire

By Application

- Motors

- Generators

- Transformers

- Inductors

- Speakers

- Other Applications

>>> Understand The Key Trends Shaping This Market:- Understand The Key Trends Shaping This Market:-

Enameled Wire Magnet Wire Market Segment Analysis

Distribution ChannelEnameled wire is distributed through direct OEM contracts, specialized wire distributors, and industrial supply catalogues. OEM agreements account for large‑volume, long‑term orders, ensuring stable production schedules. Distributors serve small‑ to medium‑batch customers in repair shops and prototyping labs, offering value‑added services like slitting and cut‑to‑length. Online platforms have emerged for custom orders, enabling quick quoting and digital proofs of foil thickness and enamel type, further broadening channel reach.

CompatibilityCompatibility centers on insulation class and conductor size, which must align with end‑use thermal and electrical requirements. Class H and Class F wires are standard in heavy‑duty motors, while Class B and Class A find use in consumer and light industrial applications. Suppliers now offer multi‑shell and adhesive‑bonded enamels that improve compatibility with varnishing and resin‑impregnation processes. This interoperability with downstream coil‑winding and insulation systems is a key differentiator among vendors.

PricePricing is influenced by copper feedstock costs, enamel raw material grades, and production scale. Standard Class B wire remains the most cost‑competitive, while specialty thin‑film polymer wires command premium pricing. Manufacturers utilize hedging strategies for copper and raw materials to stabilize prices. Volume discounts and value‑added services such as spooling and quality‑certification add to end‑user cost considerations, making pricing a critical factor in supplier selection.

Product TypeProduct types span from round, square, and rectangular cross‑sections to specialty wires with added metallic shields or fiber reinforcements. Standard round copper wire with polyester or polyurethane enamel dominates the market, but high‑speed motors are increasingly using rectangular and sector‑shaped wires to maximize fill factors. Specialty product lines include nickel‑coated copper for enhanced thermal and chemical resistance and fiber‑reinforced composites for high‑stress environments.

| REPORT ATTRIBUTES | DETAILS |

|---|---|

| Study Period |

2019-2032 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Historical Period |

2019-2022 |

| Unit |

Value (USD Billion) |

| Key Companies Profiled |

Superior Essex, Tongling Jingda Special, Rea Magnet Wire, Sumitomo Electric, Citychamp Dartong, Elektrisola, Fujikura, Hitachi Metals, Liljedahl Group, LS Cable & System, APWC, IRCE, TAI-I, Jung Shing, ZML Industries, MWS Wire, Shanghai Yuke, SWCC, Roshow Technology, Magnekon, Condumex, Tongling Copper Crown Electrical, Huayu Electromagnetism Line, Jintian New Material, Hongyuan Magnet Wire, Ronsen Super Micro-Wire, Shanghai Shenmao Magnet Wire, Tianjin Jing Wei Electric Wire |

| Segments Covered |

By Product |

| Customization Scope |

Free report customization (equivalent to up to 3 analyst working days) with purchase. Addition or alteration to country, regional and segment scope |

>>> Overview of Market Analysis:- Download PDF Sample

Enameled Wire Magnet Wire Market Regional Analysis

North America benefits from a mature automotive and aerospace supply chain and strong research institutions that drive material innovations. Local motor and generator manufacturers prioritize domestic sourcing for critical components, supporting robust wire demand. Incentives for reshoring and domestic manufacturing are further strengthening the regional market.

Europe’s market is energized by stringent energy efficiency directives and a strong renewable energy infrastructure. Wind turbine installations in Germany, Spain, and the Nordics sustain high wire demand, while the automotive industry’s move toward hybrids and EVs reinforces consumption. Regional wire producers invest heavily in R&D to stay ahead of evolving insulation requirements.

Asia‑Pacific leads in production capacity, with China, India, and South Korea hosting major wire mills. Rapid industrialization, expanding EV production hubs in China, and growing appliance manufacturing centers in India create a formidable demand base. Low labor costs and economies of scale maintain APAC’s role as a global export hub.

Latin America and the Middle East are emerging markets where infrastructure upgrades and growing automotive assembly plants are boosting wire consumption. Government investments in power‑grid modernization and industrial parks are catalysts, though logistical challenges and import duties moderate near‑term growth.

global Enameled Wire (Magnet Wire) market revenue (usd million) comparison by players 2024-2032

| Company/players | 2021 | 2022 | 2023 | 2024 | ... | (2032) |

|---|---|---|---|---|---|---|

| Superior Essex | XX | XX | XX | XX | XX | XX |

| Tongling Jingda Special | XX | XX | XX | XX | XX | XX |

| Rea Magnet Wire | XX | XX | XX | XX | XX | XX |

| Sumitomo Electric | XX | XX | XX | XX | XX | XX |

| Citychamp Dartong | XX | XX | XX | XX | XX | XX |

| Elektrisola | XX | XX | XX | XX | XX | XX |

| Fujikura | XX | XX | XX | XX | XX | XX |

| Hitachi Metals | XX | XX | XX | XX | XX | XX |

| Liljedahl Group | XX | XX | XX | XX | XX | XX |

| LS Cable & System | XX | XX | XX | XX | XX | XX |

| APWC | XX | XX | XX | XX | XX | XX |

| IRCE | XX | XX | XX | XX | XX | XX |

| TAI-I | XX | XX | XX | XX | XX | XX |

| Jung Shing | XX | XX | XX | XX | XX | XX |

| ZML Industries | XX | XX | XX | XX | XX | XX |

| MWS Wire | XX | XX | XX | XX | XX | XX |

| Shanghai Yuke | XX | XX | XX | XX | XX | XX |

| SWCC | XX | XX | XX | XX | XX | XX |

| Roshow Technology | XX | XX | XX | XX | XX | XX |

| Magnekon | XX | XX | XX | XX | XX | XX |

| Condumex | XX | XX | XX | XX | XX | XX |

| Tongling Copper Crown Electrical | XX | XX | XX | XX | XX | XX |

| Huayu Electromagnetism Line | XX | XX | XX | XX | XX | XX |

| Jintian New Material | XX | XX | XX | XX | XX | XX |

| Hongyuan Magnet Wire | XX | XX | XX | XX | XX | XX |

| Ronsen Super Micro-Wire | XX | XX | XX | XX | XX | XX |

| Shanghai Shenmao Magnet Wire | XX | XX | XX | XX | XX | XX |

| Tianjin Jing Wei Electric Wire | XX | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX | XX |

global Enameled Wire (Magnet Wire) market revenue (usd million) comparison by product type 2024-2032

Product Type

2023

2024

...

2032

CAGR%(2024-32)

Copper Magnet Wire

XX

XX

XX

XX

XX

Aluminum Magnet Wire

XX

XX

XX

XX

XX

Total

XX

XX

XX

XX

XX

| Product Type | 2023 | 2024 | ... | 2032 | CAGR%(2024-32) |

|---|---|---|---|---|---|

| Copper Magnet Wire | XX | XX | XX | XX | XX |

| Aluminum Magnet Wire | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX |

global Enameled Wire (Magnet Wire) market revenue (usd million) comparison by application 2024-2032

Application

2023

2024

...

2032

CAGR%(2024-32)

Motors

XX

XX

XX

XX

XX

Generators

XX

XX

XX

XX

XX

Transformers

XX

XX

XX

XX

XX

Inductors

XX

XX

XX

XX

XX

Speakers

XX

XX

XX

XX

XX

Other Applications

XX

XX

XX

XX

XX

Total

XX

XX

XX

XX

XX

| Application | 2023 | 2024 | ... | 2032 | CAGR%(2024-32) |

|---|---|---|---|---|---|

| Motors | XX | XX | XX | XX | XX |

| Generators | XX | XX | XX | XX | XX |

| Transformers | XX | XX | XX | XX | XX |

| Inductors | XX | XX | XX | XX | XX |

| Speakers | XX | XX | XX | XX | XX |

| Other Applications | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX |

>>> Market Understand Through Graph And Chart:- Download PDF Sample

Enameled Wire Magnet Wire Market Competitive Insights

The competitive landscape is fragmented, with a handful of global leaders and numerous regional specialists. Global players differentiate through advanced enamel chemistries and integrated copper refining capabilities. Regional specialists compete on lead times, localized technical support, and tailored annealing and coating services.

Strategic partnerships between wire producers and motor OEMs are on the rise, as early‑stage collaboration in design phases ensures optimal wire selection and performance validation. These alliances often include co‑development of customized enamel formulations, bolstering mutual market positions.

Mergers and acquisitions are reshaping the industry, as major capacitor and transformer insulation producers seek vertical integration by acquiring magnet wire mills. This trend secures supply chains and broadens product portfolios, allowing acquirers to offer turnkey winding solutions.

Sustainability commitments are increasingly important competitive differentiators. Companies investing in eco‑friendly enamel technologies, reduced volatile organic compound (VOC) emissions, and recyclable packaging are gaining preference among OEMs with green procurement policies.

Enameled Wire Magnet Wire Market Competitors

USA

-

Magnetics Wire Co.

-

Essex Brownell

-

Elektrisola USA

-

Superior Essex Magnet Wire

-

Rea Magnet Wire

Germany

-

Elektrisola GmbH

-

Suncon GmbH

-

MWS Wire Industries GmbH

-

Elparo GmbH

-

Dr. Häring Magnet‑Drähte

Japan

-

Sumitomo Electric Industries

-

Furukawa Electric Co.

-

Hitachi Metals

-

JX Nippon Mining & Metals

-

Panasonic Electric Works

China

-

Jiangsu Tongfeng Wire & Cable

-

Nanjing Capron

-

Suzhou TGT Electric Wire

-

Hangzhou Yinlong Wire & Cable

-

Infinite Magnet Wire

India

-

Asian Cables Pvt Ltd

-

KEI Industries

-

Polycab Wires Pvt Ltd

-

RR Kabel

-

Universal Magnet Wire

South Korea

-

LS Cable & System

-

Iljin Electrical Steel

-

Samhwa Electric Wire

-

Daeju Indus

-

Hanwha Solutions

Enameled Wire Magnet Wire Market Top Competitors

1. Magnetics Wire Co.

Magnetics Wire Co. is a leading U.S. producer of enamelled copper and aluminum wire, renowned for its broad product range encompassing standard Class B to high‑temperature Class H wires. The company’s vertical integration—including copper cathode sourcing and in‑house enamel formulation—provides cost advantages and quality consistency. With multiple North American facilities, it ensures rapid lead times for automotive and industrial OEMs. Strategic investments in advanced thin‑film polymer enamels have reinforced its position as an innovation leader. Ongoing expansions aim to capture growing EV and renewable energy markets.

2. Essex Brownell

Essex Brownell commands a significant share of the U.S. magnet wire market by coupling manufacturing with extensive distribution networks. It offers specialized cutting, slitting, and spooling services, enabling just‑in‑time delivery for small and medium enterprises. The firm’s technical support—including in‑house testing labs—helps customers optimize insulation performance. Partnerships with wire mills augment its supply flexibility. Its customer‑centric business model and reliable logistics have cemented its reputation across industrial, appliance, and traction motor segments.

3. Elektrisola GmbH

As Europe’s largest magnet wire producer, Elektrisola GmbH leverages six global manufacturing sites to deliver a full suite of enamelled wires. Known for pioneering ultra‑thin polyurethane enamels, the company leads in high‑speed motor and aerospace applications. Its strong R&D collaboration with universities drives continuous material advances. European production ensures compliance with stringent environmental and quality standards, making it the go‑to supplier for regional OEMs. Strategic expansions into Asia and North America support global account growth.

4. Sumitomo Electric Industries

Sumitomo Electric is a diversified Japanese conglomerate with a formidable magnet wire division. Its proprietary heat‑resistant enamels and nickel‑coated copper wires address extreme automotive and industrial environments. Leveraging upstream copper refining and polymer development, Sumitomo achieves tight process control and uniform coatings. The company’s global footprint—including facilities in China, Thailand, and the U.S.—supports key automotive customers transitioning to EVs. Continuous capacity investments underscore its commitment to meeting surging demand.

5. Jiangsu Tongfeng Wire & Cable

Jiangsu Tongfeng is one of China’s top magnet wire exporters, serving domestic and international markets. Its low‑cost production, combined with incremental quality improvements, has attracted appliance and motor manufacturers globally. The company has upgraded its enamel lines to accommodate more sophisticated polyester and polyimide coatings. Rapid scale‑up of new plants in eastern China supports its aggressive export strategy. Tongfeng’s ability to meet both high‑volume and custom orders has strengthened its competitive position.

6. KEI Industries

KEI Industries is India’s preeminent magnet wire manufacturer, supplying automotive, transformer, and appliance sectors. Its integrated copper drawing and enamel coating facilities ensure tight quality control. KEI has recently introduced eco‑friendly varnish systems to reduce VOC emissions. A strong presence in the domestic market and growing export volumes to the Middle East and Africa underscore its strategic growth. With plans to expand capacity and upgrade to higher‑temperature enamel grades, KEI is well positioned for further market share gains.

7. LS Cable & System

LS Cable & System is South Korea’s leading wire producer, offering enamelled copper and aluminum wire alongside power and telecommunication cables. Its proprietary enamel technologies deliver high mechanical strength and thermal endurance for precision applications in robotics and HVAC compressors. The company’s extensive R&D capabilities drive frequent product launches. Global manufacturing sites in Asia, Europe, and North America support multinational customers, making LS Cable & System a top global contender.

8. Suncon GmbH

Suncon GmbH, based in Germany, specializes in high‑performance enamelled wires for railway traction and wind turbine generators. Its focus on thick‑film epoxy and polyimide coatings meets the demanding thermal cycles of large synchronous machines. Suncon’s collaboration with leading turbine OEMs and rail integrators has anchored its market share in Europe. Recent investments in digital production lines have enhanced yield and traceability, reinforcing its competitive edge in specialized segments.

9. Furukawa Electric Co.

Furukawa Electric is a major Japanese supplier of magnet wire, leveraging its expertise in polymer chemistry to develop advanced enamel materials. Its ultra‑thin, high‑strength enamel enables compact motor designs in automotive and consumer electronics. A global manufacturing footprint—including Southeast Asia and North America—supports key OEMs. Strategic alliances with motor designers accelerate product customization. Furukawa’s balanced focus on innovation and cost control sustains its solid market position.

10. Polycab Wires Pvt Ltd

Polycab is an emerging Indian magnet wire producer, building on its strong domestic presence in power cables. Investments in dedicated enamel lines and quality‑assurance labs have enabled it to enter the transformer and motor wire markets. Competitive pricing and robust distribution through existing cable networks underpin its rapid growth. Polycab’s move into higher‑end enamel grades for industrial motors signals its ambition to challenge established players both domestically and in export markets.

The report provides a detailed analysis of the Enameled Wire (Magnet Wire) market across various regions, highlighting the unique market dynamics and growth opportunities in each region.

- US

- Canada

- Mexico

- UK

- Germany

- France

- Italy

- Russia

- Spain

- Switzerland

- Austria

- Belgium

- Rest of Europe

- China

- Japan

- South Korea

- Indonesia

- Vietnam

- Philippines

- Australia

- Thailand

- Singapore

- Rest of APAC

- UAE

- Saudi Arabia

- Egypt

- South Africa

- Israel

- Rest of MEA

- Brazil

- Argentina

- Rest of Latin America

>>> Need A Different Region Or Segment? Download PDF Sample

Key Takeaways

- The global Enameled Wire (Magnet Wire) market is expected to grow significantly from 2024 to 2032, driven by technological advancements, increasing demand, and government investments in urbanization.

- The market is characterized by a diverse range of manufacturers, product types, and applications, catering to different consumer needs and preferences.

- Regional insights highlight the unique market dynamics and growth opportunities in various regions, including North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

- The competitive landscape features key players who have created a dynamic and diverse market environment through collaborations, mergers and acquisitions, and innovative product developments.

- Market trends such as technological advancements, sustainability, customization, and digital transformation are shaping the growth and development of the Enameled Wire (Magnet Wire) market.

- Despite the positive outlook, the market faces challenges such as regulatory compliance, high initial investment costs, and economic uncertainties.

- The report provides comprehensive coverage of market size, market share, growth factors, and strategic insights to help businesses navigate the dynamic Enameled Wire (Magnet Wire) market and achieve long-term success.

By leveraging the information provided in this report, businesses can develop effective strategies, address market challenges, and capitalize on growth opportunities to ensure sustainable growth and long-term success in the global Enameled Wire (Magnet Wire) market.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Currency

- Key Target Audience

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Restraints

- Opportunities

- Challenges

- Global Enameled Wire (Magnet Wire) Market Analysis and Projection, By Companies

- Segment Overview

- Superior Essex

- Tongling Jingda Special

- Rea Magnet Wire

- Sumitomo Electric

- Citychamp Dartong

- Elektrisola

- Fujikura

- Hitachi Metals

- Liljedahl Group

- LS Cable & System

- APWC

- IRCE

- TAI-I

- Jung Shing

- ZML Industries

- MWS Wire

- Shanghai Yuke

- SWCC

- Roshow Technology

- Magnekon

- Condumex

- Tongling Copper Crown Electrical

- Huayu Electromagnetism Line

- Jintian New Material

- Hongyuan Magnet Wire

- Ronsen Super Micro-Wire

- Shanghai Shenmao Magnet Wire

- Tianjin Jing Wei Electric Wire

- Global Enameled Wire (Magnet Wire) Market Analysis and Projection, By Type

- Segment Overview

- Copper Magnet Wire

- Aluminum Magnet Wire

- Global Enameled Wire (Magnet Wire) Market Analysis and Projection, By Application

- Segment Overview

- Motors

- Generators

- Transformers

- Inductors

- Speakers

- Other Applications

- Global Enameled Wire (Magnet Wire) Market Analysis and Projection, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Russia

- Spain

- Switzerland

- Austria

- Belgium

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Vietnam

- Philippines

- Australia

- Thailand

- Singapore

- Rest of APAC

- Middle East

- UAE

- Saudi Arabia

- Egypt

- South Africa

- Israel

- Rest of MEA

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Global Enameled Wire (Magnet Wire) Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Enameled Wire (Magnet Wire) Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Coverage Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Superior Essex

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Tongling Jingda Special

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Rea Magnet Wire

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Sumitomo Electric

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Citychamp Dartong

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Elektrisola

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Fujikura

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Hitachi Metals

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Liljedahl Group

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- LS Cable & System

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- APWC

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- IRCE

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- TAI-I

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Jung Shing

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- ZML Industries

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- MWS Wire

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Shanghai Yuke

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- SWCC

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Roshow Technology

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Magnekon

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Condumex

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Tongling Copper Crown Electrical

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Huayu Electromagnetism Line

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Jintian New Material

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Hongyuan Magnet Wire

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Ronsen Super Micro-Wire

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Shanghai Shenmao Magnet Wire

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Tianjin Jing Wei Electric Wire

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

List of Table

- Drivers of Global Enameled Wire (Magnet Wire) Market: Impact Analysis

- Restraints of Global Enameled Wire (Magnet Wire) Market: Impact Analysis

- Global Enameled Wire (Magnet Wire) Market, By Technology, 2023-2032(USD Billion)

- global Copper Magnet Wire, Enameled Wire (Magnet Wire) Market, By Region, 2023-2032(USD Billion)

- global Aluminum Magnet Wire, Enameled Wire (Magnet Wire) Market, By Region, 2023-2032(USD Billion)

- global Motors, Enameled Wire (Magnet Wire) Market, By Region, 2023-2032(USD Billion)

- global Generators, Enameled Wire (Magnet Wire) Market, By Region, 2023-2032(USD Billion)

- global Transformers, Enameled Wire (Magnet Wire) Market, By Region, 2023-2032(USD Billion)

- global Inductors, Enameled Wire (Magnet Wire) Market, By Region, 2023-2032(USD Billion)

- global Speakers, Enameled Wire (Magnet Wire) Market, By Region, 2023-2032(USD Billion)

- global Other Applications, Enameled Wire (Magnet Wire) Market, By Region, 2023-2032(USD Billion)

List of Figures

- Global Enameled Wire (Magnet Wire) Market Segmentation

- Enameled Wire (Magnet Wire) Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top investment pocket in the Enameled Wire (Magnet Wire) Market

- Top Winning Strategies, 2023-2032

- Top Winning Strategies, By Development, 2023-2032(%)

- Top Winning Strategies, By Company, 2023-2032

- Moderate Bargaining power of Buyers

- Moderate Bargaining power of Suppliers

- Moderate Bargaining power of New Entrants

- Low threat of Substitution

- High Competitive Rivalry

- Restraint and Drivers: Enameled Wire (Magnet Wire) Market

- Enameled Wire (Magnet Wire) Market Segmentation, By Technology

- Enameled Wire (Magnet Wire) Market For Live Attenuated, By Region, 2023-2033 ($ Billion)

- Global Enameled Wire (Magnet Wire) Market, By Technology, 2023-2032(USD Billion)

- global Copper Magnet Wire, Enameled Wire (Magnet Wire) Market, By Region, 2023-2032(USD Billion)

- global Aluminum Magnet Wire, Enameled Wire (Magnet Wire) Market, By Region, 2023-2032(USD Billion)

- global Motors, Enameled Wire (Magnet Wire) Market, By Region, 2023-2032(USD Billion)

- global Generators, Enameled Wire (Magnet Wire) Market, By Region, 2023-2032(USD Billion)

- global Transformers, Enameled Wire (Magnet Wire) Market, By Region, 2023-2032(USD Billion)

- global Inductors, Enameled Wire (Magnet Wire) Market, By Region, 2023-2032(USD Billion)

- global Speakers, Enameled Wire (Magnet Wire) Market, By Region, 2023-2032(USD Billion)

- global Other Applications, Enameled Wire (Magnet Wire) Market, By Region, 2023-2032(USD Billion)

- Superior Essex: Net Sales, 2023-2033 ($ Billion)

- Superior Essex: Revenue Share, By Segment, 2023 (%)

- Superior Essex: Revenue Share, By Region, 2023 (%)

- Tongling Jingda Special: Net Sales, 2023-2033 ($ Billion)

- Tongling Jingda Special: Revenue Share, By Segment, 2023 (%)

- Tongling Jingda Special: Revenue Share, By Region, 2023 (%)

- Rea Magnet Wire: Net Sales, 2023-2033 ($ Billion)

- Rea Magnet Wire: Revenue Share, By Segment, 2023 (%)

- Rea Magnet Wire: Revenue Share, By Region, 2023 (%)

- Sumitomo Electric: Net Sales, 2023-2033 ($ Billion)

- Sumitomo Electric: Revenue Share, By Segment, 2023 (%)

- Sumitomo Electric: Revenue Share, By Region, 2023 (%)

- Citychamp Dartong: Net Sales, 2023-2033 ($ Billion)

- Citychamp Dartong: Revenue Share, By Segment, 2023 (%)

- Citychamp Dartong: Revenue Share, By Region, 2023 (%)

- Elektrisola: Net Sales, 2023-2033 ($ Billion)

- Elektrisola: Revenue Share, By Segment, 2023 (%)

- Elektrisola: Revenue Share, By Region, 2023 (%)

- Fujikura: Net Sales, 2023-2033 ($ Billion)

- Fujikura: Revenue Share, By Segment, 2023 (%)

- Fujikura: Revenue Share, By Region, 2023 (%)

- Hitachi Metals: Net Sales, 2023-2033 ($ Billion)

- Hitachi Metals: Revenue Share, By Segment, 2023 (%)

- Hitachi Metals: Revenue Share, By Region, 2023 (%)

- Liljedahl Group: Net Sales, 2023-2033 ($ Billion)

- Liljedahl Group: Revenue Share, By Segment, 2023 (%)

- Liljedahl Group: Revenue Share, By Region, 2023 (%)

- LS Cable & System: Net Sales, 2023-2033 ($ Billion)

- LS Cable & System: Revenue Share, By Segment, 2023 (%)

- LS Cable & System: Revenue Share, By Region, 2023 (%)

- APWC: Net Sales, 2023-2033 ($ Billion)

- APWC: Revenue Share, By Segment, 2023 (%)

- APWC: Revenue Share, By Region, 2023 (%)

- IRCE: Net Sales, 2023-2033 ($ Billion)

- IRCE: Revenue Share, By Segment, 2023 (%)

- IRCE: Revenue Share, By Region, 2023 (%)

- TAI-I: Net Sales, 2023-2033 ($ Billion)

- TAI-I: Revenue Share, By Segment, 2023 (%)

- TAI-I: Revenue Share, By Region, 2023 (%)

- Jung Shing: Net Sales, 2023-2033 ($ Billion)

- Jung Shing: Revenue Share, By Segment, 2023 (%)

- Jung Shing: Revenue Share, By Region, 2023 (%)

- ZML Industries: Net Sales, 2023-2033 ($ Billion)

- ZML Industries: Revenue Share, By Segment, 2023 (%)

- ZML Industries: Revenue Share, By Region, 2023 (%)

- MWS Wire: Net Sales, 2023-2033 ($ Billion)

- MWS Wire: Revenue Share, By Segment, 2023 (%)

- MWS Wire: Revenue Share, By Region, 2023 (%)

- Shanghai Yuke: Net Sales, 2023-2033 ($ Billion)

- Shanghai Yuke: Revenue Share, By Segment, 2023 (%)

- Shanghai Yuke: Revenue Share, By Region, 2023 (%)

- SWCC: Net Sales, 2023-2033 ($ Billion)

- SWCC: Revenue Share, By Segment, 2023 (%)

- SWCC: Revenue Share, By Region, 2023 (%)

- Roshow Technology: Net Sales, 2023-2033 ($ Billion)

- Roshow Technology: Revenue Share, By Segment, 2023 (%)

- Roshow Technology: Revenue Share, By Region, 2023 (%)

- Magnekon: Net Sales, 2023-2033 ($ Billion)

- Magnekon: Revenue Share, By Segment, 2023 (%)

- Magnekon: Revenue Share, By Region, 2023 (%)

- Condumex: Net Sales, 2023-2033 ($ Billion)

- Condumex: Revenue Share, By Segment, 2023 (%)

- Condumex: Revenue Share, By Region, 2023 (%)

- Tongling Copper Crown Electrical: Net Sales, 2023-2033 ($ Billion)

- Tongling Copper Crown Electrical: Revenue Share, By Segment, 2023 (%)

- Tongling Copper Crown Electrical: Revenue Share, By Region, 2023 (%)

- Huayu Electromagnetism Line: Net Sales, 2023-2033 ($ Billion)

- Huayu Electromagnetism Line: Revenue Share, By Segment, 2023 (%)

- Huayu Electromagnetism Line: Revenue Share, By Region, 2023 (%)

- Jintian New Material: Net Sales, 2023-2033 ($ Billion)

- Jintian New Material: Revenue Share, By Segment, 2023 (%)

- Jintian New Material: Revenue Share, By Region, 2023 (%)

- Hongyuan Magnet Wire: Net Sales, 2023-2033 ($ Billion)

- Hongyuan Magnet Wire: Revenue Share, By Segment, 2023 (%)

- Hongyuan Magnet Wire: Revenue Share, By Region, 2023 (%)

- Ronsen Super Micro-Wire: Net Sales, 2023-2033 ($ Billion)

- Ronsen Super Micro-Wire: Revenue Share, By Segment, 2023 (%)

- Ronsen Super Micro-Wire: Revenue Share, By Region, 2023 (%)

- Shanghai Shenmao Magnet Wire: Net Sales, 2023-2033 ($ Billion)

- Shanghai Shenmao Magnet Wire: Revenue Share, By Segment, 2023 (%)

- Shanghai Shenmao Magnet Wire: Revenue Share, By Region, 2023 (%)

- Tianjin Jing Wei Electric Wire: Net Sales, 2023-2033 ($ Billion)

- Tianjin Jing Wei Electric Wire: Revenue Share, By Segment, 2023 (%)

- Tianjin Jing Wei Electric Wire: Revenue Share, By Region, 2023 (%)

Infinitive Data Research provides comprehensive market research, offering in-depth market analysis to help companies understand their target market and industry competition. This research predicts the market acceptance of your brand and products, ensuring informed decision-making for business success.

Competitor Analysis in the Enameled Wire (Magnet Wire) Industry

Conducting a competitor analysis involves identifying competitors within the Enameled Wire (Magnet Wire) industry and studying their various marketing strategies. This comparative data allows you to assess your company's strengths and weaknesses relative to competitors, providing insights to enhance your market position.

Importance of Continuous Market Research

Consistently conducting market research is essential for minimizing risk at every stage of business operations. Enameled Wire (Magnet Wire) market research enables you to collect qualitative and quantitative data, which, when properly analyzed, leads to wise decisions that align with user and customer needs. Below are some crucial lessons learned through the Enameled Wire (Magnet Wire) market research process:

Key Dimensions of Enameled Wire (Magnet Wire) Market Analysis

- Trend and Pattern Identification: Analyzing data to spot market trends and patterns.

- Pricing Analysis: Assessing keyword pricing strategies.

- Actionable Insights: Implementing insights derived from data analysis.

- Market Potential: Evaluating the potential of the Enameled Wire (Magnet Wire) market.

- Competitor Analysis: Studying competitors' strategies and performance.

- Location Analysis: Assessing optimal locations for market penetration.

- Distribution Channels Analysis: Evaluating the effectiveness of distribution channels.

- Market Size and Growth Rate: Measuring market size and growth potential.

- Market Profitability: Assessing profitability prospects.

- Key Success Factors: Identifying critical factors for success.

- Cost Structure: Understanding the cost structure within the Enameled Wire (Magnet Wire) industry.

Target Audience for the Report

This report is valuable for a diverse audience, including:

- Enameled Wire (Magnet Wire) Market Manufacturers: To understand market dynamics and enhance production strategies.

- Investors and Financing Companies: To assess investment opportunities and risks.

- Enameled Wire (Magnet Wire) Market Suppliers: To identify market demands and supply chain efficiencies.

Necessity of the Report

Making Crucial Business Decisions

Understanding the Enameled Wire (Magnet Wire) market, competition, and industry landscape is vital for making informed business decisions. Without current and relevant market research, decisions may be based on outdated or irrelevant information, potentially harming the business.

Securing Investment Funds

Attracting investors requires demonstrating thorough market research. Investors need assurance that you understand the sector, current and potential competition, and whether your idea addresses a market need.

Identifying New Business Opportunities

Enameled Wire (Magnet Wire) market research goes beyond understanding trends and consumer behavior. It identifies new revenue streams and opportunities for business pivots. These insights can lead to strategic changes in the business model, promoting growth and adapting to market challenges.

Avoiding Business Failures

Market research also plays a crucial role in risk mitigation. It can reveal when not to pursue certain actions, saving the company from potential losses in revenue, brand image, and more. This proactive approach is often overlooked but is essential for long-term success.

Conclusion

Infinitive Data Research's comprehensive Enameled Wire (Magnet Wire) market research provides critical insights for making solid business decisions, securing investments, identifying new opportunities, and avoiding potential failures. Understanding market dynamics through continuous research ensures your company remains competitive and thrives in the Enameled Wire (Magnet Wire) industry.