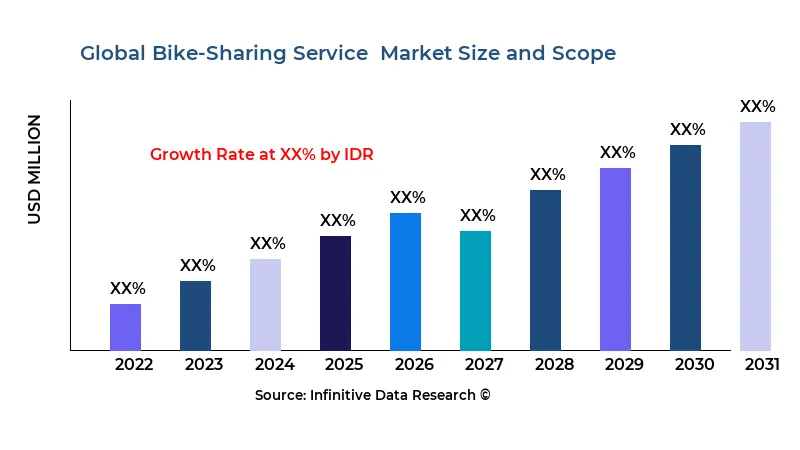

Bike-Sharing Service Market Growth CAGR Overview

According to research by Infinitive Data Research, the global Bike-Sharing Service Market size was valued at USD 4.8 Bln (billion) in 2024 and is Calculated to reach USD 8.4 Bln (billion) by the end of 2032, growing at an anticipated compound annual growth rate (CAGR) of 13.3% during the forecast period 2024 to 2032. This projected growth is driven by its increasing adoption across Software & Services industries such as Age 18-24, Age 25-34, Age 35-44, OthersThe dynamics of the bike‐sharing service market are driven by a rapidly changing urban environment and a growing focus on reducing carbon emissions. As urban populations continue to expand and congestion worsens in major cities, municipalities are increasingly turning to bike‐sharing as a viable alternative to private vehicle ownership. This shift has led to significant investments by both public and private sectors in cycling infrastructure and technology integration. Moreover, consumer preferences are changing as riders seek flexible, health‐conscious, and cost‐effective transport solutions, prompting service providers to adopt innovative models that blend technology with sustainability.

Another key aspect of the market dynamics is the evolution of digital platforms that integrate real‐time tracking, easy payment options, and user-friendly mobile apps. This technological evolution has transformed the experience for both operators and users, ensuring that service quality remains high and operational efficiencies are continuously enhanced. In parallel, urban planning initiatives and environmental regulations have collectively spurred a more robust bike‐sharing ecosystem, fostering a competitive environment where differentiation is achieved through innovation and customer service.

The role of government policy and local regulations cannot be understated as they have a profound impact on the deployment and management of bike‐sharing networks. Several cities have introduced incentives to promote cycling, including subsidies for bike infrastructure and dedicated cycling lanes. These initiatives have helped mitigate some of the challenges faced by the industry, such as vandalism, theft, and operational inefficiencies. As a result, market operators are often in a constant state of adaptation, recalibrating their strategies to stay aligned with evolving legal and infrastructural landscapes.

Finally, the interplay between public sentiment and environmental sustainability has created a market where community support plays a pivotal role. Increasing awareness about the benefits of reducing urban pollution and congestion has led to a wider acceptance of bike‐sharing services. This social endorsement, combined with improvements in technology and operational models, reinforces the market’s long‐term potential and offers a pathway for continuous growth and transformation.

>>> Understand The Key Trends Shaping This Market:- Download PDF Sample

Bike Sharing Service Market Growth Factors

Several factors are contributing to the robust growth of the bike‐sharing service market. One major factor is the rapid pace of urbanization, which has led to an increased need for alternative transportation solutions that alleviate congestion and reduce pollution. As cities invest more heavily in cycling infrastructure and connectivity, consumers are more inclined to adopt bike‐sharing options, thereby driving demand for these services. This trend is further amplified by growing environmental concerns and the push for sustainable urban mobility solutions that reduce the overall carbon footprint of transportation systems.

Another significant growth driver is the evolution of digital and mobile technologies that have made bike‐sharing services more accessible and user friendly. The integration of smart technologies, such as GPS tracking, real‐time availability updates, and secure payment gateways, has not only enhanced the user experience but also streamlined the operations of bike‐sharing companies. These technological advances contribute to higher user satisfaction and retention rates, which in turn fuel market growth. Moreover, the increased penetration of smartphones across diverse demographic segments ensures that a larger audience can easily engage with these services.

Investment in eco‐friendly transportation solutions by both private players and government agencies also acts as a key growth catalyst. In many urban centers, public–private partnerships are forming to expand bike‐sharing networks, thereby ensuring that infrastructure and financial support are readily available. This strategic collaboration helps in lowering the barrier to entry for new operators while also driving competition and innovation within the sector. Consequently, increased market penetration is observed not only in well‐developed urban areas but also in emerging cities, which contributes significantly to the overall growth trajectory.

Furthermore, the growing consumer awareness around health and fitness has played an influential role in accelerating market growth. As more individuals look for ways to incorporate physical activity into their daily commute, the appeal of bike‐sharing services continues to rise. This shift in consumer behavior is bolstered by rising disposable incomes and an increasing inclination toward active lifestyles. The convergence of health, economic, and environmental benefits makes bike‐sharing an attractive proposition, ensuring that the market remains dynamic and poised for continued expansion.

Market Analysis By Competitors

- JUMP Bikes

- Citi Bike

- LimeBike

- Capital Bikeshare

- Divvy Bikes

- Blue Bikes (Hubway)

- Ford GoBike

- Mobike

- Hellobike

- Nextbike

- Call a bike

- Santander Cycles

- V�lib

- Bicing

- SG Bike

- Ola Pedal

- Zoomcar PEDL

- Mobycy

- Yulu Bikes

- Letscycle

- Docomo Bikeshare

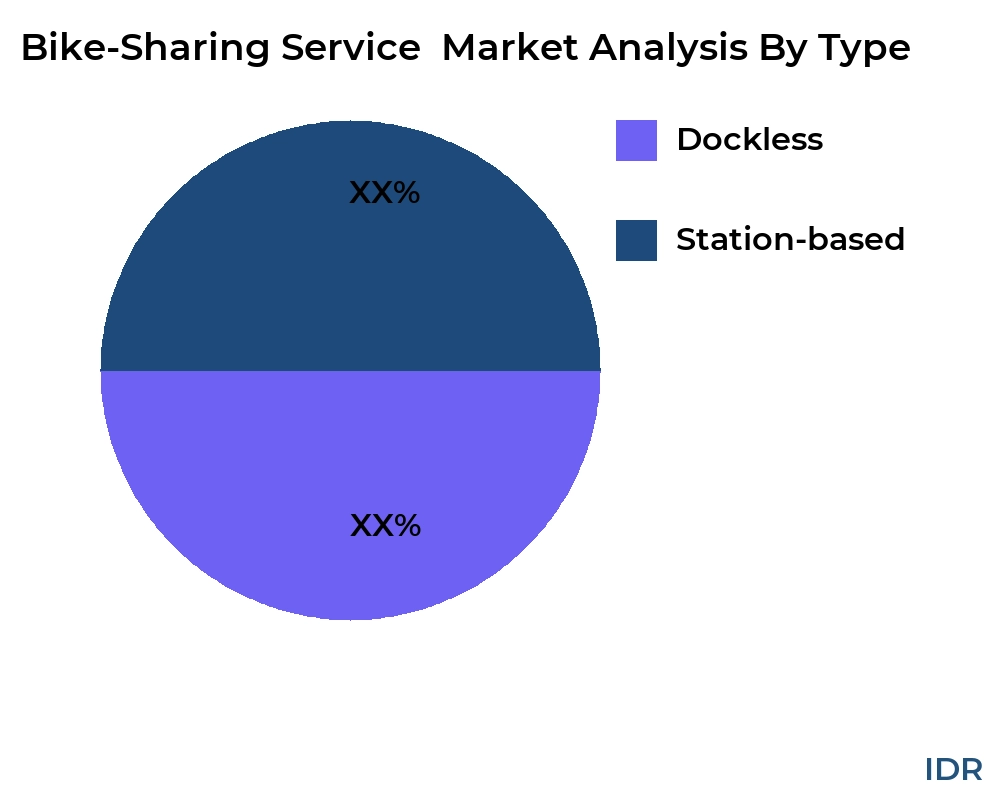

By Product Type

- Dockless

- Station-based

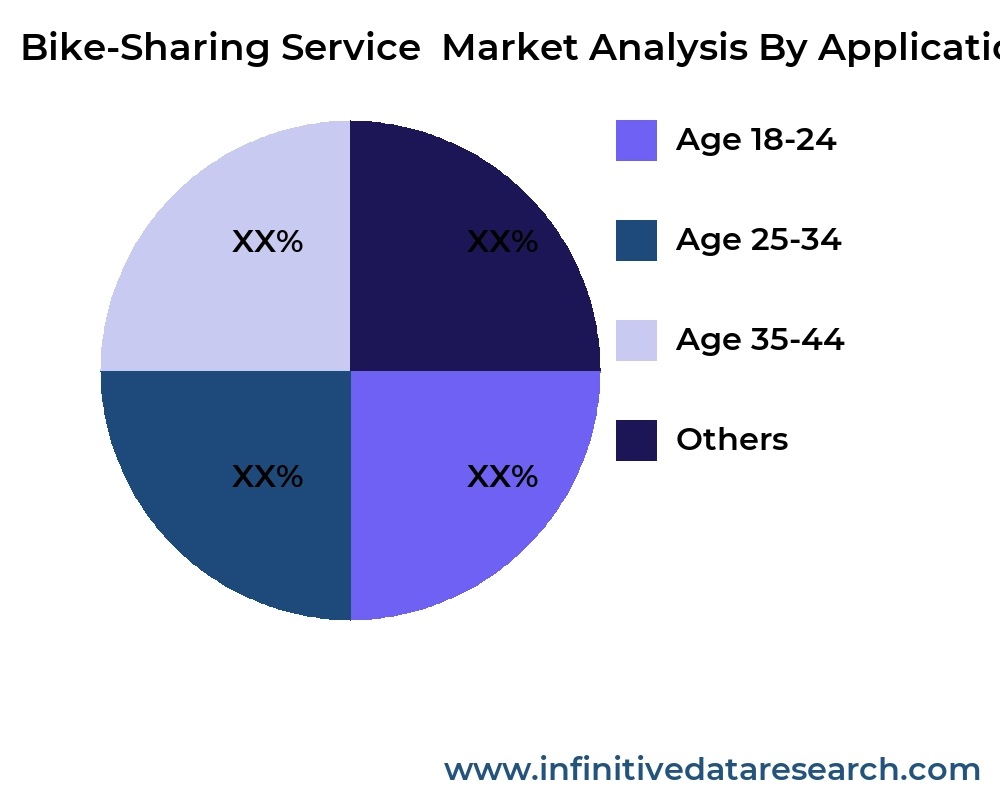

By Application

- Age 18-24

- Age 25-34

- Age 35-44

- Others

>>> Understand The Key Trends Shaping This Market:- Understand The Key Trends Shaping This Market:-

Bike Sharing Service Market Segment Analysis

Distribution Channel:

Distribution channels in the bike‐sharing market are evolving rapidly with a strong emphasis on digital platforms. Online portals and mobile applications have become the primary means through which customers access services, reserve bikes, and make payments. Traditional kiosks and physical rental points still hold value in certain markets, especially where digital penetration is moderate. However, the seamless integration of data analytics and location‐based services in app interfaces is transforming customer interactions and enabling operators to optimize fleet distribution and maintenance schedules. This shift is creating a more efficient and user‐friendly ecosystem that directly influences the growth of the market.

Compatibility:

The bike fleet within the bike‐sharing service market is increasingly diversified to cater to different consumer needs. Operators now offer a blend of conventional pedal bikes, electric bikes, and even specialized cargo bikes, ensuring that the service is accessible to a wide range of users. This versatility not only broadens the target demographic but also supports diverse urban terrains and commuting patterns. The integration of various bike types within a single network also requires sophisticated software solutions to manage compatibility between different models and maintenance needs, thereby driving technological innovation and operational efficiency in the market.

Price Range:

Price segmentation within the bike‐sharing market reflects the varied economic profiles of its user base. Service providers typically offer multiple pricing models, ranging from pay‐per‐ride options to monthly or annual subscription plans. This flexibility in pricing ensures that the service remains accessible to both occasional users and regular commuters. Premium pricing options often include additional features such as enhanced bike quality, priority access, and integrated safety features, which appeal to a more affluent segment. Meanwhile, competitive pricing in lower tiers encourages mass adoption, making bike‐sharing a universally appealing mode of urban transport.

Product Type:

Product types in the bike‐sharing market have expanded significantly in recent years, with companies offering not only traditional pedal bikes but also electric and specialized utility bikes. Each product type is designed to meet specific user requirements, ranging from short urban commutes to longer, more challenging rides in diverse topographies. Electric bikes, in particular, have seen a surge in demand due to their ease of use and ability to tackle longer distances with minimal effort. The broad range of product types available enhances the market’s flexibility and positions bike‐sharing as a multifaceted solution to urban mobility challenges.

| REPORT ATTRIBUTES | DETAILS |

|---|---|

| Study Period |

2019-2032 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Historical Period |

2019-2022 |

| Unit |

Value (USD Billion) |

| Key Companies Profiled |

JUMP Bikes, Citi Bike, LimeBike, Capital Bikeshare, Divvy Bikes, Blue Bikes (Hubway), Ford GoBike, Mobike, Hellobike, Nextbike, Call a bike, Santander Cycles, V�lib, Bicing, SG Bike, Ola Pedal, Zoomcar PEDL, Mobycy, Yulu Bikes, Letscycle, Docomo Bikeshare |

| Segments Covered |

By Product |

| Customization Scope |

Free report customization (equivalent to up to 3 analyst working days) with purchase. Addition or alteration to country, regional and segment scope |

>>> Overview of Market Analysis:- Download PDF Sample

Bike Sharing Service Market Regional Analysis

In North America, the bike‐sharing market is witnessing robust growth driven by an increasing focus on sustainable transportation and heavy investments in smart city infrastructure. Urban centers are aggressively promoting eco‐friendly commuting alternatives to reduce congestion and pollution. Major metropolitan areas have implemented supportive policies, and the presence of established bike‐sharing networks has paved the way for new entrants to capture market share. The regional market is characterized by technological advancements and collaborations between municipal authorities and private operators, which further enhance service quality and accessibility.

Europe continues to be a forerunner in embracing bike‐sharing services, owing largely to mature cycling cultures and comprehensive urban planning. European cities have long recognized the benefits of cycling for both health and environmental reasons, resulting in widespread adoption of bike‐sharing systems. Extensive cycling networks, government subsidies, and rigorous safety standards have contributed to an environment where innovation thrives. This steady evolution has encouraged traditional transport operators to integrate bike‐sharing options into their service portfolios, reinforcing the market’s long‐term potential.

Asia‐Pacific represents one of the fastest‐growing regions in the bike‐sharing service market. Rapid urbanization, coupled with a rising middle class and technological readiness, has created a fertile ground for bike‐sharing initiatives. Cities in China, India, and Southeast Asia are witnessing significant expansions in their bike fleets, driven by both public policy and private investment. The region’s growth is further bolstered by innovative mobile applications and digital payment systems that cater to a tech‐savvy population, making bike‐sharing a convenient and efficient mode of transportation.

Latin America and the Middle East are emerging as promising markets for bike‐sharing services as well. In these regions, efforts to modernize urban transportation are increasingly incorporating eco‐friendly solutions. Strategic partnerships between local governments and international firms have enabled the establishment of bike‐sharing networks in major cities, promoting a healthier and more sustainable lifestyle. Despite certain infrastructural challenges, continuous improvements in technology and increased consumer interest are paving the way for steady market expansion and increased penetration in these areas.

global Bike-Sharing Service market revenue (usd million) comparison by players 2024-2032

| Company/players | 2021 | 2022 | 2023 | 2024 | ... | (2032) |

|---|---|---|---|---|---|---|

| JUMP Bikes | XX | XX | XX | XX | XX | XX |

| Citi Bike | XX | XX | XX | XX | XX | XX |

| LimeBike | XX | XX | XX | XX | XX | XX |

| Capital Bikeshare | XX | XX | XX | XX | XX | XX |

| Divvy Bikes | XX | XX | XX | XX | XX | XX |

| Blue Bikes (Hubway) | XX | XX | XX | XX | XX | XX |

| Ford GoBike | XX | XX | XX | XX | XX | XX |

| Mobike | XX | XX | XX | XX | XX | XX |

| Hellobike | XX | XX | XX | XX | XX | XX |

| Nextbike | XX | XX | XX | XX | XX | XX |

| Call a bike | XX | XX | XX | XX | XX | XX |

| Santander Cycles | XX | XX | XX | XX | XX | XX |

| V�lib | XX | XX | XX | XX | XX | XX |

| Bicing | XX | XX | XX | XX | XX | XX |

| SG Bike | XX | XX | XX | XX | XX | XX |

| Ola Pedal | XX | XX | XX | XX | XX | XX |

| Zoomcar PEDL | XX | XX | XX | XX | XX | XX |

| Mobycy | XX | XX | XX | XX | XX | XX |

| Yulu Bikes | XX | XX | XX | XX | XX | XX |

| Letscycle | XX | XX | XX | XX | XX | XX |

| Docomo Bikeshare | XX | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX | XX |

global Bike-Sharing Service market revenue (usd million) comparison by product type 2024-2032

Product Type

2023

2024

...

2032

CAGR%(2024-32)

Dockless

XX

XX

XX

XX

XX

Station-based

XX

XX

XX

XX

XX

Total

XX

XX

XX

XX

XX

| Product Type | 2023 | 2024 | ... | 2032 | CAGR%(2024-32) |

|---|---|---|---|---|---|

| Dockless | XX | XX | XX | XX | XX |

| Station-based | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX |

global Bike-Sharing Service market revenue (usd million) comparison by application 2024-2032

Application

2023

2024

...

2032

CAGR%(2024-32)

Age 18-24

XX

XX

XX

XX

XX

Age 25-34

XX

XX

XX

XX

XX

Age 35-44

XX

XX

XX

XX

XX

Others

XX

XX

XX

XX

XX

Total

XX

XX

XX

XX

XX

| Application | 2023 | 2024 | ... | 2032 | CAGR%(2024-32) |

|---|---|---|---|---|---|

| Age 18-24 | XX | XX | XX | XX | XX |

| Age 25-34 | XX | XX | XX | XX | XX |

| Age 35-44 | XX | XX | XX | XX | XX |

| Others | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX |

>>> Market Understand Through Graph And Chart:- Download PDF Sample

Bike Sharing Service Market Competitive Insights

The competitive landscape in the bike‐sharing market is highly dynamic, with a mix of established players and innovative startups vying for market share. Key players are investing heavily in technological enhancements, fleet expansion, and customer service improvements to differentiate themselves in an increasingly crowded market. This intense competition is fostering rapid innovation, as companies strive to offer seamless, efficient, and eco‐friendly transport solutions. Moreover, strategic collaborations and mergers are not uncommon as firms seek to combine resources and expertise to scale their operations and enhance service coverage.

Innovation remains a central pillar of competition in this market. Operators are continuously refining their digital interfaces, leveraging big data and IoT solutions to optimize routes, manage fleet availability, and ensure rapid maintenance responses. This technological drive not only improves operational efficiency but also enriches the user experience, thereby attracting and retaining a diverse customer base. As a result, companies that can balance technological innovation with robust customer service are likely to dominate the competitive landscape in the coming years.

Market players are also placing a significant emphasis on geographical expansion to tap into emerging urban centers. By tailoring their offerings to suit local needs—whether through localized pricing, bike models, or app features—firms are able to build strong regional presences and capture niche markets. This localized approach, combined with global operational expertise, has created a competitive environment where both large multinational corporations and agile startups are able to thrive. The resulting diversity in market offerings is pushing the industry towards higher standards of service and operational excellence.

Competitive pressures are further intensified by the need to address regulatory challenges and public safety concerns. Companies are continuously adapting to meet evolving local government mandates related to safety, accessibility, and environmental impact. This proactive approach to regulation not only builds trust with consumers but also ensures that operators remain compliant in various markets. In turn, this drives competitive differentiation as firms develop unique strategies to align their business models with stringent regulatory frameworks while still delivering superior service quality.

Bike Sharing Service Market Competitors

United States

• Citi Bike

• Jump Bikes

• Spin Mobility

• Motivate Inc.

• Ford GoBike

United Kingdom

• Santander Cycles

• Mobike UK

• Ofo UK

• Barclays Bikes

• NextBike UK

Germany

• Call a Bike (Deutsche Bahn)

• Nextbike Germany

• StadtRAD

• Mobike Germany

• Lime Germany

France

• Vélib’ Métropole

• Jump France

• Lime France

• City’Z

• Ofo France

China

• Mobike

• Ofo

• Hellobike

• DiDi Bike

• Youon Bike

India

• Yulu

• Rapido Cycle

• Vogo Cycle

• Bounce Bikes

• Yana Bike

Bike Sharing Service Market Top Competitors

Citi Bike stands out as one of the most established operators, having built a robust network in major U.S. cities and developed a reputation for reliability and consistent service quality. Its integration with local transit systems and strong public–private partnerships have enabled it to maintain a leading position in urban mobility.

Lime is recognized as an innovative force in the bike‐sharing arena, leveraging cutting‐edge technology and expansive geographic coverage. The company’s commitment to sustainability and smart city integration has cemented its status as a preferred choice for environmentally conscious urban commuters.

Jump Bikes has rapidly evolved from a startup to a competitive service provider by focusing on technological innovation and expanding its fleet to include both pedal and electric bikes. Its agile business model and strategic partnerships with larger mobility firms have allowed it to capture significant market share in key urban areas.

Mobike has revolutionized the bike‐sharing industry with its extensive deployment in densely populated regions. With a strong focus on operational efficiency and user convenience, Mobike’s large-scale fleet and data‐driven approach to management have positioned it as a leader in emerging markets and advanced urban environments alike.

Ofo, despite facing various operational challenges, remains a notable competitor due to its early market entry and extensive network in Asia. Its focus on affordability and accessibility has allowed it to build a substantial user base, particularly in high‐density urban areas where cost efficiency is paramount.

Nextbike is known for its high service reliability and continuous technological upgrades. By integrating smart maintenance and real‐time fleet management, Nextbike has secured its reputation as a dependable provider that consistently meets the dynamic needs of urban commuters.

Spin has carved out a niche by concentrating on optimizing the user experience through robust digital platforms and innovative app features. Its targeted marketing strategies and continuous improvements in fleet management have contributed to steady growth and a loyal customer base.

Bluegogo has emerged as a competitive player by focusing on cost‐effective solutions and operational flexibility. Despite being a relatively new entrant, its commitment to service quality and rapid expansion plans have allowed it to gain traction in several urban centers.

Youon Bike distinguishes itself by tailoring its service offerings to regional preferences and local market demands. Its emphasis on customization and community engagement has helped build a strong brand identity in diverse urban settings, further solidifying its competitive stance.

Yulu has made significant inroads into the market by leveraging digital innovation and strategic urban partnerships. Focused on providing sustainable and health‐oriented transportation solutions, Yulu’s approach has resonated well with younger, tech‐savvy commuters, reinforcing its position as a market leader.

The report provides a detailed analysis of the Bike-Sharing Service market across various regions, highlighting the unique market dynamics and growth opportunities in each region.

- US

- Canada

- Mexico

- UK

- Germany

- France

- Italy

- Russia

- Spain

- Switzerland

- Austria

- Belgium

- Rest of Europe

- China

- Japan

- South Korea

- Indonesia

- Vietnam

- Philippines

- Australia

- Thailand

- Singapore

- Rest of APAC

- UAE

- Saudi Arabia

- Egypt

- South Africa

- Israel

- Rest of MEA

- Brazil

- Argentina

- Rest of Latin America

>>> Need A Different Region Or Segment? Download PDF Sample

Key Takeaways

- The global Bike-Sharing Service market is expected to grow significantly from 2024 to 2032, driven by technological advancements, increasing demand, and government investments in urbanization.

- The market is characterized by a diverse range of manufacturers, product types, and applications, catering to different consumer needs and preferences.

- Regional insights highlight the unique market dynamics and growth opportunities in various regions, including North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

- The competitive landscape features key players who have created a dynamic and diverse market environment through collaborations, mergers and acquisitions, and innovative product developments.

- Market trends such as technological advancements, sustainability, customization, and digital transformation are shaping the growth and development of the Bike-Sharing Service market.

- Despite the positive outlook, the market faces challenges such as regulatory compliance, high initial investment costs, and economic uncertainties.

- The report provides comprehensive coverage of market size, market share, growth factors, and strategic insights to help businesses navigate the dynamic Bike-Sharing Service market and achieve long-term success.

By leveraging the information provided in this report, businesses can develop effective strategies, address market challenges, and capitalize on growth opportunities to ensure sustainable growth and long-term success in the global Bike-Sharing Service market.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Currency

- Key Target Audience

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Restraints

- Opportunities

- Challenges

- Global Bike-Sharing Service Market Analysis and Projection, By Companies

- Segment Overview

- JUMP Bikes

- Citi Bike

- LimeBike

- Capital Bikeshare

- Divvy Bikes

- Blue Bikes (Hubway)

- Ford GoBike

- Mobike

- Hellobike

- Nextbike

- Call a bike

- Santander Cycles

- V�lib

- Bicing

- SG Bike

- Ola Pedal

- Zoomcar PEDL

- Mobycy

- Yulu Bikes

- Letscycle

- Docomo Bikeshare

- Global Bike-Sharing Service Market Analysis and Projection, By Type

- Segment Overview

- Dockless

- Station-based

- Global Bike-Sharing Service Market Analysis and Projection, By Application

- Segment Overview

- Age 18-24

- Age 25-34

- Age 35-44

- Others

- Global Bike-Sharing Service Market Analysis and Projection, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Russia

- Spain

- Switzerland

- Austria

- Belgium

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Vietnam

- Philippines

- Australia

- Thailand

- Singapore

- Rest of APAC

- Middle East

- UAE

- Saudi Arabia

- Egypt

- South Africa

- Israel

- Rest of MEA

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Global Bike-Sharing Service Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Bike-Sharing Service Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Coverage Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- JUMP Bikes

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Citi Bike

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- LimeBike

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Capital Bikeshare

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Divvy Bikes

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Blue Bikes (Hubway)

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Ford GoBike

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Mobike

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Hellobike

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Nextbike

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Call a bike

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Santander Cycles

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- V�lib

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Bicing

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- SG Bike

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Ola Pedal

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Zoomcar PEDL

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Mobycy

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Yulu Bikes

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Letscycle

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Docomo Bikeshare

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

List of Table

- Drivers of Global Bike-Sharing Service Market: Impact Analysis

- Restraints of Global Bike-Sharing Service Market: Impact Analysis

- Global Bike-Sharing Service Market, By Technology, 2023-2032(USD Billion)

- global Dockless, Bike-Sharing Service Market, By Region, 2023-2032(USD Billion)

- global Station-based, Bike-Sharing Service Market, By Region, 2023-2032(USD Billion)

- global Age 18-24, Bike-Sharing Service Market, By Region, 2023-2032(USD Billion)

- global Age 25-34, Bike-Sharing Service Market, By Region, 2023-2032(USD Billion)

- global Age 35-44, Bike-Sharing Service Market, By Region, 2023-2032(USD Billion)

- global Others, Bike-Sharing Service Market, By Region, 2023-2032(USD Billion)

List of Figures

- Global Bike-Sharing Service Market Segmentation

- Bike-Sharing Service Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top investment pocket in the Bike-Sharing Service Market

- Top Winning Strategies, 2023-2032

- Top Winning Strategies, By Development, 2023-2032(%)

- Top Winning Strategies, By Company, 2023-2032

- Moderate Bargaining power of Buyers

- Moderate Bargaining power of Suppliers

- Moderate Bargaining power of New Entrants

- Low threat of Substitution

- High Competitive Rivalry

- Restraint and Drivers: Bike-Sharing Service Market

- Bike-Sharing Service Market Segmentation, By Technology

- Bike-Sharing Service Market For Live Attenuated, By Region, 2023-2033 ($ Billion)

- Global Bike-Sharing Service Market, By Technology, 2023-2032(USD Billion)

- global Dockless, Bike-Sharing Service Market, By Region, 2023-2032(USD Billion)

- global Station-based, Bike-Sharing Service Market, By Region, 2023-2032(USD Billion)

- global Age 18-24, Bike-Sharing Service Market, By Region, 2023-2032(USD Billion)

- global Age 25-34, Bike-Sharing Service Market, By Region, 2023-2032(USD Billion)

- global Age 35-44, Bike-Sharing Service Market, By Region, 2023-2032(USD Billion)

- global Others, Bike-Sharing Service Market, By Region, 2023-2032(USD Billion)

- JUMP Bikes: Net Sales, 2023-2033 ($ Billion)

- JUMP Bikes: Revenue Share, By Segment, 2023 (%)

- JUMP Bikes: Revenue Share, By Region, 2023 (%)

- Citi Bike: Net Sales, 2023-2033 ($ Billion)

- Citi Bike: Revenue Share, By Segment, 2023 (%)

- Citi Bike: Revenue Share, By Region, 2023 (%)

- LimeBike: Net Sales, 2023-2033 ($ Billion)

- LimeBike: Revenue Share, By Segment, 2023 (%)

- LimeBike: Revenue Share, By Region, 2023 (%)

- Capital Bikeshare: Net Sales, 2023-2033 ($ Billion)

- Capital Bikeshare: Revenue Share, By Segment, 2023 (%)

- Capital Bikeshare: Revenue Share, By Region, 2023 (%)

- Divvy Bikes: Net Sales, 2023-2033 ($ Billion)

- Divvy Bikes: Revenue Share, By Segment, 2023 (%)

- Divvy Bikes: Revenue Share, By Region, 2023 (%)

- Blue Bikes (Hubway): Net Sales, 2023-2033 ($ Billion)

- Blue Bikes (Hubway): Revenue Share, By Segment, 2023 (%)

- Blue Bikes (Hubway): Revenue Share, By Region, 2023 (%)

- Ford GoBike: Net Sales, 2023-2033 ($ Billion)

- Ford GoBike: Revenue Share, By Segment, 2023 (%)

- Ford GoBike: Revenue Share, By Region, 2023 (%)

- Mobike: Net Sales, 2023-2033 ($ Billion)

- Mobike: Revenue Share, By Segment, 2023 (%)

- Mobike: Revenue Share, By Region, 2023 (%)

- Hellobike: Net Sales, 2023-2033 ($ Billion)

- Hellobike: Revenue Share, By Segment, 2023 (%)

- Hellobike: Revenue Share, By Region, 2023 (%)

- Nextbike: Net Sales, 2023-2033 ($ Billion)

- Nextbike: Revenue Share, By Segment, 2023 (%)

- Nextbike: Revenue Share, By Region, 2023 (%)

- Call a bike: Net Sales, 2023-2033 ($ Billion)

- Call a bike: Revenue Share, By Segment, 2023 (%)

- Call a bike: Revenue Share, By Region, 2023 (%)

- Santander Cycles: Net Sales, 2023-2033 ($ Billion)

- Santander Cycles: Revenue Share, By Segment, 2023 (%)

- Santander Cycles: Revenue Share, By Region, 2023 (%)

- V�lib: Net Sales, 2023-2033 ($ Billion)

- V�lib: Revenue Share, By Segment, 2023 (%)

- V�lib: Revenue Share, By Region, 2023 (%)

- Bicing: Net Sales, 2023-2033 ($ Billion)

- Bicing: Revenue Share, By Segment, 2023 (%)

- Bicing: Revenue Share, By Region, 2023 (%)

- SG Bike: Net Sales, 2023-2033 ($ Billion)

- SG Bike: Revenue Share, By Segment, 2023 (%)

- SG Bike: Revenue Share, By Region, 2023 (%)

- Ola Pedal: Net Sales, 2023-2033 ($ Billion)

- Ola Pedal: Revenue Share, By Segment, 2023 (%)

- Ola Pedal: Revenue Share, By Region, 2023 (%)

- Zoomcar PEDL: Net Sales, 2023-2033 ($ Billion)

- Zoomcar PEDL: Revenue Share, By Segment, 2023 (%)

- Zoomcar PEDL: Revenue Share, By Region, 2023 (%)

- Mobycy: Net Sales, 2023-2033 ($ Billion)

- Mobycy: Revenue Share, By Segment, 2023 (%)

- Mobycy: Revenue Share, By Region, 2023 (%)

- Yulu Bikes: Net Sales, 2023-2033 ($ Billion)

- Yulu Bikes: Revenue Share, By Segment, 2023 (%)

- Yulu Bikes: Revenue Share, By Region, 2023 (%)

- Letscycle: Net Sales, 2023-2033 ($ Billion)

- Letscycle: Revenue Share, By Segment, 2023 (%)

- Letscycle: Revenue Share, By Region, 2023 (%)

- Docomo Bikeshare: Net Sales, 2023-2033 ($ Billion)

- Docomo Bikeshare: Revenue Share, By Segment, 2023 (%)

- Docomo Bikeshare: Revenue Share, By Region, 2023 (%)

Infinitive Data Research provides comprehensive market research, offering in-depth market analysis to help companies understand their target market and industry competition. This research predicts the market acceptance of your brand and products, ensuring informed decision-making for business success.

Competitor Analysis in the Bike-Sharing Service Industry

Conducting a competitor analysis involves identifying competitors within the Bike-Sharing Service industry and studying their various marketing strategies. This comparative data allows you to assess your company's strengths and weaknesses relative to competitors, providing insights to enhance your market position.

Importance of Continuous Market Research

Consistently conducting market research is essential for minimizing risk at every stage of business operations. Bike-Sharing Service market research enables you to collect qualitative and quantitative data, which, when properly analyzed, leads to wise decisions that align with user and customer needs. Below are some crucial lessons learned through the Bike-Sharing Service market research process:

Key Dimensions of Bike-Sharing Service Market Analysis

- Trend and Pattern Identification: Analyzing data to spot market trends and patterns.

- Pricing Analysis: Assessing keyword pricing strategies.

- Actionable Insights: Implementing insights derived from data analysis.

- Market Potential: Evaluating the potential of the Bike-Sharing Service market.

- Competitor Analysis: Studying competitors' strategies and performance.

- Location Analysis: Assessing optimal locations for market penetration.

- Distribution Channels Analysis: Evaluating the effectiveness of distribution channels.

- Market Size and Growth Rate: Measuring market size and growth potential.

- Market Profitability: Assessing profitability prospects.

- Key Success Factors: Identifying critical factors for success.

- Cost Structure: Understanding the cost structure within the Bike-Sharing Service industry.

Target Audience for the Report

This report is valuable for a diverse audience, including:

- Bike-Sharing Service Market Manufacturers: To understand market dynamics and enhance production strategies.

- Investors and Financing Companies: To assess investment opportunities and risks.

- Bike-Sharing Service Market Suppliers: To identify market demands and supply chain efficiencies.

Necessity of the Report

Making Crucial Business Decisions

Understanding the Bike-Sharing Service market, competition, and industry landscape is vital for making informed business decisions. Without current and relevant market research, decisions may be based on outdated or irrelevant information, potentially harming the business.

Securing Investment Funds

Attracting investors requires demonstrating thorough market research. Investors need assurance that you understand the sector, current and potential competition, and whether your idea addresses a market need.

Identifying New Business Opportunities

Bike-Sharing Service market research goes beyond understanding trends and consumer behavior. It identifies new revenue streams and opportunities for business pivots. These insights can lead to strategic changes in the business model, promoting growth and adapting to market challenges.

Avoiding Business Failures

Market research also plays a crucial role in risk mitigation. It can reveal when not to pursue certain actions, saving the company from potential losses in revenue, brand image, and more. This proactive approach is often overlooked but is essential for long-term success.

Conclusion

Infinitive Data Research's comprehensive Bike-Sharing Service market research provides critical insights for making solid business decisions, securing investments, identifying new opportunities, and avoiding potential failures. Understanding market dynamics through continuous research ensures your company remains competitive and thrives in the Bike-Sharing Service industry.